Global Decoys and Dispensers Market - Key Trends & Drivers Summarized

Why Are Decoys and Dispensers Gaining Strategic Importance Across Military and Civil Applications?

Decoys and dispensers have evolved from niche tools into essential components of modern defense and aviation systems, playing a pivotal role in mission success and platform survivability. In military contexts, decoys are used to mislead, confuse, or distract enemy targeting systems, while dispensers deploy various countermeasures, such as flares and chaff, to neutralize incoming threats like radar-guided and infrared-seeking missiles. The growing sophistication of guided munitions and electronic warfare has made the development and deployment of advanced decoy systems more critical than ever. Airborne, naval, and ground platforms are now routinely equipped with integrated dispenser systems that allow for automated or pilot-controlled release of countermeasures during combat scenarios. These systems not only protect equipment but also save lives, creating a significant operational advantage. Beyond defense, decoys and dispensers are increasingly being utilized in civilian aviation for protection against man-portable air defense systems (MANPADS), particularly in high-risk regions. Additionally, non-military sectors such as wildlife conservation and aviation safety are adopting decoy technologies to control bird migration patterns and mitigate aircraft bird-strike hazards. The growing importance of survivability, strategic deception, and threat deterrence in both military and civil spheres is driving demand for more intelligent, responsive, and integrated decoy and dispenser systems. As the geopolitical climate remains tense and asymmetric warfare threats rise, the role of these technologies is expected to become even more pronounced across various domains of application.How Is Technology Advancing the Capabilities of Modern Decoys and Dispensers?

Technological advancements are significantly reshaping the landscape of decoy and dispenser systems, making them more intelligent, automated, and adaptable to dynamic threat environments. One of the most transformative innovations is the integration of electronic countermeasure (ECM) capabilities directly into decoys, allowing them to emit radar or infrared signatures that mimic real assets with exceptional fidelity. These active decoys can now respond in real time to radar sweeps and missile seeker inputs, creating more convincing diversions than ever before. Dispensers are also being enhanced with smart release mechanisms, guided by onboard sensors, threat detection algorithms, and mission management software, which determine the optimal timing and pattern of countermeasure deployment. Multi-spectral decoys capable of simulating visual, radar, and infrared signatures simultaneously are becoming more prevalent, as they offer protection against a broader array of targeting technologies. Innovations in materials science have led to the development of lightweight, compact, and temperature-resistant countermeasures that are easier to store and deploy from multiple platforms. Autonomous drone-based decoys are emerging as a disruptive trend, offering reusable and programmable tools that can act independently or in swarms to deceive enemy defenses. In parallel, the miniaturization of dispensers is enabling their integration into smaller platforms, including unmanned aerial vehicles (UAVs) and ground-based systems. These technological enhancements are being matched by advances in software, including AI-based threat analysis and predictive modeling tools that allow for real-time threat identification and the dynamic adjustment of countermeasure tactics. Together, these innovations are transforming decoy and dispenser systems from passive defense tools into active elements of integrated warfare strategies.What Market Trends Are Driving Broader Adoption of Decoys and Dispensers Across Global Defense Forces?

A number of key market trends are contributing to the expanded adoption of decoys and dispensers across global defense establishments and beyond. One major trend is the growing emphasis on multi-domain operations, where land, air, sea, space, and cyber forces operate cohesively against diverse threats. This integrated approach demands interoperable defense systems, including decoy and dispenser technologies that can be seamlessly adapted across platforms and environments. As regional conflicts and geopolitical tensions intensify, nations are investing more in defense modernization, including upgrades to existing aircraft, naval vessels, and ground vehicles that incorporate advanced survivability technologies. Another significant trend is the rise of asymmetric threats, such as portable missile systems and drone swarms, which are challenging traditional defense doctrines and requiring more agile, responsive countermeasure systems. As part of their strategic doctrine, many countries are now prioritizing active protection systems (APS) that include both hard-kill and soft-kill capabilities, the latter of which is where decoys and dispensers play a crucial role. Defense procurement processes are also changing, with a growing preference for modular, scalable systems that can be upgraded through software and hardware enhancements without full platform replacement. Additionally, the increasing involvement of private sector innovators and defense tech startups is accelerating the pace of innovation and reducing costs, making these systems more accessible to medium and lower-tier militaries. Export opportunities are also expanding, especially in emerging economies that are building new defense capabilities from the ground up. These market dynamics reflect a growing understanding that in a world of unpredictable and rapidly evolving threats, the ability to deceive, distract, and disrupt is just as vital as direct firepower.What Are the Primary Drivers Behind the Rapid Expansion of the Decoys and Dispensers Market?

The growth in the decoys and dispensers market is being driven by a combination of strategic, technological, operational, and geopolitical factors that are redefining modern defense capabilities. A primary driver is the evolution of guided missile technology and electronic warfare systems, which has made traditional armor and passive defense measures less effective. In response, militaries are investing heavily in decoy and dispenser systems that provide dynamic, real-time protection by confusing or diverting incoming threats. The increasing need for force protection in hostile or uncertain environments is also driving demand, as both manned and unmanned platforms face elevated risks from enemy fire, surveillance, and tracking systems. The rise in military budgets, particularly in countries across Asia-Pacific, the Middle East, and Eastern Europe, is enabling large-scale procurement of next-generation defensive systems. Urban warfare and counter-insurgency operations present unique challenges where the ability to deploy localized, responsive countermeasures can significantly enhance survivability. Another key driver is the expansion of unmanned systems in defense operations, which require miniaturized and efficient decoy systems that can operate autonomously or in concert with manned assets. Meanwhile, global supply chains and defense collaborations are accelerating technology transfer and standardization, allowing for quicker development and deployment across allied forces. In civilian aviation, the need for aircraft protection in conflict zones and unstable regions is pushing commercial entities and governments to adopt flare and chaff dispensing systems for passenger and cargo flights. Finally, the increasing integration of artificial intelligence and predictive analytics is creating opportunities for decoy systems that can adapt in real time to changing threat landscapes. These factors collectively underscore the strategic importance and commercial viability of decoys and dispensers in shaping the future of defense readiness and tactical deception.Scope of the Report

The report analyzes the Decoys and Dispensers market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Pyrotechnic, Pyrophoric, Other Types); Application (Fixed-wing Aircraft Application, Rotary-wing Aircraft Application, Unmanned Aircraft Vehicles Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Pyrotechnic segment, which is expected to reach US$1.7 Billion by 2030 with a CAGR of a 6.7%. The Pyrophoric segment is also set to grow at 8.0% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $584.5 Million in 2024, and China, forecasted to grow at an impressive 11.0% CAGR to reach $675.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Decoys and Dispensers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Decoys and Dispensers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Decoys and Dispensers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Allen Company, BAE Systems plc, Bird B Gone, Blackhawk!, Chemring Group PLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Decoys and Dispensers market report include:

- Allen Company

- BAE Systems plc

- Bird B Gone

- Blackhawk!

- Chemring Group PLC

- DecoyPro

- EDO Corporation (Harris L3Harris)

- Flambeau Outdoors

- Heat-Activated Technologies Inc

- Heatmax (makers of HotHands)

- Lockheed Martin Corporation

- Margo Supplies Ltd.

- Northrop Grumman Corporation

- Primos Hunting

- Raytheon Technologies (RTX)

- Reind Industries Inc.

- Rig'Em Right Outdoors

- RUAG AG

- Teledyne FLIR

- Vista Outdoor Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allen Company

- BAE Systems plc

- Bird B Gone

- Blackhawk!

- Chemring Group PLC

- DecoyPro

- EDO Corporation (Harris L3Harris)

- Flambeau Outdoors

- Heat-Activated Technologies Inc

- Heatmax (makers of HotHands)

- Lockheed Martin Corporation

- Margo Supplies Ltd.

- Northrop Grumman Corporation

- Primos Hunting

- Raytheon Technologies (RTX)

- Reind Industries Inc.

- Rig'Em Right Outdoors

- RUAG AG

- Teledyne FLIR

- Vista Outdoor Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

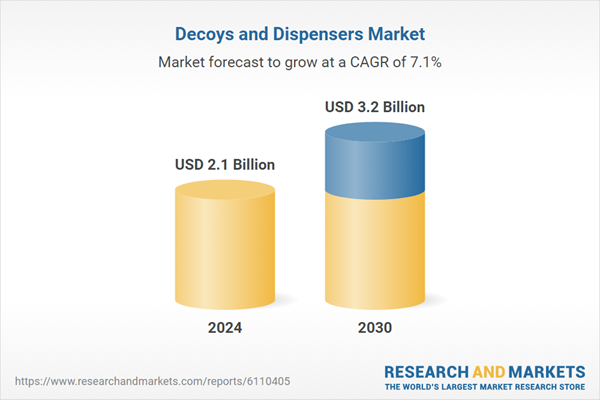

| Estimated Market Value ( USD | $ 2.1 Billion |

| Forecasted Market Value ( USD | $ 3.2 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |