Global Security And Surveillance Storage Market - Key Trends & Drivers Summarized

Why Is Data Storage Becoming a Strategic Backbone for Modern Surveillance Systems?

The exponential growth in video surveillance data, driven by high-resolution IP cameras, real-time analytics, and regulatory mandates for extended retention, is transforming storage infrastructure into a central pillar of security and surveillance ecosystems. Modern surveillance deployments-spanning smart cities, airports, critical infrastructure, enterprise campuses, and transportation networks-generate terabytes of video and metadata daily. As 4K, 8K, panoramic, and multi-sensor cameras become standard, storage systems must not only scale but deliver high write endurance, consistent throughput, and rapid retrieval capabilities for forensic investigations and live monitoring.Additionally, surveillance storage is moving beyond basic archival toward real-time processing, metadata indexing, and AI-driven anomaly detection. Edge-to-core storage architectures are gaining traction, where video is captured and processed locally at the edge for latency-sensitive use cases like facial recognition or license plate reading, and subsequently transferred to centralized or cloud storage for long-term retention. This shift is pushing demand for tiered storage systems that combine high-speed SSDs for edge analytics, high-capacity HDDs for bulk retention, and cloud integration for scalable archival. The evolution of surveillance from passive recording to active threat intelligence is thus driving a complete reimagining of storage strategies.

How Are Technology Trends Reshaping the Surveillance Storage Landscape?

Key technological advancements are reshaping how surveillance storage systems are designed and deployed. AI and deep learning algorithms require vast volumes of structured and unstructured video data to train and operate effectively, necessitating storage that is optimized for large-scale video ingestion and parallel access. Storage devices with built-in AI inferencing capabilities and support for object-based data tagging are emerging to meet these needs. Simultaneously, hybrid storage models are being adopted, where on-premises NAS (Network Attached Storage) or SAN (Storage Area Network) arrays interface seamlessly with public cloud platforms via APIs for dynamic load balancing and cost-efficient long-term storage.High-availability and failover mechanisms are also being built into surveillance storage systems to ensure business continuity and data integrity in mission-critical environments. Features such as RAID configurations, erasure coding, multi-node replication, and geo-distributed backups are increasingly standard in enterprise-grade deployments. Video Management Systems (VMS) are being integrated natively with storage orchestration layers to enable smarter recording policies-like event-triggered storage, adaptive frame rates, and AI-prioritized caching. These innovations are not only improving performance and reducing cost per GB but also enabling faster investigations, compliance reporting, and situational awareness.

Which End-Use Sectors Are Accelerating the Adoption of Scalable Surveillance Storage Solutions?

Multiple verticals are accelerating demand for robust surveillance storage infrastructure. The smart cities segment is one of the largest adopters, driven by integrated public safety programs involving thousands of high-definition street cameras, intelligent traffic management, and public event surveillance. Transport hubs-airports, railway stations, and logistics depots-require high-redundancy storage for continuous monitoring of passenger flows, baggage handling, and perimeter security. Financial institutions and data centers, facing strict compliance requirements (e.g., PCI DSS, GDPR), are investing in secure, encrypted storage that supports long retention periods and tamper-proof audit trails.Retail and hospitality chains are using surveillance footage for both security and operational insights-such as customer footfall analytics, inventory shrinkage detection, and staff performance. This dual use is increasing the need for accessible and searchable storage solutions that support both live streaming and historical data mining. In industrial and energy sectors, surveillance systems are being integrated with SCADA and IoT platforms for facility protection and anomaly detection in remote or hazardous environments, creating demand for ruggedized, edge-resilient storage systems. Governmental and military agencies are also leading in storage adoption for command-and-control centers, requiring high-security, air-gapped, and real-time compliant storage environments.

What Is Fueling the Global Expansion of the Security and Surveillance Storage Market?

The growth in the security and surveillance storage market is driven by several factors, including rising public safety investments, proliferation of smart monitoring infrastructure, and regulatory pressures for data retention and forensic traceability. Governments worldwide are deploying surveillance as a core component of urban resilience strategies, law enforcement support, and counterterrorism infrastructure. This is leading to record-setting installations of surveillance cameras, drones, and body-worn devices-all of which require secure and scalable storage. The standardization of retention requirements-for example, 90 days or more in several jurisdictions-is further expanding baseline storage demand.Cost optimization and modular scalability are key buying criteria, leading to a shift toward storage-as-a-service (SaaS) models, cloud surveillance storage, and hybrid edge-cloud deployments. Vendors are offering integrated hardware-software packages with intelligent storage tiering, backup automation, and AI-native features, reducing total cost of ownership (TCO) and easing deployment complexity. At the same time, cyber threats targeting surveillance infrastructure are compelling organizations to invest in storage with embedded security-such as data encryption, access logs, and anomaly detection systems.

With the global push toward digital urbanization, AI-led surveillance, and predictive threat management, storage is no longer a passive backend utility but a critical enabler of real-time intelligence. As video analytics, data privacy, and smart infrastructure converge, the surveillance storage market is expected to grow robustly-evolving into a multi-tiered, application-aware, and security-hardened data ecosystem.

Scope of the Report

The report analyzes the Security and Surveillance Storage market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (NAS Storage, SAN Storage, DAS Storage, Other Product Types); Storage Media (HDD Storage Media, SSD Storage Media); Deployment (Cloud Deployment, On-Premise Deployment); End-Use (Government & Defense End-Use, Education End-Use, BFSI End-Use, Retail End-Use, Transportation & Logistics End-Use, Healthcare End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the NAS Storage segment, which is expected to reach US$9.3 Billion by 2030 with a CAGR of a 5.8%. The SAN Storage segment is also set to grow at 9.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.8 Billion in 2024, and China, forecasted to grow at an impressive 11.0% CAGR to reach $4.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Security and Surveillance Storage Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Security and Surveillance Storage Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Security and Surveillance Storage Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Axis Communications, Bosch Security Systems, Dahua Technology, Dell Technologies, Digital Watchdog and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Security and Surveillance Storage market report include:

- Axis Communications

- Bosch Security Systems

- Dahua Technology

- Dell Technologies

- Digital Watchdog

- Eagle Eye Networks

- Genetec

- Hanwha Vision

- Hikvision

- Honeywell Security

- Huawei Technologies

- Milestone Systems

- Motorola Solutions

- NetApp

- Pelco

- Quantum Corporation

- Seagate Technology

- Synology Inc.

- Western Digital Corporation

- ZKTeco

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Axis Communications

- Bosch Security Systems

- Dahua Technology

- Dell Technologies

- Digital Watchdog

- Eagle Eye Networks

- Genetec

- Hanwha Vision

- Hikvision

- Honeywell Security

- Huawei Technologies

- Milestone Systems

- Motorola Solutions

- NetApp

- Pelco

- Quantum Corporation

- Seagate Technology

- Synology Inc.

- Western Digital Corporation

- ZKTeco

Table Information

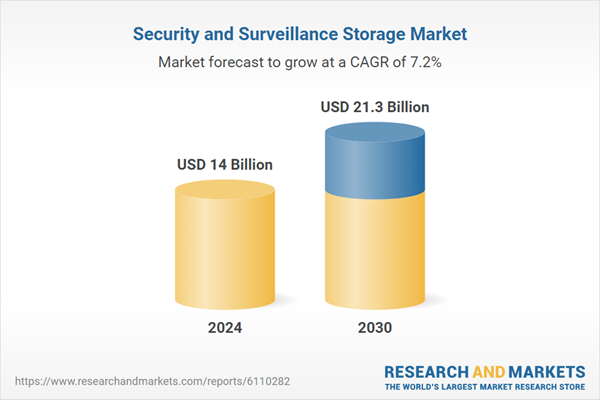

| Report Attribute | Details |

|---|---|

| No. of Pages | 481 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 14 Billion |

| Forecasted Market Value ( USD | $ 21.3 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |