Global Aviation Refueling Market: Key Trends & Drivers Summarized

How Is the Aviation Refueling Sector Adapting to the Demands of Modern Air Traffic?

Aviation refueling has evolved significantly over the past decade, driven by the growing volume of global air traffic, increasing fuel efficiency standards, and heightened emphasis on operational reliability. As both commercial and cargo aviation sectors expand, the demand for efficient, safe, and timely refueling operations has become a strategic priority for airlines, airports, and fuel suppliers. Ground handling operations now require tighter synchronization with aircraft turnaround schedules, prompting the development of automated fueling systems and real-time fuel management software. The increased complexity of fleet compositions, including narrow-body, wide-body, and long-haul aircraft, demands flexible refueling infrastructure that can accommodate different tank configurations and fueling needs. Modern airports are upgrading their hydrant systems, tank farms, and fuel truck fleets to improve flow rates and reduce refueling times, which directly impacts gate utilization and departure punctuality. Fuel quality assurance protocols have also become more stringent, with greater focus on contamination prevention, temperature control, and documentation. Moreover, the industry is investing in digital monitoring tools that provide real-time visibility into fuel inventory, tank levels, and refueling progress. These technologies reduce human error, ensure safety compliance, and allow for predictive maintenance of fueling equipment. With aviation becoming increasingly data-driven, refueling is no longer viewed as a simple ground service but as a mission-critical operation requiring precision, coordination, and technological integration to support the growing demands of the global air transport network.What Role Are Regulations and Safety Protocols Playing in Shaping Refueling Practices?

Regulatory standards and safety protocols are foundational to the aviation refueling industry, guiding everything from fuel quality management to on-the-ground operational procedures. Aviation fuel is highly volatile, making safety an uncompromising priority in every aspect of refueling, whether at major international hubs or regional airstrips. Agencies such as the International Air Transport Association, the International Civil Aviation Organization, and national aviation authorities mandate strict compliance with fuel storage, handling, and delivery procedures. These regulations are regularly updated to reflect new risks, technological advancements, and environmental considerations. For example, anti-static grounding, bonding procedures, and pressure checks are mandatory practices designed to prevent fire hazards during fueling. Fuel quality is closely monitored, with rigorous sampling and laboratory testing to detect impurities, water contamination, or degradation. Personnel involved in fueling operations are required to undergo extensive training and certification to ensure they adhere to operational protocols and respond effectively to emergencies. Environmental regulations are also influencing fueling practices, particularly around fuel spill prevention, containment systems, and emissions generated during fuel transfer operations. Refueling vehicles and equipment are now often fitted with vapor recovery systems and spill-proof nozzles to reduce environmental impact. Auditing and compliance tracking have become more automated, with digital platforms recording every step of the refueling process for inspection and review. In increasingly congested airports, adherence to strict refueling time windows and coordination with air traffic control and ground crews are crucial to maintaining safe and efficient operations. Through these regulatory frameworks and protocols, the aviation sector is ensuring that refueling meets the highest standards of safety, accountability, and environmental stewardship.How Are Alternative Fuels and Sustainability Goals Reshaping Aviation Refueling Infrastructure?

The global push toward decarbonization and sustainability is significantly reshaping the landscape of aviation refueling, prompting both technological innovation and infrastructure overhaul. With aviation responsible for a considerable share of global carbon emissions, the sector is under increasing pressure to transition to cleaner fuel sources such as sustainable aviation fuel, hydrogen, and, eventually, electric propulsion. Among these, sustainable aviation fuel has emerged as the most scalable near-term solution, offering a lower-emission alternative to conventional jet fuel while being compatible with existing aircraft engines. To accommodate the use of SAF, airports and fuel suppliers are upgrading storage facilities, blending equipment, and supply chain logistics to handle the unique properties of bio-based and synthetic fuels. In some cases, parallel fueling infrastructure is being developed to prevent cross-contamination and ensure traceability of SAF volumes used by specific flights. Hydrogen, although still in early adoption, presents a longer-term transformation that will require a fundamental redesign of refueling systems, storage, and distribution networks due to its cryogenic storage requirements and high flammability. Electrification is also making inroads in ground refueling operations, with electric fuel trucks and automated hydrant systems reducing emissions and improving operational efficiency. Regulatory incentives, carbon credit programs, and airline sustainability commitments are accelerating the integration of alternative fuels into mainstream refueling operations. Moreover, digital fuel management platforms are being adapted to track emissions reductions, fuel lifecycle data, and compliance with international sustainability standards. As the transition gains momentum, refueling infrastructure is evolving from a purely functional necessity into a strategic component of aviation’s climate response and future-proofing strategy.What Market Forces and Technological Advancements Are Driving Growth in Aviation Refueling?

The growth in the aviation refueling market is driven by a combination of expanding air travel demand, modernization of ground operations, and the increasing complexity of airline fuel requirements. The post-pandemic resurgence in both domestic and international flights has led to a sharp increase in fuel consumption, pushing airports and fuel providers to scale up their refueling capacities and improve turnaround efficiency. Airline fleet modernization, with the introduction of new-generation aircraft such as the Boeing 787 and Airbus A350, brings with it more advanced fuel management systems that require precise fueling techniques and volume optimization. Rising jet fuel prices and volatility in the global energy market are prompting airlines to seek better fuel efficiency and tighter control over fuel procurement and usage, thereby increasing demand for intelligent refueling systems and analytics platforms. Technological advancements are enabling the deployment of automated refueling vehicles, wireless communication between aircraft and ground systems, and real-time monitoring of tank levels and fuel flow rates. These innovations reduce refueling times, enhance safety, and allow for better resource planning. The digitization of fuel transactions, including blockchain-based tracking and smart contracts, is also streamlining payment processes and improving transparency between fuel suppliers and operators. Additionally, growing airport infrastructure in emerging economies and increased military aircraft refueling needs are creating new opportunities for specialized fueling solutions and mobile refueling units. As urban air mobility and electric vertical takeoff and landing aircraft become commercially viable, entirely new refueling paradigms will emerge, requiring further innovation in energy delivery systems. These combined market forces are ensuring that aviation refueling remains a dynamic and rapidly evolving segment of the global aviation ecosystem.Scope of the Report

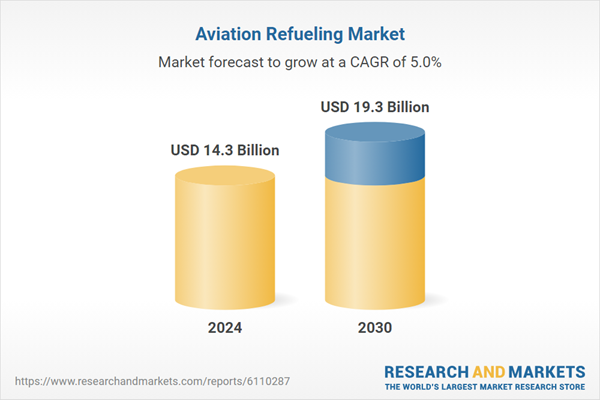

The report analyzes the Aviation Refueling market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Component (Aviation Refueler Component, Dispenser Component, Refueling Pods Component, Probe & Drogue Component, Other Components); Application (Commercial Airplane Application, Military Airplane Application, Helicopters Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Aviation Refueler Component segment, which is expected to reach US$7.3 Billion by 2030 with a CAGR of a 5.2%. The Dispenser Component segment is also set to grow at 5.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.9 Billion in 2024, and China, forecasted to grow at an impressive 8.0% CAGR to reach $3.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Aviation Refueling Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Aviation Refueling Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Aviation Refueling Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Air BP, Allied Aviation Services, Inc., Atlantic Aviation, Avfuel Corporation, Bharat Petroleum Corporation Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Aviation Refueling market report include:

- Air BP

- Allied Aviation Services, Inc.

- Atlantic Aviation

- Avfuel Corporation

- Bharat Petroleum Corporation Ltd.

- Chevron Corporation

- ExxonMobil Aviation

- Gulf Aviation Services

- HCS Group (HCS Aviation)

- Indian Oil Corporation Ltd. (IOCL)

- John Menzies plc (Menzies Aviation)

- Lukoil Aviation

- Nayara Energy Ltd.

- Neste Oyj

- PTT Public Company Limited

- Qatar Jet Fuel Company (QJet)

- Repsol S.A.

- Shell Aviation

- TotalEnergies Aviation

- World Fuel Services Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Air BP

- Allied Aviation Services, Inc.

- Atlantic Aviation

- Avfuel Corporation

- Bharat Petroleum Corporation Ltd.

- Chevron Corporation

- ExxonMobil Aviation

- Gulf Aviation Services

- HCS Group (HCS Aviation)

- Indian Oil Corporation Ltd. (IOCL)

- John Menzies plc (Menzies Aviation)

- Lukoil Aviation

- Nayara Energy Ltd.

- Neste Oyj

- PTT Public Company Limited

- Qatar Jet Fuel Company (QJet)

- Repsol S.A.

- Shell Aviation

- TotalEnergies Aviation

- World Fuel Services Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 280 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 14.3 Billion |

| Forecasted Market Value ( USD | $ 19.3 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |