Global Virtual Care Market - Key Trends & Drivers Summarized

Why Is Virtual Care Transitioning from a Pandemic-Era Necessity to a Long-Term Healthcare Staple?

Virtual care, encompassing video consultations, remote diagnostics, teletherapy, and digital chronic care management, is no longer seen as an interim solution. The pandemic may have catalyzed its rapid adoption, but the continued integration of virtual care into mainstream healthcare delivery highlights its enduring relevance. Key drivers include rising patient expectations for convenience, the surge in chronic illness burden, clinician shortages, and the need to expand access to underserved populations. As payers and providers adapt to value-based care models, virtual care has emerged as a critical lever for delivering cost-effective, scalable, and continuous care.Hospitals, insurers, and integrated health networks are embedding virtual care into primary care pathways, behavioral health programs, post-acute care, and disease-specific interventions such as diabetes management or cardiac rehabilitation. Additionally, the proliferation of hybrid care models is reshaping workflows to blend in-person and virtual consultations for optimized care continuity. With infrastructure investments in broadband, 5G, and secure data platforms gaining traction, virtual care is becoming more interoperable and clinically reliable. The transition from episodic to longitudinal patient engagement-powered by digital tools-continues to redefine how care is accessed and delivered.

How Are Digital Technologies Enhancing Virtual Care Platforms and Clinical Workflows?

AI and automation are transforming virtual care platforms into intelligent health orchestration tools. From AI-powered symptom checkers and triage bots to automated EHR documentation and clinical decision support, technology is minimizing administrative friction and enhancing clinician efficiency. Natural language processing (NLP) tools are being integrated to transcribe video consultations in real time, tag ICD codes, and auto-populate patient charts. Meanwhile, remote patient monitoring (RPM) tools-using Bluetooth-enabled glucometers, pulse oximeters, and wearables-are delivering real-time health data directly into provider dashboards.Cloud-native architectures and API-driven interoperability allow virtual care platforms to integrate seamlessly with lab systems, radiology portals, and electronic prescribing systems. This ensures that virtual visits aren’t standalone encounters but part of a cohesive care journey. Voice-enabled AI assistants, smart scheduling engines, and biometric authentication are further enriching the patient and provider experience. As cybersecurity becomes a top priority, virtual care platforms are implementing advanced encryption, multi-factor authentication, and role-based access controls to ensure data security and regulatory compliance.

Which Patient Segments and Clinical Areas Are Driving Adoption Most Rapidly?

Behavioral and mental health have seen the most explosive growth in virtual care, with providers offering therapy, psychiatric assessments, and substance abuse counseling through secure video platforms. Chronic disease management is another key segment, especially for conditions requiring long-term monitoring and education such as hypertension, COPD, and Type 2 diabetes. Virtual care is enabling these patients to engage with care teams more frequently without the logistical burden of clinic visits, resulting in improved adherence and early detection of complications.Rural and remote populations are also key beneficiaries. In regions with clinician shortages and geographic barriers, virtual care bridges critical access gaps. Elderly patients, particularly those managing multiple co-morbidities, are benefiting from home-based care via teleconsultation and connected health devices. Pediatrics, dermatology, reproductive health, and oncology follow-ups are increasingly being delivered through virtual models to reduce care delays and patient load at tertiary centers. Additionally, employer-sponsored virtual care services are on the rise, especially among self-insured companies looking to reduce absenteeism and healthcare costs.

What Factors Are Fueling the Continued Growth of the Virtual Care Market?

The growth in the virtual care market is driven by several factors, including shifting patient behavior, payer-provider alignment on cost containment, and the maturation of enabling technologies. Patients are increasingly demanding healthcare that matches the convenience and accessibility of consumer digital services. At the same time, governments and insurers are updating reimbursement frameworks to make telehealth services viable at scale-permanently extending many of the flexibilities introduced during the pandemic.Strategic partnerships between health systems, technology providers, and digital health startups are accelerating platform development and care innovation. Venture funding continues to flow into virtual-first care models, remote diagnostics, and hybrid clinics, signaling sustained market confidence. Meanwhile, regulatory efforts around data privacy and care standardization are stabilizing the sector and fostering trust. As AI-enabled triage, asynchronous messaging, and virtual specialty clinics become commonplace, virtual care will evolve into a core delivery channel rather than an alternative-reshaping the healthcare landscape into one that is more distributed, proactive, and equitable.

Scope of the Report

The report analyzes the Virtual Care market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Component (Solutions Component, Services Component); Deployment (Video-based Mode, Audio-based Mode, Messaging-based Mode); End-User (Home Healthcare End-User, Hospitals End-User, Other End-Users).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Solutions Component segment, which is expected to reach US$28.6 Billion by 2030 with a CAGR of a 21.7%. The Services Component segment is also set to grow at 28.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.6 Billion in 2024, and China, forecasted to grow at an impressive 23.4% CAGR to reach $7.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Virtual Care Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Virtual Care Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Virtual Care Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amwell, Babylon Health, BetterHelp, BetterHelp, Cerebral and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Virtual Care market report include:

- Amwell

- Babylon Health

- BetterHelp

- BetterHelp

- Cerebral

- Doctor On Demand

- Doxy.me

- HealthTap

- Hims & Hers Health

- Hinge Health

- Lemonaid Health

- LiveHealth Online

- MDLIVE

- MDlive

- MeMD

- Omada Health

- One Medical

- PlushCare

- Ro (formerly Roman)

- SimplePractice

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amwell

- Babylon Health

- BetterHelp

- BetterHelp

- Cerebral

- Doctor On Demand

- Doxy.me

- HealthTap

- Hims & Hers Health

- Hinge Health

- Lemonaid Health

- LiveHealth Online

- MDLIVE

- MDlive

- MeMD

- Omada Health

- One Medical

- PlushCare

- Ro (formerly Roman)

- SimplePractice

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 174 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

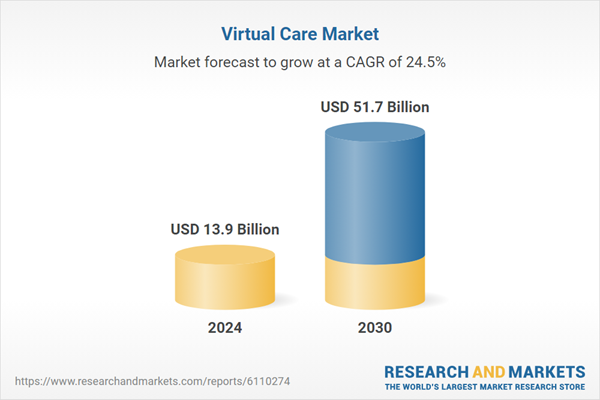

| Estimated Market Value ( USD | $ 13.9 Billion |

| Forecasted Market Value ( USD | $ 51.7 Billion |

| Compound Annual Growth Rate | 24.5% |

| Regions Covered | Global |

![Patient Experience Technology Market by Offering, Function [Appointment (Online Booking), Registration (Intake), Virtual Care (Telehealth, RPM), Communication, Feedback], End User (Providers, Payers, Pharma & Biotech), Region - Global Forecast to 2030 - Product Image](http://www.researchandmarkets.com/product_images/12859/12859906_60px_jpg/patient_experience_technology_market.jpg)