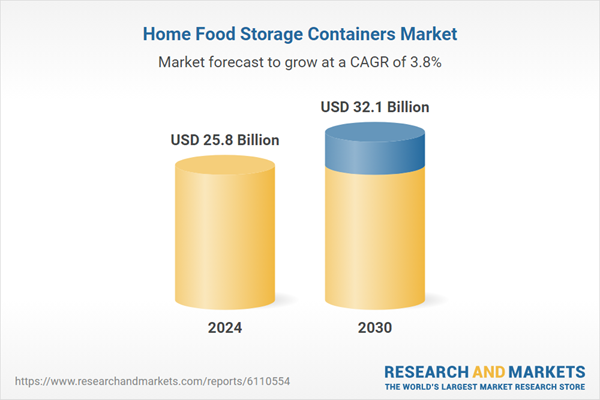

Global Home Food Storage Containers Market - Key Trends & Drivers Summarized

How Are Changing Lifestyles Altering Household Food Storage Practices?

Modern households are increasingly shifting toward organized, health-conscious, and waste-reducing kitchen habits, directly influencing demand for home food storage containers. As home cooking becomes more frequent, particularly in urban settings with dual-income families, consumers are seeking efficient ways to store leftovers, prep meals in advance, and preserve fresh ingredients. This trend is particularly strong among young professionals and nuclear families who rely on batch cooking and portion planning. The shift toward weekly grocery planning and reduced food wastage has positioned storage containers as essential tools in daily kitchen routines.Busy schedules and hybrid working lifestyles have also contributed to rising interest in ready-to-use storage systems that reduce time spent on meal prep. Consumers are increasingly favoring containers that allow seamless transition from refrigerator to microwave or oven. Stackable, space-saving designs help maximize compact urban kitchen spaces, while color-coded lids, airtight seals, and visibility features improve usability. The move from disorganized, mixed-material containers to coordinated sets reflects a growing preference for tidiness, efficiency, and visual appeal in food storage practices.

Why Is Material Innovation Influencing Consumer Choices?

Materials used in food storage containers are evolving in response to health, safety, and environmental considerations. Traditional plastic containers, while still dominant, face increasing scrutiny due to concerns over chemical leaching and single-use consumption. This has led to growing demand for BPA-free plastics, silicone-based containers, and alternatives like tempered glass and stainless steel. Glass containers are valued for their non-reactive nature and microwave safety, while silicone is appreciated for flexibility and ease of cleaning.Sustainability is also influencing material preferences. Reusable containers are gaining prominence among environmentally conscious consumers who seek to reduce reliance on disposable wraps or takeaway packaging. Brands are responding with products that offer longer life cycles and reduced environmental impact. Compostable lids, recycled content, and minimalist packaging are becoming common. Aesthetic trends are also affecting choices, as clear materials and neutral color palettes align with minimalist kitchen designs. Containers that combine function with modern design appeal are seeing wider adoption in both mass and premium segments.

How Is Technology Enhancing Product Design and Storage Efficiency?

Technological improvements in design and manufacturing are driving product differentiation in the food storage container market. Vacuum sealing systems are increasingly used to extend shelf life by slowing oxidation and microbial growth. Electric container systems with built-in freshness indicators and automated air removal are emerging in high-end segments. These systems help track food storage time and quality, supporting efficient inventory management at home. Features such as steam vents, clip-lock seals, modular stacking, and measurement markings add functional value.Digital integration is gradually entering the space, especially in smart kitchens. Connected containers with QR codes or embedded chips can track storage dates through mobile apps, sending alerts to avoid spoilage. While adoption of such features remains limited to early adopters, these innovations point to a broader move toward intelligent kitchen systems. Manufacturing techniques have also advanced, improving heat resistance, material uniformity, and lid-fit precision. Injection-molded plastics and reinforced glass now allow multi-use functionality across storage, heating, and serving without degrading performance.

What Is Fueling Market Expansion Across Household Segments?

Growth in the home food storage containers market is driven by several factors including increased meal planning habits, demand for sustainable storage options, and rising penetration of modular kitchen infrastructure. As more consumers seek to organize kitchen spaces, demand is growing for container sets designed to fit shelves, drawers, and lunch systems. This shift is also supported by rising urbanization and changing dietary patterns, with consumers storing a broader variety of ingredients, fresh produce, and ready meals at home.Material innovation and functional upgrades have helped manufacturers tap into wider end-use segments. Entry-level products continue to serve mass-market needs, while premium containers made of borosilicate glass or stainless steel appeal to health-focused consumers. Compact container systems designed for small fridges and portion-controlled eating are gaining traction among urban professionals. Expansion in online retail channels has also made it easier for smaller brands and niche products to reach consumers with specialized needs. Adoption is further supported by food safety concerns, especially in regions with hot climates where spoilage risks are high. Collectively, these factors are shaping a market defined by versatility, durability, and consumer awareness.

Scope of the Report

The report analyzes the Home Food Storage Containers market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Storage Bag, Storage Pouch, Storage Containers); Type (Rigid Container, Flexible Container); Material (Plastic Container, Paper Container, Metal Container, Glass Container); Application (Fruits & Vegetables Application, Meat Products Application, Candy & Confections Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Storage Bag segment, which is expected to reach US$17.2 Billion by 2030 with a CAGR of a 3.5%. The Storage Pouch segment is also set to grow at 4.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.0 Billion in 2024, and China, forecasted to grow at an impressive 6.9% CAGR to reach $6.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Home Food Storage Containers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Home Food Storage Containers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Home Food Storage Containers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amcor plc, Anchor Hocking, Ball Corporation, Bormioli Rocco SpA, Cambro Manufacturing Co. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Home Food Storage Containers market report include:

- Amcor plc

- Anchor Hocking

- Ball Corporation

- Bormioli Rocco SpA

- Cambro Manufacturing Co.

- Clorox Company

- Corelle Brands

- Glasslock (Corelle Brands)

- Lock & Lock Co., Ltd.

- Molded Fiber Glass Co.

- Newell Brands

- OXO (OXO Good Grips)

- Prepara

- Progressive International

- Pyrex

- Rubbermaid (Newell)

- Sistema Plastics

- Snapware (Corelle Brands)

- Thermos L.L.C.

- Tupperware Brands Corporation

- Vremi

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amcor plc

- Anchor Hocking

- Ball Corporation

- Bormioli Rocco SpA

- Cambro Manufacturing Co.

- Clorox Company

- Corelle Brands

- Glasslock (Corelle Brands)

- Lock & Lock Co., Ltd.

- Molded Fiber Glass Co.

- Newell Brands

- OXO (OXO Good Grips)

- Prepara

- Progressive International

- Pyrex

- Rubbermaid (Newell)

- Sistema Plastics

- Snapware (Corelle Brands)

- Thermos L.L.C.

- Tupperware Brands Corporation

- Vremi

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 472 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 25.8 Billion |

| Forecasted Market Value ( USD | $ 32.1 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |