Global Reaming Tools Market - Key Trends & Drivers Summarized

Why Are Reaming Tools Critical to Modern Machining Processes?

Reaming tools, often considered a finishing operation in the machining chain, play an indispensable role in achieving high-precision hole sizing and superior surface finishes across industrial applications. Used across sectors such as automotive, aerospace, general engineering, and medical device manufacturing, reamers help ensure tight dimensional tolerances and surface roughness that downstream processes often depend on. As demand for precision-engineered components increases, reaming tools are gaining relevance for their ability to deliver round, true, and consistent holes without compromising material integrity.What distinguishes reaming from other hole-finishing processes is its efficiency in achieving micron-level accuracy without inducing thermal or mechanical distortion. In an era where components are being miniaturized, light-weighted, or subjected to harsh mechanical loads, reaming tools provide a consistent and repeatable solution for maintaining geometric accuracy. For industries such as aerospace-where rivet holes or engine components demand high fatigue resistance-the reamer's role in achieving precision tolerances is mission-critical.

How Are Design Innovations and Tooling Materials Enhancing Performance?

The evolution of reaming tools is being shaped by both material science and design optimization. Advanced carbide grades, coated HSS (high-speed steel), and cermet-based reamers are replacing conventional tools in high-speed and high-load environments. Coatings like TiN, TiAlN, and diamond-like carbon (DLC) enhance wear resistance, reduce friction, and support dry machining-a feature that reduces coolant dependency and improves sustainability in shop floors.Design innovations include adjustable reamers, multi-flute geometries, and modular head systems that improve tool life and chip evacuation. Helical flute reamers, for instance, are gaining popularity for their ability to perform reaming operations in soft or ductile materials like aluminum and brass without smearing or chip clogging. In harder materials such as hardened steel or Inconel, straight-flute or carbide reamers with customized rake angles and back taper geometries are preferred to minimize chatter and ensure consistent surface finish.

Reamers are also increasingly integrated into CNC tool libraries with CAM-compatible geometries, making them easier to simulate, program, and apply in high-precision machining environments. Quick-change systems and digital tool presetting ensure that tool changes are fast, precise, and consistent-minimizing downtime and improving production throughput in lean manufacturing lines.

Which End-Use Segments and Global Markets Are Fueling Demand?

Automotive remains the largest consumer of reaming tools, particularly in engine blocks, transmission casings, and suspension components where bore tolerances must meet exacting OEM standards. As ICE vehicles evolve into EVs, the demand is shifting from cylinder bores to battery housing, motor casing, and electric drive train components-all of which still require precise hole machining. Aerospace applications are growing in complexity, with titanium alloys and composite sandwich materials demanding high-precision reaming tools that can withstand abrasive wear while maintaining form stability.Medical device manufacturing is another high-growth area. Surgical tools, orthopedic implants, and endoscopic components require micro-diameter reaming operations with exceptional surface finishes. In this sector, carbide micro-reamers and disposable precision reamers are preferred due to their sterility, accuracy, and ease of integration with robotic surgical manufacturing.

Regionally, Asia-Pacific dominates the global market led by strong manufacturing bases in China, Japan, South Korea, and India. Europe follows closely, with Germany, Italy, and France showcasing high adoption of advanced reaming solutions in precision machining. North America remains a critical market, especially for aerospace-grade and defense components. Latin America and Africa, while smaller in scale, are witnessing growth due to industrial localization and regional tooling production.

What Is Driving Growth in the Global Reaming Tools Market?

The growth in the global reaming tools market is driven by the rising need for precision engineering, rapid tooling innovation, and increased automation in manufacturing. As industries across automotive, medical, and aerospace sectors shift toward tighter tolerances and faster cycle times, reaming tools have emerged as essential elements in the finishing toolkit of advanced machining systems.Tool manufacturers are investing heavily in material R&D, hybrid designs, and digitally compatible geometries to cater to evolving end-user requirements. The rise of Industry 4.0 is accelerating demand for smart tooling systems-reamers included-that feature tool wear detection, digital presetting, and predictive maintenance integrations. This not only improves operational efficiency but also extends tool life and reduces production waste.

Growing emphasis on sustainable manufacturing and energy-efficient machining is further pushing demand for reamers that can operate under minimum quantity lubrication (MQL) or dry cutting conditions. The modularity of modern reaming systems-especially those designed for high-speed and automated lines-ensures they are adaptable across platforms, including CNC lathes, multi-spindle drills, and robotic arms. As industrial complexity and quality expectations rise globally, the reaming tools market is well-positioned for continued expansion, supported by technology adoption, tooling upgrades, and precision-led growth strategies.

Scope of the Report

The report analyzes the Reaming Tools market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Straight Reamer, Adjustable Hand Reamer, Shell Reamer, Rose Reamer, Tapered Reamer, Combination Reamer, Other Types); Application (Size an Existing Hole Application, Smooth an Existing Hole Application, Align Holes Application, Enlarge an Existing Hole Application, Deburring Application); End-Use (Manufacturing End-Use, Aerospace End-Use, Automotive End-Use, Energy End-Use, Machinery End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Straight Reamer segment, which is expected to reach US$968.7 Million by 2030 with a CAGR of a 3.0%. The Adjustable Hand Reamer segment is also set to grow at 4.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $750.7 Million in 2024, and China, forecasted to grow at an impressive 5.6% CAGR to reach $641.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Reaming Tools Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Reaming Tools Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Reaming Tools Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Atlas Copco AB, BIG Kaiser Precision Tooling Inc., Ceratizit Group, Clortech Reamers, Cogsdill and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Reaming Tools market report include:

- Atlas Copco AB

- BIG Kaiser Precision Tooling Inc.

- Ceratizit Group

- Clortech Reamers

- Cogsdill

- DATC

- Dormer Pramet

- Fotofab

- Grainger

- Guhring KG

- Harvey Tool

- HORN Cutting Tools

- ICS Cutting Tools

- ISCAR Ltd.

- Klein Tools

- KOMET Group

- MAPAL Dr. Kress KG

- Mitsubishi Materials Corporation

- National Oilwell Varco (NOV)

- Sandvik Coromant

- Walter Tools (Walter AG)

- WIDIA

- Yankee Reamers

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Atlas Copco AB

- BIG Kaiser Precision Tooling Inc.

- Ceratizit Group

- Clortech Reamers

- Cogsdill

- DATC

- Dormer Pramet

- Fotofab

- Grainger

- Guhring KG

- Harvey Tool

- HORN Cutting Tools

- ICS Cutting Tools

- ISCAR Ltd.

- Klein Tools

- KOMET Group

- MAPAL Dr. Kress KG

- Mitsubishi Materials Corporation

- National Oilwell Varco (NOV)

- Sandvik Coromant

- Walter Tools (Walter AG)

- WIDIA

- Yankee Reamers

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 402 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

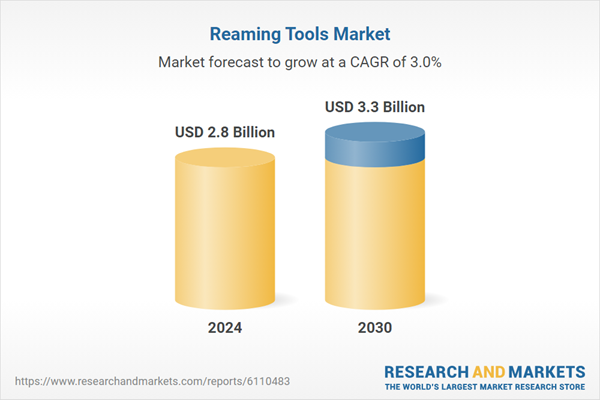

| Estimated Market Value ( USD | $ 2.8 Billion |

| Forecasted Market Value ( USD | $ 3.3 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |