Global Electrical Tapes Market - Key Trends & Drivers Summarized

How Are Materials and Manufacturing Shifts Reshaping Electrical Tape Technology?

Electrical tapes have transitioned from basic insulation wraps to advanced functional layers tailored for diverse electrical and electronic applications. These tapes are no longer limited to PVC-based varieties. Polyimide, PTFE, polyester, and rubber-based tapes are gaining preference due to their enhanced thermal resistance, dielectric strength, and flame retardance. Product innovation is focused on meeting the safety, reliability, and environmental performance standards required by evolving electrical codes and regulations. High-performance adhesive systems that can withstand heat, UV radiation, and chemical exposure are becoming essential, particularly in industrial-grade tapes.Manufacturing trends show increasing use of solvent-free and low-VOC adhesives to address sustainability concerns. Automation in production and precise coating technologies are enabling consistent tape quality and uniform thickness, which are critical for sensitive applications such as cable shielding and PCB wrapping. Manufacturers are adopting multi-layer designs with differential adhesives to support dual-function tapes, especially where both mechanical binding and electrical insulation are needed in compact devices. Continuous developments in base films, adhesive chemistry, and pressure-sensitive backing materials reflect the growing demand for durability in high-voltage, automotive, and renewable energy environments.

What End-Use Trends Are Creating Diverse Functional Demands on Electrical Tapes?

End-use diversification has expanded significantly, with electrical tapes now used across residential wiring, high-capacity grid systems, vehicle electronics, and digital infrastructure. In residential and commercial buildings, electrical tapes remain essential for insulation, splicing, and phase marking. However, the growing use of smart appliances and complex HVAC systems has increased the requirement for heat-resistant and color-coded tapes. In industrial environments, tapes are increasingly used in motor windings, cable harnesses, and control panels, often under harsh operational conditions.Within automotive and EV manufacturing, electrical tapes are used in wire bundling, EMI shielding, and battery insulation. As vehicles incorporate more sensors and electronics, demand for flame-retardant and high-adhesion tapes has risen. In renewable energy, wind turbines and solar arrays require tapes that can endure high temperatures, salt exposure, and mechanical stress. Additionally, in electronics manufacturing, compact PCB designs demand ultra-thin insulation tapes with stable electrical properties and minimal outgassing, especially in semiconductors and display modules. This widening scope of end-use is reinforcing the need for specialized formulations that can reliably perform in niche applications.

Which Regional and Technological Shifts Are Influencing Market Preferences?

Regionally, product standards and tape preferences vary based on climate conditions, voltage ratings, and industry practices. In colder climates, tapes with low-temperature flexibility are prioritized, while in high-humidity regions, moisture-resistant formulations dominate. North America and parts of Europe exhibit strong demand for UL-rated and RoHS-compliant products, particularly in professional-grade electrical installations. In contrast, emerging economies prioritize cost-efficiency and availability, creating demand for general-purpose tapes that still meet basic insulation needs.Technology integration in tape production is also changing market dynamics. Digital quality inspection systems and precision slitting machines are reducing defect rates and increasing throughput. Anti-static, flame-retardant, and EMI-shielded tapes are being used in advanced electronics and data centers, where interference can compromise performance. Customization based on client specifications, such as width, adhesive tack, and elongation properties, is helping manufacturers meet diverse industry requirements. Meanwhile, regulatory scrutiny around material safety, flammability ratings, and recyclability is pushing manufacturers to reformulate products without compromising performance standards.

What Factors Are Driving the Rapid Growth in the Electrical Tapes Market?

Growth in the electrical tapes market is driven by several factors related to technology upgrades, evolving end-use requirements, and stricter safety compliance. The shift toward energy-efficient buildings and electrified transport systems is increasing demand for high-performance insulation and cable management solutions. Expansion in EV production is a key driver, with electrical tapes used in battery pack protection, wire routing, and thermal management. Automotive lightweighting strategies are also encouraging the use of tapes over traditional clips and fasteners, given their bonding strength and design flexibility.Electronics miniaturization is creating demand for tapes that provide precise insulation without bulk. This includes tapes with low dielectric constants and minimal thickness for use in wearable devices, mobile components, and circuit boards. Infrastructure upgrades in power grids, especially in urban and semi-urban areas, are further expanding the scope of application. In manufacturing settings, automation and robotics depend on stable power and signal transmission, driving adoption of more durable and resilient tape types. Lastly, stricter safety and sustainability mandates across regions are reinforcing the transition to halogen-free, low-VOC, and recyclable tape materials, contributing significantly to long-term market growth.

Scope of the Report

The report analyzes the Electrical Tapes market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Material (Vinyl Material, Rubber Material, Polyester Material, PVC Material); Adhesive Type (Acrylic Adhesive, Rubber Adhesive, Silicone Adhesive); Application (Electrical Insulation Application, Wire Harnessing Application, Surface Protection Application, General Masking Application); End-Use (Construction End-Use, Automotive End-Use, Telecommunications End-Use, Consumer Electronics End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Vinyl Material segment, which is expected to reach US$8.6 Billion by 2030 with a CAGR of a 6.2%. The Rubber Material segment is also set to grow at 3.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.1 Billion in 2024, and China, forecasted to grow at an impressive 9.0% CAGR to reach $4.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electrical Tapes Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electrical Tapes Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electrical Tapes Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, Achem Technology Corporation (YC Group), Advance Tapes International Ltd., Avery Dennison Corporation, Berry Global Group, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Electrical Tapes market report include:

- 3M Company

- Achem Technology Corporation (YC Group)

- Advance Tapes International Ltd.

- Avery Dennison Corporation

- Berry Global Group, Inc.

- Coroplast Fritz Müller GmbH & Co. KG

- Denka Company Limited

- Electro Tape Specialties Inc.

- Furukawa Electric Co., Ltd.

- HellermannTyton Group PLC

- Intertape Polymer Group Inc.

- Lohmann Tape Group

- Nitto Denko Corporation

- Parafix Tapes & Conversions Ltd.

- Plymouth Rubber Europa, S.A.

- Scapa Group plc

- Shurtape Technologies, LLC

- Tesa SE

- Teraoka Seisakusho Co., Ltd.

- Wurth Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Achem Technology Corporation (YC Group)

- Advance Tapes International Ltd.

- Avery Dennison Corporation

- Berry Global Group, Inc.

- Coroplast Fritz Müller GmbH & Co. KG

- Denka Company Limited

- Electro Tape Specialties Inc.

- Furukawa Electric Co., Ltd.

- HellermannTyton Group PLC

- Intertape Polymer Group Inc.

- Lohmann Tape Group

- Nitto Denko Corporation

- Parafix Tapes & Conversions Ltd.

- Plymouth Rubber Europa, S.A.

- Scapa Group plc

- Shurtape Technologies, LLC

- Tesa SE

- Teraoka Seisakusho Co., Ltd.

- Wurth Group

Table Information

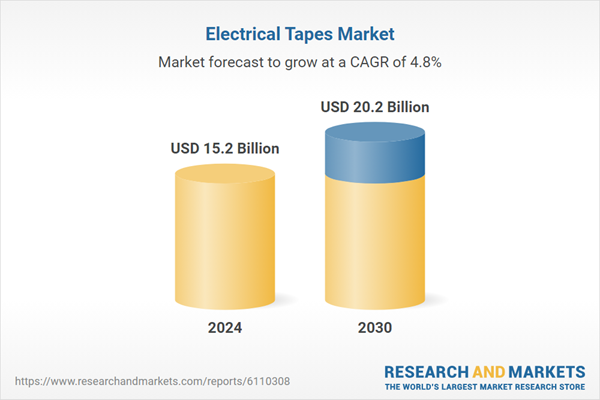

| Report Attribute | Details |

|---|---|

| No. of Pages | 480 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 15.2 Billion |

| Forecasted Market Value ( USD | $ 20.2 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |