Global Automotive Telematics System Market: Key Trends & Drivers Summarized

Is Telematics Transforming Vehicles into Intelligent Connected Platforms?

Automotive telematics systems are rapidly redefining how vehicles operate, communicate, and integrate into broader digital ecosystems. These systems combine telecommunications and informatics to enable real-time data transmission between vehicles, infrastructure, and cloud platforms. At the heart of this transformation is the ability of telematics to collect, process, and transmit data related to vehicle location, speed, engine diagnostics, driver behavior, and environmental conditions. Modern telematics units are equipped with GPS modules, cellular modems, embedded processors, and a range of sensors that turn vehicles into mobile data centers. This connectivity supports a wide array of applications including fleet tracking, remote diagnostics, driver safety analysis, predictive maintenance, and usage-based insurance. As vehicles become more connected, telematics systems are also playing a crucial role in enhancing infotainment services, over-the-air software updates, and emergency response capabilities. Automakers are integrating telematics as a standard offering in new vehicle models, making it a central pillar of software-defined vehicle platforms. Consumers are increasingly expecting real-time updates, route optimization, voice-based services, and mobile app integration as part of the in-vehicle experience. At the same time, advances in cloud computing and artificial intelligence are enabling more sophisticated telematics services that adapt to user behavior and optimize vehicle performance. With 5G connectivity, the speed and reliability of data exchange between vehicles and external systems have improved dramatically, paving the way for vehicle-to-everything communication. This positions telematics not just as a convenience tool but also as a strategic enabler of autonomous driving, smart mobility and integrated transport networks of the future.How Are Regulatory and Cybersecurity Challenges Shaping the Telematics Ecosystem?

As the automotive telematics system becomes an essential component of vehicle infrastructure, it is increasingly subject to complex regulatory, privacy, and cybersecurity challenges. With the flow of sensitive data such as location history, driving patterns, and user profiles, regulatory authorities are enacting stricter guidelines to govern how telematics data is collected, stored, and used. In regions such as the European Union, regulations under the General Data Protection Regulation (GDPR) require clear user consent, data minimization, and transparent communication on data practices. Similar frameworks are emerging in North America, Japan, and Australia, compelling automakers and telematics service providers to redesign their systems with privacy by design principles. Another growing concern is cybersecurity, especially as telematics becomes a critical channel for remote access and over-the-air updates. Vulnerabilities in telematics platforms could expose vehicles to malicious attacks, data breaches, and operational disruptions. In response, automotive cybersecurity standards such as ISO/SAE 21434 are being adopted to guide secure system development and risk mitigation strategies. Regulatory agencies are also requiring manufacturers to report cybersecurity incidents and demonstrate resilience through penetration testing and encryption standards. Additionally, national transport authorities are implementing rules around mandatory telematics in commercial vehicles to support electronic logging, emission tracking, and accident forensics. The insurance industry is advocating for standardized telematics protocols to ensure consistent data quality across providers. As these regulatory and security demands grow, telematics vendors are investing in secure cloud infrastructure, blockchain-based data management, and endpoint protection technologies. This shift is steering the industry toward a future where telematics systems are not only connected and intelligent but also secure, compliant, and trustworthy.Which Applications and Industry Verticals Are Leading Telematics Adoption?

Automotive telematics systems are being rapidly adopted across a wide range of industry verticals, each leveraging its capabilities to meet operational, financial, and strategic objectives. The fleet management sector remains the largest adopter, using telematics to monitor vehicle health, driver behavior, fuel consumption, and route efficiency in real time. Logistics and delivery companies rely on telematics to enhance asset utilization, reduce fuel costs, and ensure timely deliveries through dynamic routing and geofencing. Public transportation systems are deploying telematics to optimize bus schedules, improve passenger safety, and monitor emissions. In the consumer automotive market, telematics is being embedded into infotainment and connected services platforms to support features such as remote start, stolen vehicle recovery, and in-vehicle concierge services. Car rental and ride-hailing companies are using telematics to track vehicle usage, enforce service-level agreements, and manage preventive maintenance. The insurance sector is increasingly integrating telematics for usage-based insurance models, rewarding safe driving with lower premiums and enabling real-time risk assessment. Emergency response services are benefiting from telematics through automatic crash notification and eCall systems that transmit vehicle and occupant data to rescue teams. The integration of telematics in electric vehicles is also gaining ground, providing insights into battery status, charging behavior, and energy consumption patterns. Automotive OEMs are using telematics data for product development, warranty analysis, and customer engagement strategies. Additionally, smart city initiatives are beginning to integrate telematics data into traffic management systems, helping reduce congestion and improve road safety. These varied applications demonstrate how telematics is evolving from a back-end utility to a front-line enabler of mobility, safety, and customer value.What Forces Are Driving the Growth of the Automotive Telematics System Market?

The growth in the automotive telematics system market is driven by several interconnected forces rooted in technological innovation, business model evolution, and evolving consumer demands. One of the primary drivers is the rapid expansion of connected vehicle infrastructure, supported by widespread mobile internet access, falling data transmission costs, and advanced GPS and sensor technologies. The shift toward electrification and autonomous driving has made telematics a core requirement for monitoring system health, managing software updates, and coordinating with external systems. Automakers are moving toward subscription-based service models, and telematics platforms provide the foundation for recurring revenue streams through connected services, infotainment packages, and remote diagnostics. The increasing demand for operational transparency in commercial fleets is prompting fleet operators to adopt telematics for real-time visibility, compliance tracking, and cost control. Regulatory mandates requiring electronic logging devices, vehicle tracking, and driver fatigue monitoring are further encouraging adoption, especially in North America, Europe, and parts of Asia. Rising consumer expectations for digital interfaces, mobile app control, and remote diagnostics are pressuring OEMs to integrate comprehensive telematics solutions from the design phase. Cloud computing and AI are enabling scalable, data-rich telematics platforms that support advanced analytics, personalized services, and cross-platform integration. The insurance industry's growing reliance on telematics to power usage-based insurance and fraud detection is also boosting demand. Furthermore, the integration of telematics data into broader mobility and infrastructure systems is reinforcing its role in future smart city and connected transport initiatives. These dynamics collectively indicate a robust and accelerating trajectory for the automotive telematics system market, with strong momentum from both commercial and consumer sectors.Scope of the Report

The report analyzes the Automotive Telematics System market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Service (Infotainment & Navigation Service, Fleet Management Service, Safety & Security Service, Diagnostics Service).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Infotainment & Navigation Service segment, which is expected to reach US$24.9 Billion by 2030 with a CAGR of a 13.0%. The Fleet Management Service segment is also set to grow at 16.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.5 Billion in 2024, and China, forecasted to grow at an impressive 19.3% CAGR to reach $13.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Telematics System Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Telematics System Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Telematics System Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Airbiquity Inc., AT&T Inc., Bosch Mobility (Robert Bosch GmbH), Continental AG, Denso Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Automotive Telematics System market report include:

- Airbiquity Inc.

- AT&T Inc.

- Bosch Mobility (Robert Bosch GmbH)

- Continental AG

- Denso Corporation

- Ericsson AB

- Geotab Inc.

- Harman International

- Intel Corporation (Mobileye)

- LG Electronics (Vehicle Components)

- Mitsubishi Electric Corporation

- NTT DATA Corporation

- NXP Semiconductors N.V.

- Qualcomm Technologies, Inc.

- Sierra Wireless (Semtech)

- Teltonika Telematics

- TomTom N.V.

- Trimble Inc.

- Verizon Communications Inc.

- Visteon Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airbiquity Inc.

- AT&T Inc.

- Bosch Mobility (Robert Bosch GmbH)

- Continental AG

- Denso Corporation

- Ericsson AB

- Geotab Inc.

- Harman International

- Intel Corporation (Mobileye)

- LG Electronics (Vehicle Components)

- Mitsubishi Electric Corporation

- NTT DATA Corporation

- NXP Semiconductors N.V.

- Qualcomm Technologies, Inc.

- Sierra Wireless (Semtech)

- Teltonika Telematics

- TomTom N.V.

- Trimble Inc.

- Verizon Communications Inc.

- Visteon Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | February 2026 |

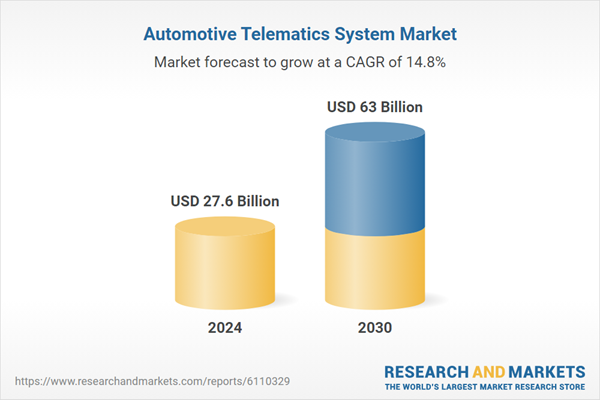

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 27.6 Billion |

| Forecasted Market Value ( USD | $ 63 Billion |

| Compound Annual Growth Rate | 14.8% |

| Regions Covered | Global |