Global Peaking Power Plants Market - Key Trends & Drivers Summarized

Why Are Peaking Power Plants Critical in a Renewable Energy-Dominant Grid?

Peaking power plants serve a unique role in electricity systems by providing short-term, high-output power during periods of peak demand or supply imbalance. Unlike baseload power plants, peakers are characterized by fast startup times, flexible operation, and high ramping capability-making them indispensable in grid stability management, especially as renewable energy penetration rises globally. With the growing volatility in power supply from solar and wind sources, peaking plants offer the rapid responsiveness needed to fill demand gaps, prevent blackouts, and maintain frequency control.Traditional peaking plants have primarily relied on open-cycle gas turbines (OCGTs) and diesel generators due to their low capital cost and fast deployment. However, modern peaking plants are increasingly adopting aeroderivative turbines, reciprocating gas engines, and even battery-assisted hybrids to enhance efficiency and emission control. These systems are particularly important in deregulated electricity markets where real-time pricing and reserve margins fluctuate dramatically based on renewable output and grid load.

As the global energy transition accelerates, peaking plants are gaining renewed attention not only as gap-fillers but also as strategic assets supporting energy security and reliability. The integration of intermittent renewables, coupled with the retirement of coal-fired baseload capacity, creates a structural need for dispatchable backup power-positioning peaking plants as grid-stabilizing anchors in modern power systems.

What Technology and Fuel Innovations Are Reshaping Peaking Plant Performance?

The peaking power sector is witnessing a significant transformation in terms of technology architecture, fuel flexibility, and environmental footprint. Advanced aeroderivative turbines offer rapid load-following capabilities, low start-up emissions, and modular deployment, making them ideal for both urban and remote installations. These turbines are increasingly being designed for dual-fuel operation, allowing seamless switching between natural gas, diesel, and in some cases, green hydrogen or synthetic fuels.Hybrid peaker plants combining gas turbines with battery energy storage systems (BESS) are emerging as a critical innovation. In such configurations, batteries handle sub-minute fluctuations while the gas turbine ramps up to provide sustained output. This hybridization reduces fuel consumption, improves system response time, and allows for ancillary services participation such as frequency regulation and voltage support. Moreover, digital twin technologies and AI-powered monitoring systems are optimizing maintenance schedules and predicting performance anomalies in real-time.

Environmental regulations are driving cleaner peaking technologies. Low-NOx combustors, selective catalytic reduction (SCR) systems, and carbon capture-ready designs are being integrated into new builds. At the same time, hydrogen-ready peaking plants are under development in Europe and Asia, anticipating future fuel shifts. These plants are designed to burn increasing blends of hydrogen with natural gas, gradually decarbonizing the peaking fleet without compromising operational flexibility.

Which Markets and Applications Are Driving Global Deployment of Peaking Capacity?

Peaking power plants are predominantly used in urban grids, islanded power systems, and industrial parks with variable or unpredictable loads. Their applications range from balancing renewable variability to supplying emergency power during natural disasters, transmission failures, or cybersecurity incidents. In countries with extreme seasonal load curves-such as air-conditioning peaks in the Middle East or winter heating peaks in Europe-peaking capacity ensures grid adequacy and reliability.North America remains a leading market, especially in the U.S., where Independent System Operators (ISOs) procure capacity through competitive auctions and demand response programs. The ERCOT and CAISO markets, in particular, have seen a surge in flexible peaking capacity as solar and wind share increases. Europe is undergoing a renaissance in peaker capacity, driven by coal plant retirements, interconnection bottlenecks, and higher carbon pricing. Countries like the UK, Germany, and Italy are actively investing in flexible backup capacity to safeguard renewable-heavy grids.

Asia-Pacific is expanding peaking capacity rapidly, led by Australia, South Korea, and India. In these countries, the need to balance solar-heavy daytime grids and accommodate industrial surges during evening hours is creating demand for agile generation assets. Africa and Latin America, while limited in grid infrastructure, are leveraging peaker plants for energy access in remote regions and as insurance against hydroelectric shortfalls during drought years.

What Factors Are Driving the Growth of the Global Peaking Power Plants Market?

The growth in the global peaking power plants market is driven by the increasing volatility of electricity demand and supply, the rising share of variable renewable energy, the global push for grid reliability, and the emergence of hybrid and low-emission peaker technologies. As more baseload plants retire and grids become more weather-dependent, the role of peakers as rapid-response and reserve capacity providers becomes more critical.Policy frameworks promoting flexible capacity markets, capacity remuneration mechanisms, and ancillary service procurement are incentivizing the construction of new peaker fleets. Simultaneously, advances in modular plant design, containerized gensets, and mobile turbine units are reducing time-to-deployment, making peakers more responsive to emergency and short-term needs. Fuel diversity-from natural gas and LPG to biogas and hydrogen-enhances their adaptability to different regulatory and supply scenarios.

Investments from utilities, independent power producers (IPPs), and energy infrastructure funds are flowing into modern, emission-compliant peaking assets. These assets, while historically underutilized, are now viewed as indispensable complements to storage, demand response, and grid digitization. As the world’s power systems transition toward a more dynamic, decarbonized, and distributed model, peaking power plants will remain essential guardians of reliability, resilience, and responsiveness.

Scope of the Report

The report analyzes the Peaking Power Plants market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Hydropower Plant, Natural Gas Power Plant, Biogas Power Plant, Petroleum-based Power Plant, Other Types); End-User (Industrial End-User, Commercial End-User, Residential End-User).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hydropower Plant segment, which is expected to reach US$57.5 Billion by 2030 with a CAGR of a 2.5%. The Natural Gas Power Plant segment is also set to grow at 2.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $39.2 Billion in 2024, and China, forecasted to grow at an impressive 5.8% CAGR to reach $34.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Peaking Power Plants Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Peaking Power Plants Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Peaking Power Plants Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., Alstom (GE Gas Power), APR Energy LLC, CenterPoint Energy, Clarke Energy Limited and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Peaking Power Plants market report include:

- ABB Ltd.

- Alstom (GE Gas Power)

- APR Energy LLC

- CenterPoint Energy

- Clarke Energy Limited

- Dominion Energy

- Duke Energy Corporation

- E.ON SE

- Edina UK Limited

- Enel S.p.A.

- ENGIE SA

- Eversource Energy

- FirstEnergy Corp.

- GE Vernova (formerly GE Gas Power)

- Iberdrola SA

- MAN Energy Solutions SE

- NextEra Energy Inc.

- NRG Energy Inc.

- PG&E Corporation

- Siemens Energy

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- Alstom (GE Gas Power)

- APR Energy LLC

- CenterPoint Energy

- Clarke Energy Limited

- Dominion Energy

- Duke Energy Corporation

- E.ON SE

- Edina UK Limited

- Enel S.p.A.

- ENGIE SA

- Eversource Energy

- FirstEnergy Corp.

- GE Vernova (formerly GE Gas Power)

- Iberdrola SA

- MAN Energy Solutions SE

- NextEra Energy Inc.

- NRG Energy Inc.

- PG&E Corporation

- Siemens Energy

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 277 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

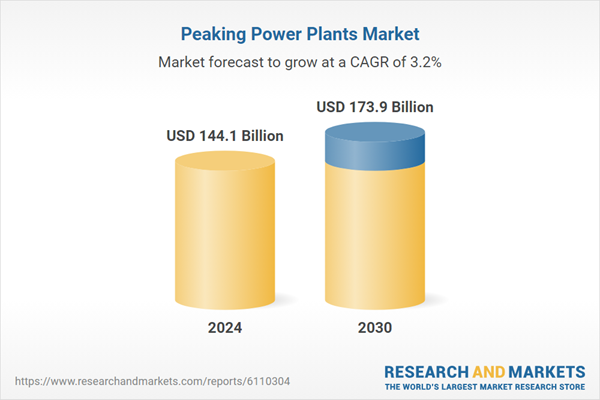

| Estimated Market Value ( USD | $ 144.1 Billion |

| Forecasted Market Value ( USD | $ 173.9 Billion |

| Compound Annual Growth Rate | 3.2% |

| Regions Covered | Global |