Global Advanced Battle Management Systems (ABMS) Market - Key Trends & Drivers Summarized

How Are Advanced Battle Management Systems Redefining Modern Warfare in the Digital Era?

Advanced Battle Management Systems (ABMS) are fundamentally transforming how military forces operate by introducing a highly integrated, data-driven approach to battlefield awareness, command, and control. These systems represent a significant evolution from traditional command-and-control architectures, emphasizing real-time data exchange, artificial intelligence integration, and network-centric operations across multiple domains, including air, land, sea, space, and cyber. ABMS enables commanders to access and share critical information instantaneously, connecting assets such as satellites, drones, aircraft, ships, and ground forces through secure, high-speed networks. This networked approach allows for faster and more informed decision-making, thereby increasing the agility, responsiveness, and survivability of forces in complex combat environments. In contrast to legacy systems, which often relied on isolated platforms and delayed communications, ABMS enables dynamic targeting, distributed mission planning, and seamless integration between manned and unmanned systems. As near-peer adversaries develop more sophisticated anti-access and area denial (A2/AD) strategies, the ability to operate within contested environments becomes paramount. ABMS offers a strategic advantage by allowing operators to penetrate enemy defenses, reroute assets in real time, and maintain operational superiority even under electronic warfare conditions. Moreover, the shift toward cloud computing and edge processing ensures that data is processed and acted upon at the point of need, rather than routed through centralized command hubs. With the increasing complexity of future conflicts, ABMS is becoming a cornerstone of next-generation defense strategies focused on speed, precision, and adaptability.Why Are Defense Forces Prioritizing Investments in ABMS for Multi-Domain Operations?

Defense forces worldwide are prioritizing investments in Advanced Battle Management Systems because of their ability to support multi-domain operations (MDO), which are essential in confronting sophisticated and technologically advanced adversaries. Modern warfare no longer occurs in a single domain but spans land, air, sea, space, and cyberspace simultaneously, requiring seamless integration and synchronization of operations across all theaters. ABMS serves as a digital backbone for coordinating these efforts, allowing disparate systems and units to function as a cohesive and responsive force. This coordination is especially important in scenarios that demand rapid target identification, cross-domain asset deployment, and layered defense. For example, ABMS enables an Air Force drone to detect a ground threat and instantly share targeting data with a naval ship or an artillery unit for immediate engagement. Such capabilities rely on an ecosystem of sensors, cloud infrastructure, machine learning algorithms, and communication satellites working in concert. Defense organizations, particularly in the United States and allied NATO countries, are allocating substantial budgets toward ABMS development and deployment because it offers an unprecedented level of situational awareness and operational efficiency. These investments are also motivated by geopolitical tensions and the increasing risk of hybrid warfare, where rapid response and coordination can determine mission success. Additionally, ABMS facilitates interoperability between allied forces, ensuring that multinational coalitions can operate using a unified digital framework. This is critical in joint operations, peacekeeping missions, and coalition-led conflict deterrence. By enhancing both strategic and tactical capabilities, ABMS enables military forces to be more flexible, proactive, and resilient in the face of evolving threats and uncertainties on the modern battlefield.What Technological Innovations Are Powering the Development and Deployment of ABMS?

The development and deployment of Advanced Battle Management Systems are being propelled by a wave of technological innovations that are reshaping the nature of military engagement. One of the most critical enablers is artificial intelligence (AI), which supports real-time data analysis, threat prediction, decision support, and autonomous mission execution. AI algorithms can sift through massive volumes of sensor data from satellites, aircraft, ground units, and cyberspace in milliseconds, identifying patterns and anomalies that human operators might miss. Coupled with machine learning, ABMS platforms become more adaptive over time, continuously refining their recommendations based on new battlefield data. Another key technology is the use of low-latency, high-bandwidth communication networks such as 5G and secure mesh networks, which ensure that information is shared instantly across the battlespace, even in hostile or jammed environments. These communications frameworks enable seamless coordination between geographically dispersed units and platforms. Cloud computing and edge computing further enhance ABMS by allowing data to be processed locally near the source, minimizing delays and enhancing responsiveness. Sensor fusion technologies also play a vital role by combining inputs from infrared, radar, sonar, and electromagnetic sources into a single, coherent operational picture. Augmented reality (AR) and advanced user interfaces improve human-machine interaction, allowing operators to visualize complex information in intuitive formats. Additionally, cybersecurity technologies are integral to ABMS, protecting the integrity of data flows against cyberattacks and electronic interference. With all these innovations working together, ABMS moves beyond a simple command-and-control tool and becomes a force multiplier, delivering unmatched operational intelligence, speed, and precision.What Key Drivers Are Fueling the Global Expansion of the ABMS Market?

The global expansion of the Advanced Battle Management Systems market is being driven by a convergence of strategic, technological, and geopolitical factors that underscore the critical role of information dominance in modern warfare. One of the foremost drivers is the increasing complexity of global threats, including the rise of technologically advanced adversaries, cyber warfare, and the proliferation of precision-guided munitions and hypersonic weapons. In response, militaries are accelerating the adoption of ABMS to maintain strategic parity or superiority. Another key driver is the need for interoperability among allied forces in multinational operations, particularly in regions such as the Indo-Pacific, Eastern Europe, and the Middle East, where coalition-based missions are increasingly common. Budget allocations for defense modernization programs are also on the rise, with major countries such as the United States, China, and members of NATO investing heavily in digital transformation initiatives that prioritize networked warfare capabilities. In parallel, the private sector is playing a more prominent role, with defense contractors, aerospace firms, and tech companies partnering to develop ABMS components such as AI engines, communication systems, and cloud infrastructure. The rapid advancement of supporting technologies like drones, autonomous vehicles, and space-based assets further accelerates ABMS adoption, as these platforms require coordinated control and data integration to operate effectively in contested environments. Regulatory and doctrinal shifts within defense institutions are also supporting ABMS deployment by prioritizing joint all-domain command and control as a strategic imperative. Finally, the success of ABMS prototypes and pilot programs in real-world simulations and military exercises has validated the system’s effectiveness, encouraging further expansion. As these dynamics continue to evolve, ABMS is positioned to become a foundational element of 21st-century military operations across the globe.Scope of the Report

The report analyzes the Advanced Battle Management Systems (ABMS) market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Component (Hardware Component, Software Component); System (Navigation Systems, Communications & Networking Systems, Command & Control Systems, Weapon Systems); Platform (Armored Vehicle, Headquarter & Command Center, Soldier Systems); End-Use (Army End-Use, Air Force End-Use, Navy End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hardware Component segment, which is expected to reach US$9.1 Billion by 2030 with a CAGR of a 17.6%. The Software Component segment is also set to grow at 22.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.4 Billion in 2024, and China, forecasted to grow at an impressive 18.5% CAGR to reach $2.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Advanced Battle Management Systems (ABMS) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Advanced Battle Management Systems (ABMS) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Advanced Battle Management Systems (ABMS) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amazon Web Services, Anduril Industries, BAE Systems, Boeing, Collins Aerospace and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Advanced Battle Management Systems (ABMS) market report include:

- Amazon Web Services

- Anduril Industries

- BAE Systems

- Boeing

- Collins Aerospace

- DreamHammer

- ELTA Systems

- Elbit Systems

- Havelsan

- Honeywell

- KNDS

- L3Harris Technologies

- Leidos

- Lockheed Martin

- Milrem Robotics

- Northrop Grumman

- Palantir Technologies

- Raytheon Technologies

- SAIC

- STM

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amazon Web Services

- Anduril Industries

- BAE Systems

- Boeing

- Collins Aerospace

- DreamHammer

- ELTA Systems

- Elbit Systems

- Havelsan

- Honeywell

- KNDS

- L3Harris Technologies

- Leidos

- Lockheed Martin

- Milrem Robotics

- Northrop Grumman

- Palantir Technologies

- Raytheon Technologies

- SAIC

- STM

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 263 |

| Published | January 2026 |

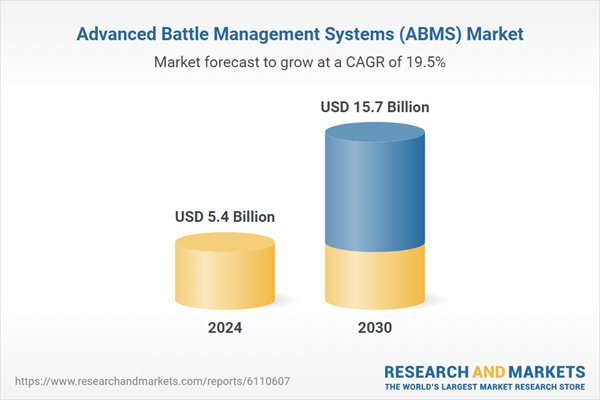

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.4 Billion |

| Forecasted Market Value ( USD | $ 15.7 Billion |

| Compound Annual Growth Rate | 19.5% |

| Regions Covered | Global |