Global Pipette Controllers Market - Key Trends & Drivers Summarized

Why Are Pipette Controllers Gaining Relevance in Precision-Driven Laboratory Environments?

In today’s life sciences and diagnostics landscape, pipette controllers have become an indispensable tool for researchers and lab technicians handling large-volume liquid transfers with high accuracy and consistency. Unlike manual pipettes, pipette controllers offer semi-automated or fully motorized functionality that significantly enhances throughput, reduces repetitive strain injuries, and ensures better liquid handling precision across a broad range of laboratory applications including molecular biology, microbiology, and pharmaceutical analysis.Their relevance has grown in tandem with the rising complexity of experimental workflows in genomics, cell culture, vaccine research, and high-throughput screening (HTS). As labs process increasingly high sample volumes under rigorous reproducibility standards, pipette controllers provide ergonomic and performance advantages that align with good laboratory practices (GLP) and ISO-certified workflows. Additionally, the widespread use of serological pipettes in tissue culture and diagnostic labs makes pipette controllers the preferred choice for aspirating and dispensing volumes between 1-100 mL, which cannot be efficiently managed with handheld micropipettes.

The COVID-19 pandemic further accelerated the adoption of advanced pipetting solutions, including controllers, as mass testing, vaccine production, and genomic sequencing demanded precision liquid transfers under tight timelines. Laboratories now expect devices that are fast, user-friendly, battery-operated, and compatible with multiple pipette sizes. These shifting requirements are helping pipette controllers evolve from optional lab tools to essential components of modern lab automation ecosystems.

How Are Design Innovations Enhancing Usability and Performance of Pipette Controllers?

Modern pipette controllers are incorporating several technological enhancements that increase precision, comfort, and operational efficiency. Key among them is variable speed control, which allows users to aspirate and dispense at fine-tuned flow rates suited to different media viscosities and experimental sensitivities. Touch-sensitive triggers and pressure-sensitive buttons now enable intuitive modulation of flow without abrupt surges that could compromise sample integrity.Another innovation lies in the integration of ergonomic design principles. Lightweight materials, contoured grips, and balanced center of gravity have significantly improved the user experience, particularly in labs where technicians conduct hundreds of pipetting actions per day. Features such as autoclavable nosepieces, hydrophobic filters, and built-in check valves reduce contamination risks and ensure compatibility with biosafety requirements.

Rechargeable lithium-ion batteries with extended life and quick charging cycles have become standard, replacing older NiMH-based systems. Some high-end models include LCD displays for battery status, programmable volume memory, and dual-mode functionality (gravity-based and motorized aspiration). Compatibility with both glass and plastic pipettes, spanning 1 mL to 100 mL, allows seamless switching between protocols without changing devices. These innovations cater to research labs, pharma QC units, and academic teaching labs with varying levels of complexity and throughput needs.

Which Application Areas and End-User Segments Are Expanding the Market Landscape?

Pipette controllers are finding increased uptake across molecular diagnostics labs, clinical chemistry labs, and bioprocessing facilities. In genomics, they are used to handle buffers, master mixes, and nucleic acid extraction solutions, where precise fluid transfers directly influence downstream assay accuracy. In biopharma R&D, pipette controllers enable sterile media handling, reagent transfers, and cell line maintenance with minimal operator fatigue and reduced risk of contamination.Academic and teaching laboratories are emerging as a prominent demand segment, especially in life sciences departments. Here, pipette controllers are valued for their simplicity, safety, and versatility-allowing instructors to standardize practical training across a range of fluid-handling tasks. In public health labs, where field-deployable equipment is essential, battery-powered pipette controllers are being adopted for on-site sample handling and reagent reconstitution during outbreak investigations.

Geographically, North America and Western Europe lead in adoption due to the presence of advanced research institutions and high lab automation penetration. Asia-Pacific is witnessing fast growth, fueled by the expansion of pharmaceutical manufacturing, increased funding in life sciences education, and the emergence of biotech clusters in countries like China, India, and South Korea. Procurement by government research centers and international health agencies is also contributing to demand stabilization in Africa and Latin America.

What Is Driving Growth in the Global Pipette Controllers Market?

The growth in the global pipette controllers market is driven by the need for ergonomic liquid handling tools, the rise in lab automation adoption, and increasing volumes of molecular biology and diagnostics work globally. As precision and repeatability become non-negotiable in regulated labs, pipette controllers offer a dependable solution for volume transfers in both basic and advanced laboratory workflows.The surge in vaccine development, cell culture expansion, and PCR-based diagnostic testing is generating high-volume liquid handling requirements that pipette controllers are uniquely suited to fulfill. Regulatory requirements mandating contamination control and accuracy verification are further pushing labs to adopt standardized, easy-to-clean, and filter-equipped controllers. The integration of pipette controllers into broader automation systems is also underway, with some units being coupled with robotic arms or liquid handling platforms for semi-automated workflows.

Growth is also being fueled by the demand for hybrid learning tools in academic environments, where cost-effective pipette controllers help balance teaching efficiency with technical accuracy. Vendor strategies like bulk purchasing programs for universities, cloud-enabled device tracking, and extended service contracts are boosting product lifecycle value and expanding user bases. With increasing convergence of quality, affordability, and versatility, pipette controllers are well-positioned for sustained adoption in the future of laboratory workflows.

Scope of the Report

The report analyzes the Pipette Controllers market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Manual Product, Electrical / Battery Powered Product); End-User (Pharmaceutical End-User, Biotechnology End-User, Other End-Users).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Manual Product segment, which is expected to reach US$168.0 Million by 2030 with a CAGR of a 2.7%. The Electrical / Battery Powered Product segment is also set to grow at 1.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $57.3 Million in 2024, and China, forecasted to grow at an impressive 4.4% CAGR to reach $45.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Pipette Controllers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Pipette Controllers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Pipette Controllers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Avantor Inc. (VWR), Biohit Healthcare, Bio-Rad Laboratories Inc., Brand GmbH & Co. KG, BrandTech (Ward's) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Pipette Controllers market report include:

- Avantor Inc. (VWR)

- Biohit Healthcare

- Bio-Rad Laboratories Inc.

- Brand GmbH & Co. KG

- BrandTech (Ward's)

- CAPP LLC

- Dr. Fischer Scientific

- Drummond Scientific

- Eppendorf AG

- Gilson Inc.

- Globe Scientific Inc.

- Hamilton Company

- Heathrow Scientific

- Hirschmann Lab Instruments

- INTEGRA Biosciences AG

- Labnet International

- Merck KGaA

- Mettler Toledo

- Sartorius AG

- Thermo Fisher Scientific

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Avantor Inc. (VWR)

- Biohit Healthcare

- Bio-Rad Laboratories Inc.

- Brand GmbH & Co. KG

- BrandTech (Ward's)

- CAPP LLC

- Dr. Fischer Scientific

- Drummond Scientific

- Eppendorf AG

- Gilson Inc.

- Globe Scientific Inc.

- Hamilton Company

- Heathrow Scientific

- Hirschmann Lab Instruments

- INTEGRA Biosciences AG

- Labnet International

- Merck KGaA

- Mettler Toledo

- Sartorius AG

- Thermo Fisher Scientific

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 278 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

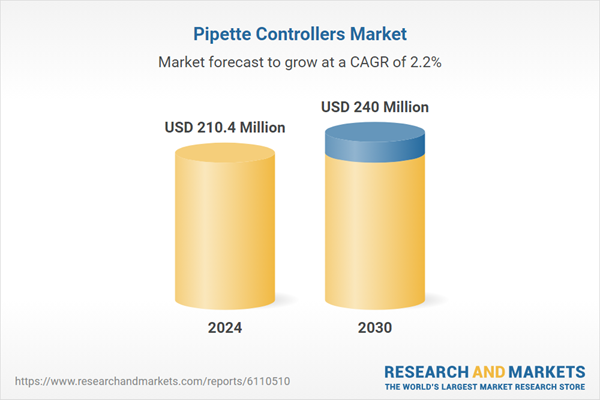

| Estimated Market Value ( USD | $ 210.4 Million |

| Forecasted Market Value ( USD | $ 240 Million |

| Compound Annual Growth Rate | 2.2% |

| Regions Covered | Global |