Global Luxury Foods Market - Key Trends & Drivers Summarized

What Is Elevating the Demand for Luxury Foods Across the Globe?

Luxury foods, once confined to elite dining and ceremonial indulgence, have become more accessible and sought-after due to rising global affluence, growing gastronomic awareness, and increasing preference for premium quality and provenance. Defined by rarity, artisanal production, and exceptional sensory profiles, luxury foods include categories such as truffles, caviar, foie gras, saffron, Wagyu beef, Iberico ham, edible gold, aged balsamic vinegar, and single-origin chocolates. These products are differentiated by their origin, processing techniques, and heritage, and are increasingly positioned as status symbols in both retail and fine dining sectors.Rising disposable incomes, especially in Asia-Pacific and the Middle East, have expanded the consumer base for luxury foods beyond traditional Western markets. Simultaneously, the globalization of culinary media, travel, and social media influencers has elevated consumer curiosity about regional specialties and rare delicacies. Fine dining restaurants, luxury hotels, and private chefs now actively curate experiences around exclusive food items, with provenance, story, and sustainability becoming integral to brand storytelling. This evolution has moved luxury foods from occasional indulgences to lifestyle elements for high-net-worth individuals (HNWIs) and aspirational buyers.

How Are Artisanal Production, Sustainability, and Supply Chain Integrity Reshaping the Market?

In the luxury foods market, authenticity and craftsmanship are critical value drivers. Producers of high-end ingredients often rely on heritage breeds, centuries-old techniques, and geographical indications (GIs) to establish their brand equity. Whether it is the hand-harvesting of saffron in Iran, natural fermentation of soy sauce in Japan, or the centuries-old method of curing Iberico ham in Spain, these traditional practices are often labor-intensive and time-consuming-contributing to the exclusivity and pricing of the final product.Increasingly, consumers are scrutinizing sustainability and ethical sourcing in their premium purchases. This has pushed suppliers to adopt traceability technologies such as blockchain, QR codes, and digital certificates to verify product origin, production practices, and compliance with environmental standards. Certifications such as organic, non-GMO, and Protected Designation of Origin (PDO) are gaining prominence in buyer decisions. For instance, the farm-to-table movement and regenerative agriculture are influencing procurement decisions in Michelin-starred kitchens, which often showcase local, biodiverse, and ethically farmed luxury produce.

Simultaneously, the luxury food ecosystem is embracing innovation without compromising heritage. Techniques like molecular gastronomy, aging in controlled environments, and hybrid fermentation are being explored to enhance flavor complexity and shelf life. Small-batch producers are leveraging digital direct-to-consumer platforms to bypass conventional retail chains, ensuring better margins while maintaining control over branding and storytelling. These supply chain refinements and narrative enhancements are allowing luxury food producers to sustain consumer trust and premium pricing.

Which Consumer Segments and Global Regions Are Steering Market Growth?

The market for luxury foods is diversifying demographically and geographically. While HNWIs and the traditional luxury consumer cohort remain central, a younger, experience-oriented segment-comprising millennials and Gen Z with rising affluence-is showing interest in artisanal and rare foods. This new segment values uniqueness, provenance, and sustainability, and is often more experimental, willing to explore exotic items like sea urchin roe (uni), bird’s nest, or bluefin tuna. Social media, especially platforms like Instagram and TikTok, plays a substantial role in popularizing luxury food experiences among these demographics.Geographically, Asia-Pacific is emerging as a powerhouse for luxury food consumption, driven by wealth creation in China, Japan, Singapore, and South Korea. The Chinese market, in particular, is increasingly influential due to a cultural emphasis on gourmet food, gifting practices, and luxury branding. Europe continues to dominate in terms of origin and production of heritage luxury foods-France, Italy, and Spain being notable centers. North America represents a mature but expanding market, with growing interest in both imported delicacies and locally produced premium artisanal foods. The Middle East is also gaining traction, particularly in the hospitality sector, where high-end resorts and luxury tourism fuel demand for rare ingredients and custom-curated menus.

E-commerce is transforming how consumers access luxury foods. Premium food subscription boxes, flash sales of rare ingredients, and online gourmet platforms are bringing niche products to wider audiences. Brands are also engaging in culinary storytelling through virtual tastings, chef collaborations, and content marketing. These strategies help build cultural cachet and brand intimacy, driving repeat purchases and word-of-mouth appeal in both retail and hospitality contexts.

What Is Fueling Growth in the Luxury Foods Market Globally?

The growth in the global luxury foods market is driven by several factors, including rising global wealth, increasing culinary sophistication among consumers, and greater access to rare and exotic ingredients via digital commerce and cross-border logistics. The aspirational value of food as a luxury experience-especially among younger consumers-is transforming how premium ingredients are sourced, branded, and consumed. Dining is no longer merely about nourishment but is being redefined as an expression of identity, lifestyle, and social status.Rising interest in gastronomy, fueled by culinary tourism, cooking shows, and influencer culture, is encouraging consumers to try products previously perceived as inaccessible. Michelin-starred restaurants, boutique hotels, and high-end catering services are continuously innovating to showcase rare ingredients in unique formats. Additionally, health-conscious HNWIs are seeking clean-label, traceable, and ethically produced indulgences, propelling demand for organic caviar, grass-fed Wagyu, and naturally harvested truffles.

Sustainability, authenticity, and digital storytelling are emerging as critical pillars for future growth. As luxury food producers embrace transparency, carbon footprint reductions, and direct consumer engagement, the market is becoming more resilient and inclusive. Coupled with technological advances in cold chain logistics and ingredient preservation, these drivers are ensuring that the luxury foods sector not only preserves its exclusivity but also expands its global reach in an increasingly connected and discerning marketplace.

Scope of the Report

The report analyzes the Luxury Foods market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Vegetarian Food, Poultry, Pork, Meat, Seafood, Other Types); End-User (Small Food Chains End-User, High-End Restaurants End-User).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Vegetarian Food segment, which is expected to reach US$13.7 Billion by 2030 with a CAGR of a 3.5%. The Poultry segment is also set to grow at 2.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $13.6 Billion in 2024, and China, forecasted to grow at an impressive 6.8% CAGR to reach $12.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Luxury Foods Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Luxury Foods Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Luxury Foods Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Agritalia, Artisans de Genève, Beluga Group, Bellota-Bellota, Calvisius Caviar and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Luxury Foods market report include:

- Agritalia

- Artisans de Genève

- Beluga Group

- Bellota-Bellota

- Calvisius Caviar

- Dean & DeLuca

- Eataly

- Fortnum & Mason

- Godiva Chocolatier

- Harrods Food Halls

- Hotel Chocolat

- La Maison du Chocolat

- Läderach

- Lindt & Sprüngli

- Maison de la Truffe

- Petrossian

- Pierre Hermé

- Sabatino Tartufi

- The Fine Cheese Co.

- Valrhona

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agritalia

- Artisans de Genève

- Beluga Group

- Bellota-Bellota

- Calvisius Caviar

- Dean & DeLuca

- Eataly

- Fortnum & Mason

- Godiva Chocolatier

- Harrods Food Halls

- Hotel Chocolat

- La Maison du Chocolat

- Läderach

- Lindt & Sprüngli

- Maison de la Truffe

- Petrossian

- Pierre Hermé

- Sabatino Tartufi

- The Fine Cheese Co.

- Valrhona

Table Information

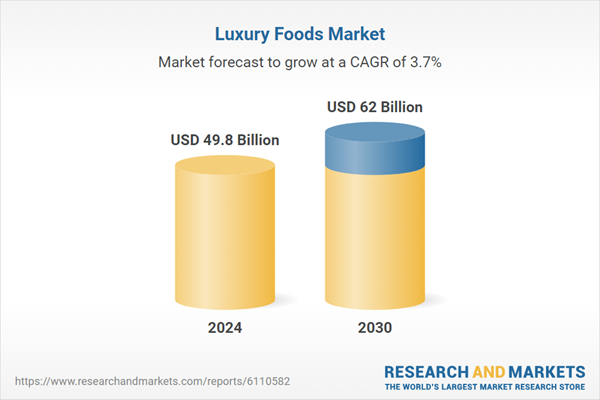

| Report Attribute | Details |

|---|---|

| No. of Pages | 279 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 49.8 Billion |

| Forecasted Market Value ( USD | $ 62 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |