Global PCR Tests Market - Key Trends & Drivers Summarized

Why Are PCR Tests Still the Gold Standard in Molecular Diagnostics?

Polymerase Chain Reaction (PCR) testing continues to stand at the forefront of molecular diagnostics due to its high specificity, sensitivity, and versatility in detecting nucleic acids across a broad spectrum of pathogens, genetic conditions, and oncology biomarkers. While initially introduced as a tool for basic research, PCR has become central to clinical diagnostics, food safety testing, forensic analysis, and environmental monitoring. Its application surged globally during the COVID-19 pandemic, and its relevance continues to evolve across routine diagnostics and precision medicine.In infectious disease diagnostics, PCR remains the gold standard for confirming active infections, with real-time quantitative PCR (qPCR) and multiplex PCR systems offering rapid turnaround and the ability to detect multiple targets simultaneously. These capabilities are essential for managing respiratory infections (e.g., influenza, RSV, SARS-CoV-2), sexually transmitted infections, and tropical diseases such as dengue and Zika. PCR also plays a crucial role in hospital-acquired infection control by enabling early detection of drug-resistant strains like MRSA or C. difficile.

Outside infectious disease, PCR is integral in genetic and prenatal screening, detecting single-nucleotide polymorphisms (SNPs), gene fusions, and chromosomal abnormalities. Oncology diagnostics increasingly rely on PCR-based assays to identify actionable mutations in tumors, guide targeted therapies, and monitor minimal residual disease. In non-clinical domains, PCR is used in water testing, agricultural pathogen detection, and food contamination screening, emphasizing its cross-industry utility and standardization.

What Technological Advancements Are Reshaping PCR Testing Platforms?

The evolution of PCR technologies has been shaped by a need for higher throughput, faster cycling times, greater multiplexing capability, and improved point-of-care (POC) applicability. Traditional thermal cyclers are being replaced or supplemented by integrated systems combining sample preparation, amplification, and detection in a single closed unit. This reduces contamination risks and simplifies workflow, particularly in resource-limited or field-based settings.Digital PCR (dPCR) represents one of the most significant advances in the last decade. By partitioning the PCR reaction into thousands of nanoliter-scale reactions, dPCR enables absolute quantification of nucleic acids without the need for standard curves. This technology is gaining traction in oncology for liquid biopsy applications and in viral load monitoring, offering higher precision in low-abundance targets. Microfluidic-based PCR devices, including lab-on-a-chip platforms, are also enabling miniaturization and ultra-fast processing, crucial for emergency diagnostics and mobile health applications.

Multiplex PCR technologies are being refined to handle increasing numbers of targets in a single reaction, driven by the rise in syndromic panel testing. This is especially valuable for diagnosing respiratory or gastrointestinal diseases where symptoms overlap. AI-integrated PCR platforms are emerging that can interpret complex amplification data, suggest probable diagnoses, and feed into centralized databases for outbreak surveillance or patient record integration. These smart systems are expected to redefine how diagnostic data is collected, processed, and utilized.

Which End-Use Segments and Global Regions Are Fueling PCR Market Expansion?

Hospitals, diagnostic reference laboratories, academic research centers, biotechnology firms, and public health agencies are the core end-users of PCR test technologies. Hospital-based molecular labs are focusing on automating high-throughput PCR workflows to reduce test backlogs and support rapid clinical decision-making. Reference labs process large test volumes across multiple disease domains, often using multiplex and dPCR platforms to expand test menus and support contract research.Research institutions use PCR to validate gene editing experiments, profile gene expression, and perform microbial sequencing. Biopharma firms depend on PCR-based assays for product safety testing, contamination control, and pharmacogenomic screening in clinical trials. Regulatory bodies and food safety authorities utilize PCR to track genetically modified organisms (GMOs), toxins, or banned substances across global supply chains, ensuring compliance with public health standards.

Geographically, North America leads in adoption due to well-established lab infrastructure, insurance reimbursement for molecular tests, and ongoing innovation from U.S.-based biotech companies. Europe is a close second, supported by coordinated public health screening programs and EU-based diagnostic manufacturers. Asia-Pacific is witnessing rapid growth, especially in China, India, and Southeast Asia, where infectious disease burden, public health investment, and rising molecular lab capacity drive demand. Latin America and Africa, while still emerging markets, are experiencing increased PCR deployment through global health funding initiatives and pandemic preparedness programs.

What Factors Are Propelling Growth in the Global PCR Tests Market?

The growth in the global PCR tests market is driven by the persistent need for early and accurate diagnosis, increasing infectious disease burden, expanding applications in oncology and genetic testing, and continual advancements in PCR automation, miniaturization, and multiplexing. As healthcare shifts toward precision medicine, the demand for nucleic acid-based testing is rising across both clinical and non-clinical settings.Ongoing threats of viral outbreaks, antimicrobial resistance, and zoonotic diseases are fueling investments in real-time PCR platforms capable of rapid, multiplexed pathogen detection. Government initiatives to strengthen diagnostic capacity, along with funding from WHO, CDC, and Gates Foundation, are enabling broader PCR test availability, particularly in underserved regions. Emerging uses of PCR in decentralized testing, such as at-home molecular kits and POC devices, are expanding the market beyond institutional labs.

Moreover, PCR’s expanding role in companion diagnostics, transplant monitoring, prenatal screening, and personalized therapy monitoring ensures long-term market relevance. The regulatory landscape is also maturing, with increased pathways for test kit approvals, emergency use authorizations, and quality control standards. With molecular biology continuing to underpin modern medicine, PCR technologies remain indispensable, flexible, and highly scalable tools poised for enduring growth.

Scope of the Report

The report analyzes the PCR Tests market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Test Type (Standard PCR Test, Real-Time PCR Test, Digital PCR Test, Other Test Types); Product Type (Instruments, Reagents & Consumables, Software & Services); Indication (Infectious Diseases, Oncology, Genetic Disorders, Other Indications); End-Use (Hospitals & Clinics End-Use, Pharma & Biotech Industries End-Use, Diagnostics Centers End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Standard PCR Test segment, which is expected to reach US$14.8 Billion by 2030 with a CAGR of a 7.1%. The Real-Time PCR Test segment is also set to grow at 3.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $6.5 Billion in 2024, and China, forecasted to grow at an impressive 8.8% CAGR to reach $6.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global PCR Tests Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global PCR Tests Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global PCR Tests Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, Agilent Technologies, Becton, Dickinson & Co. (BD), BGI Genomics, Bio-Rad Laboratories and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this PCR Tests market report include:

- Abbott Laboratories

- Agilent Technologies

- Becton, Dickinson & Co. (BD)

- BGI Genomics

- Bio-Rad Laboratories

- Cepheid (Danaher)

- DiaSorin S.p.A.

- Eurofins Scientific

- F. Hoffmann-La Roche Ltd

- Fujirebio

- GenMark Diagnostics

- Hologic

- Illumina Inc.

- LabCorp

- Luminex Corporation

- Meridian Bioscience

- Myriad Genetics

- Oxford Nanopore Technologies

- PerkinElmer

- Qiagen N.V.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Agilent Technologies

- Becton, Dickinson & Co. (BD)

- BGI Genomics

- Bio-Rad Laboratories

- Cepheid (Danaher)

- DiaSorin S.p.A.

- Eurofins Scientific

- F. Hoffmann-La Roche Ltd

- Fujirebio

- GenMark Diagnostics

- Hologic

- Illumina Inc.

- LabCorp

- Luminex Corporation

- Meridian Bioscience

- Myriad Genetics

- Oxford Nanopore Technologies

- PerkinElmer

- Qiagen N.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 479 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

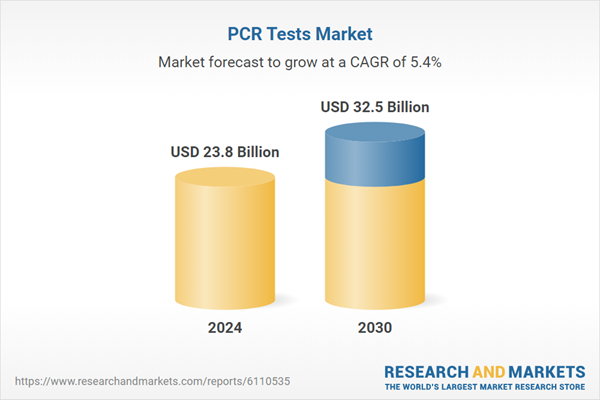

| Estimated Market Value ( USD | $ 23.8 Billion |

| Forecasted Market Value ( USD | $ 32.5 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |