Global Automotive Metal Timing Chain Market - Key Trends & Drivers Summarized

How Is the Demand for Durability and Engine Efficiency Reinforcing the Role of Metal Timing Chains?

The role of metal timing chains in automotive engines has grown increasingly prominent as automakers place greater emphasis on durability, low maintenance, and performance consistency. Metal timing chains are responsible for synchronizing the rotation of the crankshaft and camshaft, ensuring precise valve timing and optimal engine function. Unlike their belt counterparts, metal chains offer superior strength and longevity, making them a preferred choice in many modern internal combustion engines. With consumers expecting vehicles to last longer with fewer service intervals, the appeal of metal chains lies in their ability to operate reliably over the full life of the engine. This is especially important in turbocharged and direct-injection engines, which place higher loads on the timing system due to increased combustion pressure and operational temperatures. The metal timing chain's resilience to stretching, oil degradation, and thermal stress makes it ideal for such demanding applications. Automakers are also leveraging advanced engineering techniques, including variable valve timing and start-stop systems, which require precise and durable timing mechanisms. These evolving demands are reinforcing the importance of robust timing systems that can function flawlessly under high-performance and high-mileage conditions. As a result, metal timing chains are being widely adopted across both mass-market and performance vehicles, particularly in markets where longevity and powertrain efficiency are primary consumer concerns.Why Are Technological Innovations in Materials and Design Transforming Timing Chain Performance?

Advancements in metallurgy, component design, and manufacturing processes are significantly improving the performance and reliability of automotive metal timing chains. Modern chains are no longer basic metal links but are instead engineered with high-strength alloys, specialized coatings, and optimized geometries that reduce friction and wear. Material innovations such as carbonitrided steel, shot-peened surfaces, and hard-chrome finishes enhance fatigue resistance and extend operational life even under severe load and thermal conditions. Additionally, advancements in chain tensioners, guides, and sprockets ensure smoother operation, reduced noise, and improved chain stability. These components now often incorporate composite materials and hydraulic systems that automatically adjust chain tension in real time, maintaining precise timing and reducing the risk of failure. Chain designers are also focusing on reducing weight and improving compactness to meet the spatial constraints of downsized engines. As engines become smaller and more powerful, the need for compact yet durable timing mechanisms becomes more critical. The integration of computer-aided engineering and simulation tools in the design process has allowed manufacturers to predict and mitigate wear patterns, vibration issues, and noise factors before physical prototyping. Collectively, these innovations are making metal timing chains quieter, more efficient, and more reliable, which in turn boosts consumer satisfaction and reduces warranty claims for automakers.How Are Shifts in Powertrain Strategies Impacting the Adoption of Metal Timing Chains?

While the global automotive industry is steadily moving toward electrification, internal combustion engines continue to dominate many markets, particularly in regions where charging infrastructure remains underdeveloped or where long-range capabilities are prioritized. In this transitional era, automakers are refining ICE powertrains to deliver better fuel economy, lower emissions, and reduced maintenance needs, all of which support the increased adoption of metal timing chains. Hybrid vehicles, which rely on both electric and combustion propulsion, also present a strong use case for timing chains due to their frequent engine restarts and variable load cycles. These operational characteristics demand timing systems that are robust and maintenance-free, making metal chains a logical choice over belts. Additionally, with governments enforcing tighter emissions standards, OEMs are enhancing engine control systems and incorporating technologies like variable valve timing, which function best with precise and durable timing components. The ability of metal chains to handle higher engine speeds and loads with minimal elongation makes them suitable for these high-performance and fuel-efficient designs. As vehicle lifespans increase and consumers seek lower total cost of ownership, manufacturers are specifying timing chain systems that align with long-term reliability goals. Thus, even in an era of electrification, the ongoing evolution and sophistication of ICE and hybrid platforms are sustaining and, in some segments, increasing the demand for advanced metal timing chains.What Is Driving the Growth of the Global Automotive Metal Timing Chain Market?

The growth in the global automotive metal timing chain market is driven by a variety of technical, economic, and consumer-centric factors. A significant growth driver is the increasing preference among automakers for long-life, low-maintenance components that enhance powertrain durability and reduce service intervals. Metal timing chains fit this requirement by offering longer operational life and improved resilience compared to timing belts. The widespread use of turbocharged and high-compression engines is also boosting demand, as these powertrains impose greater stress on timing systems and benefit from the robustness of chain-based solutions. In the commercial vehicle and high-performance segments, where reliability and endurance are crucial, timing chains are often considered indispensable. Furthermore, rising vehicle production in emerging markets, especially in Asia-Pacific and Latin America, is contributing to higher demand for timing chain-equipped engines that offer greater longevity and reduced ownership costs. Additionally, the growth of the hybrid vehicle segment, which combines ICE durability with electric efficiency, is creating further opportunities for timing chain manufacturers. Continued investment in R&D, particularly in noise reduction, material innovation, and compact design, is making metal timing chains more attractive across vehicle categories. As automakers seek to differentiate on quality, reliability, and lifecycle value, the demand for metal timing chains is expected to rise steadily, reinforcing their role in the future of internal combustion and hybrid powertrain systems.Scope of the Report

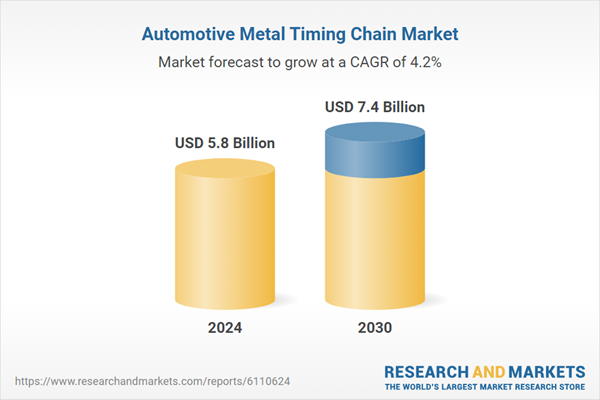

The report analyzes the Automotive Metal Timing Chain market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Single Roller Chain, Double Roller Chain, Silent Chain); Material (Steel Material, Aluminum Material, Other Materials); Distribution Channel (OEM Distribution Channel, Aftermarket Distribution Channel); End-Use (Passenger Cars End-Use, Light Commercial Vehicles End-Use, Heavy Commercial Vehicles End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Single Roller Chain segment, which is expected to reach US$4.5 Billion by 2030 with a CAGR of a 5.0%. The Double Roller Chain segment is also set to grow at 2.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.6 Billion in 2024, and China, forecasted to grow at an impressive 7.9% CAGR to reach $1.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Metal Timing Chain Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Metal Timing Chain Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Metal Timing Chain Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aisin Corporation, BorgWarner Inc., Continental AG, Daido Kogyo Co., Ltd. (DID), Denso Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Automotive Metal Timing Chain market report include:

- Aisin Corporation

- BorgWarner Inc.

- Continental AG

- Daido Kogyo Co., Ltd. (DID)

- Denso Corporation

- Enuma Chain Mfg. Co., Ltd.

- G&G Automotive Gears

- GMB Corporation

- Hengjiu Group

- IWIS Motorsysteme GmbH & Co. KG

- LGB Forge Limited

- Morse (BorgWarner Morse Systems)

- MRK Group

- NTN Corporation

- Renold Plc

- Schaeffler AG

- SKF Group

- Sunstar Engineering Inc.

- TSUBAKIMOTO Chain Co.

- YBN Chain (Yaban Chain Industrial)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aisin Corporation

- BorgWarner Inc.

- Continental AG

- Daido Kogyo Co., Ltd. (DID)

- Denso Corporation

- Enuma Chain Mfg. Co., Ltd.

- G&G Automotive Gears

- GMB Corporation

- Hengjiu Group

- IWIS Motorsysteme GmbH & Co. KG

- LGB Forge Limited

- Morse (BorgWarner Morse Systems)

- MRK Group

- NTN Corporation

- Renold Plc

- Schaeffler AG

- SKF Group

- Sunstar Engineering Inc.

- TSUBAKIMOTO Chain Co.

- YBN Chain (Yaban Chain Industrial)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 462 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.8 Billion |

| Forecasted Market Value ( USD | $ 7.4 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |