Global Marine Salvage Market - Key Trends & Drivers Summarized

Why Is Marine Salvage a Strategic Necessity in Global Maritime Operations?

Marine salvage refers to the process of recovering ships, cargo, and other assets after maritime accidents such as collisions, groundings, sinkings, or environmental disasters. Salvage operations serve critical strategic, economic, and environmental roles-preserving valuable maritime assets, maintaining navigational safety, and preventing ecological harm from oil spills, chemical leaks, or vessel degradation. In an era of intensified shipping volumes, extreme weather events, and geopolitical tension, marine salvage has become a cornerstone of maritime emergency response and insurance recovery mechanisms.Salvage activities range from refloating grounded vessels and patching hull breaches to containing hazardous spills and recovering containers lost overboard. As maritime logistics become more complex and congested-especially along chokepoints such as the Suez Canal, Strait of Malacca, and Panama Canal-the ability to quickly execute salvage operations can have immense commercial implications. Delays in refloating large vessels not only block global trade but also incur enormous demurrage and environmental costs.

How Are Advanced Technologies and Environmental Regulations Transforming the Sector?

Technological advancements have redefined the capabilities of modern marine salvage operations. Today’s salvage firms deploy sophisticated equipment such as dynamic positioning (DP) vessels, remotely operated vehicles (ROVs), side-scan sonars, and autonomous underwater drones to locate, stabilize, and recover sunken or stranded assets. Cutting-edge simulation software helps plan salvage engineering strategies in advance, accounting for tidal conditions, hull stress dynamics, and environmental impact.Underwater robotics, modular lifting systems, and subsea cutting tools have become essential for wreck removal, particularly in deep-sea scenarios. Salvage companies also use floating cranes, oil recovery skimmers, heavy-lift barges, and inert gas systems to mitigate fire or explosion risks in volatile cargo. Environmental compliance has become a key priority, with salvage operations now incorporating oil spill response modules, chemical containment booms, and waste filtration systems to align with MARPOL (Marine Pollution) and IMO regulations.

Governments and maritime regulators are mandating stricter standards for pollution prevention and crew safety during salvage operations. The Nairobi International Convention on the Removal of Wrecks, 2007, has been instrumental in assigning legal responsibilities for wreck removal in territorial and international waters. This regulatory focus has led to greater transparency, pre-contract risk assessments, and faster mobilization through pre-positioned salvage response vessels near global trade corridors.

Which Regions and Stakeholders Are Driving Demand for Salvage Services?

The Asia-Pacific region, home to some of the busiest commercial ports and most vulnerable shipping lanes, leads the marine salvage demand. Countries like China, Singapore, India, Japan, and South Korea invest heavily in domestic salvage capabilities to respond swiftly to maritime disruptions. In China, government-linked salvage agencies such as Shanghai Salvage and Guangzhou Salvage dominate the sector, often coordinating large-scale underwater recovery operations.Europe follows closely, with the Netherlands, the UK, and Norway leading salvage service innovation. Dutch firms such as Boskalis and Smit Salvage have global operations and are routinely engaged in high-risk, high-value salvage missions. In North America, the United States Coast Guard and private contractors maintain extensive salvage frameworks for oil spill prevention, vessel refloating, and environmental containment, particularly along hurricane-prone coastal areas.

Offshore oil and gas operators, shipping conglomerates, marine insurers, and port authorities constitute the primary clients for salvage operations. The offshore wind energy sector is emerging as a new growth area, requiring specialized recovery services for turbine foundations, cable systems, and floating structures. Salvage contracts are increasingly pre-negotiated through Lloyd’s Open Form (LOF), fixed-price, or time-and-materials arrangements-depending on risk, vessel value, and environmental sensitivity.

What Is Fueling Growth in the Marine Salvage Market Globally?

The growth in the global marine salvage market is driven by several factors, including rising global maritime traffic, aging vessel fleets, environmental risks, and increasing severity of climate-related sea events. As the global shipping industry contends with larger vessels, complex cargoes, and tight delivery schedules, the probability and impact of maritime accidents have also grown. Salvage services are critical to reducing losses, preserving insurance value, and maintaining navigational safety in congested trade routes.Heightened environmental awareness and stricter global maritime regulations are pushing vessel operators to contract salvage firms with proven environmental mitigation capabilities. At the same time, the digitalization of shipping and port operations is improving incident tracking, vessel monitoring, and response readiness-enabling faster salvage mobilization. Public-private partnerships are also playing a role, with governments investing in regional salvage assets to ensure maritime resilience.

Meanwhile, geopolitical risks, underwater infrastructure growth, and naval modernization are generating new salvage needs-from submarine recovery and unexploded ordnance clearance to warship refloating and military asset retrieval. As maritime security becomes intertwined with environmental stewardship and economic continuity, the marine salvage market is evolving into a mission-critical segment supported by cutting-edge engineering, regulatory alignment, and growing private sector participation.

Scope of the Report

The report analyzes the Marine Salvage market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Undertaking Minor Repairs on Vessels, Towing Services, Pollution Control Services, Refloating Grounded Vessels); Application (Inland Water Transportation Operators Application, Government Customers Application, Deepwater Non-Cargo Operators Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Undertaking Minor Repairs on Vessels segment, which is expected to reach US$326.1 Million by 2030 with a CAGR of a 8.2%. The Towing Services segment is also set to grow at 4.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $130.5 Million in 2024, and China, forecasted to grow at an impressive 10.8% CAGR to reach $149.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Marine Salvage Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Marine Salvage Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Marine Salvage Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ardent Global, Atlantic Marine Group, Bisso Marine, BlueTack Marine Services, Boluda Towage and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Marine Salvage market report include:

- Ardent Global

- Atlantic Marine Group

- Bisso Marine

- BlueTack Marine Services

- Boluda Towage

- Donjon Marine Co., Inc.

- Five Oceans Salvage

- Guangzhou Salvage Bureau

- Koole Contractors

- Mammoet Salvage B.V.

- Marine Services W.L.L.

- Multraship Salvage

- Nippon Salvage Co., Ltd.

- Resolve Marine Group

- Royal Boskalis Westminster N.V.

- Smit Salvage

- T&T Salvage LLC

- Titan Salvage (part of Ardent)

- Tsavliris Salvage Group

- Wijsmuller Salvage

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ardent Global

- Atlantic Marine Group

- Bisso Marine

- BlueTack Marine Services

- Boluda Towage

- Donjon Marine Co., Inc.

- Five Oceans Salvage

- Guangzhou Salvage Bureau

- Koole Contractors

- Mammoet Salvage B.V.

- Marine Services W.L.L.

- Multraship Salvage

- Nippon Salvage Co., Ltd.

- Resolve Marine Group

- Royal Boskalis Westminster N.V.

- Smit Salvage

- T&T Salvage LLC

- Titan Salvage (part of Ardent)

- Tsavliris Salvage Group

- Wijsmuller Salvage

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 285 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

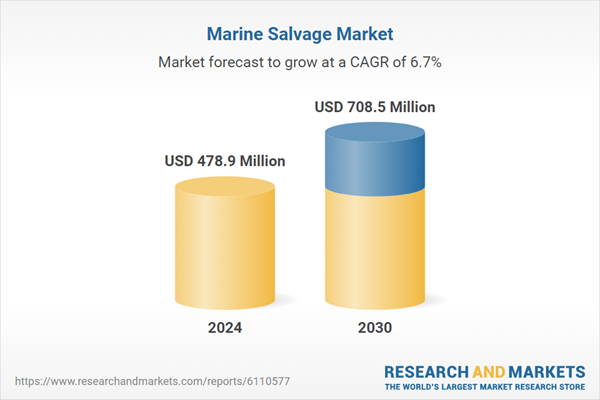

| Estimated Market Value ( USD | $ 478.9 Million |

| Forecasted Market Value ( USD | $ 708.5 Million |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |