Global Water Leak Detection Systems Market - Key Trends & Drivers Summarized

Why Is Leak Detection Becoming a Critical Pillar in Water Conservation Strategies?

As global concerns around water scarcity intensify, water leak detection systems are rapidly emerging as a crucial component of modern water management and conservation strategies. Non-revenue water, which refers to water lost before it reaches the end user, accounts for up to 30 to 50 percent of total water production in some regions. Much of this loss is due to undetected leaks in aging distribution networks and poorly maintained plumbing systems. With freshwater resources under increasing pressure from population growth, industrial expansion, and climate change, identifying and mitigating water loss at the source has become a top priority for utilities, municipalities, and commercial property owners. Leak detection systems provide early warnings that allow for timely intervention, reducing both water waste and infrastructure damage. These systems are now being integrated not only into municipal water grids but also into residential, commercial, and industrial buildings to prevent property damage and ensure uninterrupted water supply. The importance of leak detection is further emphasized by rising insurance claims related to water damage, which have become a significant cost driver in real estate and facility management. Governments and environmental bodies are also playing a role by encouraging leak detection through regulatory policies and incentives. In this context, leak detection has evolved from a reactive maintenance task to a proactive and strategic tool for sustainable water stewardship.How Are Technological Advancements Redefining Detection Accuracy and Response Speed?

Rapid advancements in sensor technologies and data analytics have revolutionized the effectiveness and precision of water leak detection systems. Traditional acoustic leak detection methods, while still in use, are now being augmented or replaced by smart systems that employ a variety of sensors, including ultrasonic, pressure, flow, and temperature sensors. These devices are capable of continuously monitoring pipelines and plumbing systems for anomalies that indicate leakage. The integration of Internet of Things (IoT) technology allows for remote and real-time data transmission, enabling instant alerts and faster response times. Cloud-based platforms and mobile applications are enhancing the user experience by providing detailed insights and visualizations of system health and leak locations. Machine learning algorithms are increasingly being utilized to differentiate between normal usage fluctuations and actual leaks, improving the accuracy of detection and reducing false positives. Some advanced systems even incorporate geospatial mapping and automated shut-off capabilities, adding layers of precision and safety. The growing use of wireless and battery-powered sensors is allowing deployment in areas previously considered inaccessible or cost-prohibitive. As a result, property managers, utilities, and industries can now implement leak detection in a broader range of environments with minimal disruption. These technological improvements are not only enhancing efficiency but also extending the capabilities of water management teams in preventing long-term damage and resource loss.What Market Trends Are Driving Adoption Across Residential, Commercial, and Utility Segments?

The adoption of water leak detection systems is expanding rapidly across residential, commercial, and municipal segments, each influenced by distinct yet converging market drivers. In the residential sector, consumers are becoming increasingly aware of the financial and environmental costs of undetected leaks, prompting investment in smart home leak detection products. Devices such as smart water meters and under-sink leak sensors are being adopted as part of broader home automation ecosystems, often linked with voice assistants and mobile notifications. In commercial properties such as hotels, hospitals, and office complexes, the potential for water damage to cause operational disruption and reputational harm is a powerful motivator for early leak detection implementation. These facilities typically require more complex, scalable systems that can monitor multiple zones and integrate with existing building management systems. For utility companies and municipalities, large-scale leak detection is becoming essential for managing non-revenue water and optimizing aging infrastructure. The use of district metered areas (DMAs) and pressure management zones enables targeted monitoring of specific sections of the water network, improving detection speed and repair prioritization. The trend toward digital water infrastructure is also promoting greater uptake of centralized, cloud-based leak detection platforms that offer comprehensive system oversight. Moreover, cost reductions in sensor manufacturing and data analytics are making these technologies more accessible, further accelerating adoption across all end-user segments.What Forces Are Driving the Growth of the Global Leak Detection Market?

The growth in the water leak detection systems market is driven by several factors tied closely to technological evolution, sectoral needs, and shifting priorities in water management. First, the aging of global water infrastructure, particularly in North America and Europe, has made leak detection indispensable for reducing operational losses and extending asset life. Second, growing regulatory and financial pressures on utilities to lower non-revenue water are prompting investments in advanced leak monitoring systems. Third, climate change and water scarcity are heightening the urgency for water conservation, making efficient leak detection a strategic imperative for both governments and private entities. Fourth, rising property insurance costs and the increasing frequency of water damage claims are driving adoption in the real estate and commercial building sectors. Fifth, advancements in sensor miniaturization, wireless communication, and battery life are enabling easier and more cost-effective deployment, particularly in remote or hard-to-access areas. Sixth, the growing popularity of smart homes and intelligent buildings is integrating leak detection as a core feature of energy and resource management systems. Seventh, increased funding from public infrastructure programs and environmental grants is helping to subsidize implementation in municipal settings. Finally, heightened consumer awareness about environmental responsibility is driving demand for technologies that help reduce water waste. Together, these forces are positioning water leak detection systems as essential components of modern infrastructure, with strong growth momentum across multiple sectors and geographies.Scope of the Report

The report analyzes the Water Leak Detection Systems market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Technology (Acoustic Technology, Non-Acoustic Technology); Component (Sensors Component, Detectors Component, Monitoring Systems Component, Other Components); Application (Residential Application, Commercial Application, Industrial Application, Municipal Application); End-User (Water Utilities End-User, Oil & Gas End-User, Manufacturing End-User, Other End-Users).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Acoustic Technology segment, which is expected to reach US$2.5 Billion by 2030 with a CAGR of a 8.6%. The Non-Acoustic Technology segment is also set to grow at 5.0% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $663.4 Million in 2024, and China, forecasted to grow at an impressive 11.7% CAGR to reach $793.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Water Leak Detection Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Water Leak Detection Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Water Leak Detection Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd, Atmos International Limited, Badger Meter, Inc., Dorlen Products, Inc., Echologics (Mueller Water Products) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Water Leak Detection Systems market report include:

- ABB Ltd

- Atmos International Limited

- Badger Meter, Inc.

- Dorlen Products, Inc.

- Echologics (Mueller Water Products)

- Electro Scan Inc.

- Gutermann AG

- Halma plc

- Hermann Sewerin GmbH

- Mueller Water Products, Inc.

- NEC Corporation

- Note: Aqualeak Detection Ltd.

- Primayer Limited

- Pure Technologies (Xylem/Echologics)

- Schneider Electric S.E.

- Siemens AG

- SPX Corporation

- TTK (TTK Leak Detection System)

- Veeder-Root Company

- Xylem Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd

- Atmos International Limited

- Badger Meter, Inc.

- Dorlen Products, Inc.

- Echologics (Mueller Water Products)

- Electro Scan Inc.

- Gutermann AG

- Halma plc

- Hermann Sewerin GmbH

- Mueller Water Products, Inc.

- NEC Corporation

- Note: Aqualeak Detection Ltd.

- Primayer Limited

- Pure Technologies (Xylem/Echologics)

- Schneider Electric S.E.

- Siemens AG

- SPX Corporation

- TTK (TTK Leak Detection System)

- Veeder-Root Company

- Xylem Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 483 |

| Published | February 2026 |

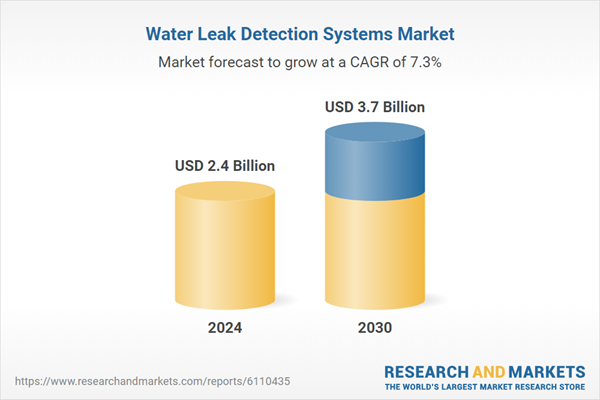

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.4 Billion |

| Forecasted Market Value ( USD | $ 3.7 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |