Global LNG Liquefaction Equipment Market - Key Trends & Drivers Summarized

Why Is LNG Liquefaction Equipment Gaining Prominence in Global Energy Transition?

Liquefied natural gas (LNG) plays a pivotal role in enabling the global transition toward cleaner energy sources by offering a lower-emission alternative to coal and oil. LNG liquefaction equipment lies at the heart of this transition, enabling the conversion of natural gas into liquid form for ease of storage and transport. With the intensification of energy security concerns, rising geopolitical tensions, and global decarbonization commitments, LNG liquefaction capacity additions are accelerating, driving up demand for robust, modular, and scalable equipment systems. From traditional base-load liquefaction trains to innovative floating LNG (FLNG) units, the sector is experiencing a renaissance in terms of technology development and market scale.The operational essence of LNG liquefaction equipment is its ability to cool natural gas to approximately -162°C, condensing it into a compact volume while preserving energy content. These systems are typically comprised of gas pre-treatment modules, main cryogenic heat exchangers, compressors, expander turbines, and power systems. Efficiency, uptime, and adaptability to feed gas variability are critical performance metrics that guide equipment selection. Modularization has emerged as a key trend, allowing quicker deployment, reduced site construction risks, and easier scalability. Additionally, the move toward FLNG vessels is expanding opportunities for liquefaction equipment deployment in remote, offshore fields previously deemed uneconomical to develop.

How Are Equipment Innovations and Process Enhancements Shaping Technology Trends?

Technology providers are focusing on improving liquefaction efficiency, reducing energy consumption, and minimizing environmental footprint. Equipment advancements are increasingly centered on optimized refrigerant cycles such as the AP-C3MR, DMR (Dual Mixed Refrigerant), and SMR (Single Mixed Refrigerant) processes. These advanced cycles enable higher thermal efficiency and flexibility under variable ambient and inlet gas conditions. Turbo-expanders and high-capacity centrifugal compressors with integrated drive systems are being developed to improve flow control, minimize leakage, and deliver greater operational precision.Compact heat exchangers, such as brazed aluminum and coil-wound designs, are being tailored for modular LNG plants to reduce footprint without compromising cooling performance. Liquefaction trains are now being configured with real-time monitoring systems integrated with AI and machine learning algorithms to predict equipment degradation, schedule proactive maintenance, and optimize energy consumption. Electrification of refrigerant compressors using grid or renewable power is gaining traction as a way to reduce carbon emissions, particularly for LNG projects aligned with net-zero strategies.

Cryogenic pump systems are also evolving, with enhanced sealing technologies and longer maintenance intervals improving lifecycle economics. Vibration-resistant mounting systems, advanced metallurgy, and digital twin technologies are becoming standard in high-capacity liquefaction projects. Additionally, FLNG platforms are driving demand for compact, lightweight liquefaction modules with high resistance to motion-induced stress and salinity corrosion. These technology trends are redefining performance benchmarks and competitive differentiation across global LNG value chains.

Which Regional and Project-Level Dynamics Are Driving Deployment Trends?

North America, particularly the United States, remains a global hotspot for LNG liquefaction capacity expansion, driven by abundant shale gas, a liberalized energy market, and rising export demand. Mega-terminals such as Sabine Pass, Freeport, and Calcasieu Pass are leading adopters of advanced liquefaction technologies, including large-scale modular trains and AI-enabled control systems. Canada is also emerging as a strong contender, with projects like LNG Canada and Woodfibre LNG placing emphasis on low-carbon liquefaction powered by hydroelectricity. These initiatives are driving demand for high-efficiency liquefaction modules and modular construction packages.Qatar, already the world’s largest LNG exporter, is significantly boosting capacity under its North Field expansion, incorporating next-generation equipment to optimize energy consumption and emissions. Australia continues to invest in brownfield expansions and FLNG solutions to enhance export flexibility. In Asia-Pacific, emerging demand centers such as India, Vietnam, and the Philippines are exploring small-scale and onshore modular liquefaction projects to meet distributed gas demand and replace heavy fuel oil in power generation.

Africa is gaining attention with Mozambique’s Coral South FLNG and Nigeria’s train expansions, signaling increased equipment demand in offshore settings. Meanwhile, Europe is intensifying investment in LNG terminals and liquefaction backhaul capacity to counterbalance reliance on pipeline gas from Russia. Equipment suppliers are responding with region-specific offerings: Arctic-ready modules for cold climates, compact skids for island-based projects, and gas composition-tolerant systems for emerging upstream markets. Local fabrication partnerships and supply chain localization are also becoming critical enablers for regional competitiveness and project bankability.

What Is Fueling Growth in the LNG Liquefaction Equipment Market Globally?

The growth in the global LNG liquefaction equipment market is driven by several factors, including the global pivot toward lower-carbon energy sources, increasing LNG trade volumes, and a shift toward decentralized and flexible liquefaction models. As LNG continues to gain share in the global energy mix, investments in new export terminals, mid-scale liquefaction units, and FLNG vessels are multiplying, directly boosting demand for technologically advanced and reliable equipment solutions.Energy security concerns, particularly in Europe and Asia, are spurring the development of LNG liquefaction hubs to mitigate supply disruption risks. LNG’s role as a transition fuel in power generation, industrial applications, and marine bunkering is expanding its geographic reach and end-use diversification, requiring a broader range of equipment configurations. Strategic partnerships between equipment manufacturers, EPC firms, and gas producers are facilitating technology transfer and accelerating project timelines, especially in emerging markets.

In parallel, environmental regulations and investor scrutiny are pushing project developers to adopt low-emission, energy-efficient liquefaction technologies. This is incentivizing R&D in compressor optimization, heat integration, waste heat recovery, and low-carbon refrigerants. As global decarbonization efforts intensify, equipment suppliers with proven sustainability credentials and integrated digital offerings are positioned to gain market share. Taken together, the interplay of market expansion, technology innovation, and regulatory alignment is creating a robust foundation for sustained growth in the LNG liquefaction equipment market.

Scope of the Report

The report analyzes the LNG Liquefaction Equipment market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Technology (AP-C3MR Technology, AP-X Technology, Cascade Technology, Mixed Fluid Cascade Technology, Other Technologies); Equipment Type (Heat Exchangers, Compressors, Pumps, Power Turbines, Other Equipment Types); End-User (Oil & Gas End-User, Energy & Power End-User, Other End-Users).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the AP-C3MR Technology segment, which is expected to reach US$9.5 Billion by 2030 with a CAGR of a 7.0%. The AP-X Technology segment is also set to grow at 3.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.2 Billion in 2024, and China, forecasted to grow at an impressive 9.1% CAGR to reach $4.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global LNG Liquefaction Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global LNG Liquefaction Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global LNG Liquefaction Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Air Products and Chemicals, Inc., Atlas Copco AB, Baker Hughes Company, Chart Industries, Inc., Chiyoda Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this LNG Liquefaction Equipment market report include:

- Air Products and Chemicals, Inc.

- Atlas Copco AB

- Baker Hughes Company

- Chart Industries, Inc.

- Chiyoda Corporation

- ConocoPhillips

- Cryostar SAS

- Elliott Group

- General Electric Company

- IHI Corporation

- JGC Corporation

- Kawasaki Heavy Industries, Ltd.

- Linde plc

- MAN Energy Solutions SE

- Mitsui E&S Holdings Co., Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Saipem S.p.A.

- Siemens Energy AG

- Technip Energies

- Wärtsilä Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Air Products and Chemicals, Inc.

- Atlas Copco AB

- Baker Hughes Company

- Chart Industries, Inc.

- Chiyoda Corporation

- ConocoPhillips

- Cryostar SAS

- Elliott Group

- General Electric Company

- IHI Corporation

- JGC Corporation

- Kawasaki Heavy Industries, Ltd.

- Linde plc

- MAN Energy Solutions SE

- Mitsui E&S Holdings Co., Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Saipem S.p.A.

- Siemens Energy AG

- Technip Energies

- Wärtsilä Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 392 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

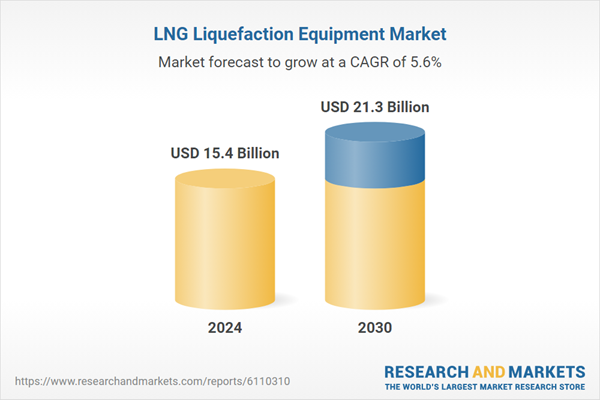

| Estimated Market Value ( USD | $ 15.4 Billion |

| Forecasted Market Value ( USD | $ 21.3 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |