Global Two-Wheelers / Motorcycles Insurance Market - Key Trends & Drivers Summarized

How Are Usage-Based and Telematics Insurance Transforming the Two-Wheeler Coverage Landscape?

The two-wheeler insurance market is undergoing a digital evolution, powered by the proliferation of telematics, smartphone-based driving apps, and embedded sensors. Traditional flat-rate insurance models are giving way to usage-based insurance (UBI), where premiums are calculated based on riding behavior, distance traveled, time-of-day usage, and compliance with road safety. With the help of real-time data collected via mobile apps or installed tracking devices, insurers are tailoring packages to reflect actual rider risk profiles, reducing fraudulent claims and improving profitability.In emerging markets, where motorbike usage is widespread and regulation enforcement is variable, telematics enables insurers to gain better visibility into customer behavior. Riders with consistent safe habits - such as smooth braking, speed regulation, and regular maintenance - can access loyalty discounts, while risky behavior triggers alerts or policy adjustments. This tech-driven transparency also empowers customers, who can track their risk scores and adjust habits to reduce premiums. Fleet operators, especially in delivery or ride-hailing businesses, are mandating telematics-integrated insurance for better cost control and compliance.

What Is the Impact of Digital Platforms and Embedded Insurance on Policy Distribution?

Digital distribution channels have revolutionized the way two-wheeler insurance is bought and managed. Insurtech platforms now offer instant policy comparisons, personalized quotes, AI-assisted chatbots, and paperless onboarding - all optimized for mobile-first interactions. This accessibility has expanded insurance penetration in underinsured regions, where traditional agency models struggled with cost and reach. Embedded insurance - offered at the point of vehicle sale or leasing - is also gaining momentum. Buyers can now purchase or renew insurance directly through OEM apps or dealer platforms, often bundled with financing, service plans, or theft protection.In response, insurance providers are launching modular products: base coverage augmented by optional add-ons like accidental damage, engine protect, zero-depreciation, pillion cover, and roadside assistance. These add-ons are often toggled within customer portals, offering flexibility rarely seen in traditional policies. Additionally, micro-insurance options with shorter durations and low premiums are popular among seasonal or low-mileage riders, improving inclusivity. Backend integration with OEMs and ride-sharing platforms enables automated coverage activation, seamless claims processing, and real-time policy status tracking.

Why Are Risk Profiles and Use Cases Expanding Across the Two-Wheeler Ecosystem?

The two-wheeler landscape is evolving to include a broader array of risk profiles - from urban commuters to long-distance tourers, gig-economy riders, and electric fleet operators. Insurance solutions are now tailored not just to the vehicle type but also to rider demographics, usage intensity, and regional risk levels. For example, gig riders operating in high-traffic zones may require flexible on-duty-only coverage, while electric two-wheelers in eco-sensitive areas may qualify for discounts based on lower emissions and range-limiting features.Emerging segments such as electric scooters and high-performance motorcycles bring unique insurance requirements. E2Ws, often connected via apps and equipped with immobilizers and GPS tracking, are attractive to insurers due to lower theft risk and more precise claims assessment. On the other hand, superbikes require coverage that includes high-value parts, track-day damage, and international usage - features absent from conventional packages. As two-wheelers serve a wider range of economic, lifestyle, and commercial functions, insurance products are becoming more customized, dynamic, and digitally managed.

The Growth in the Two-Wheelers / Motorcycles Insurance Market Is Driven by Several Factors…

The surge in the two-wheeler insurance market is powered by multiple structural and technological forces. First, the proliferation of telematics and smartphone-based UBI platforms is enabling insurers to assess risk with unprecedented granularity, reducing underwriting ambiguity and promoting safer driving habits. Second, the rise of digital distribution models - via mobile apps, insurtech marketplaces, and embedded OEM platforms - is expanding reach, lowering acquisition costs, and improving customer experience.Simultaneously, the diversification of two-wheeler use cases - commuting, delivery, touring, and rental fleets - necessitates flexible, usage-based, and rider-specific policy structures. The electrification of the two-wheeler segment is also playing a pivotal role, with E2Ws offering lower risk profiles and IoT compatibility that supports premium adjustment and remote damage diagnostics. Finally, regulatory mandates in many countries now require proof of insurance at registration or vehicle financing stage, further institutionalizing coverage across all rider segments. Together, these developments are forming the foundation for robust and sustained growth in the global two-wheeler insurance ecosystem.

Scope of the Report

The report analyzes the Two-Wheelers / Motorcycles Insurance market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Policy Type (Zero Depreciation Policy Type, Third Party Motor Insurance Policy Type, Comprehensive Motor Insurance Policy Type); Distribution Channel (Online Distribution Channel, Offline Distribution Channel).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Zero Depreciation Policy Type segment, which is expected to reach US$37.5 Billion by 2030 with a CAGR of a 3.2%. The Third Party Motor Insurance Policy Type segment is also set to grow at 4.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $13.6 Billion in 2024, and China, forecasted to grow at an impressive 6.4% CAGR to reach $12.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Two-Wheelers / Motorcycles Insurance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Two-Wheelers / Motorcycles Insurance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Two-Wheelers / Motorcycles Insurance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACKO, Acko (two-wheeler focus), Allianz (Motorcycle Division), Allstate Insurance, Aviva and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Two-Wheelers / Motorcycles Insurance market report include:

- ACKO

- Acko (two-wheeler focus)

- Allianz (Motorcycle Division)

- Allstate Insurance

- Aviva

- AXA (Motorbike Cover)

- Bajaj Allianz General Insurance

- Bikers Insure

- CG Corp Global (Coral Isle)

- Clements International

- Dairyland Insurance

- East West Insurance (Malaysia)

- Farmers Insurance

- GEICO

- Harley-Davidson Insurance

- HDFC ERGO

- ISU Global Insurance

- Let’s Ride Insurance (UK)

- Mapfre (Moto Insurance)

- Metropolitan (Progressive)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ACKO

- Acko (two-wheeler focus)

- Allianz (Motorcycle Division)

- Allstate Insurance

- Aviva

- AXA (Motorbike Cover)

- Bajaj Allianz General Insurance

- Bikers Insure

- CG Corp Global (Coral Isle)

- Clements International

- Dairyland Insurance

- East West Insurance (Malaysia)

- Farmers Insurance

- GEICO

- Harley-Davidson Insurance

- HDFC ERGO

- ISU Global Insurance

- Let’s Ride Insurance (UK)

- Mapfre (Moto Insurance)

- Metropolitan (Progressive)

Table Information

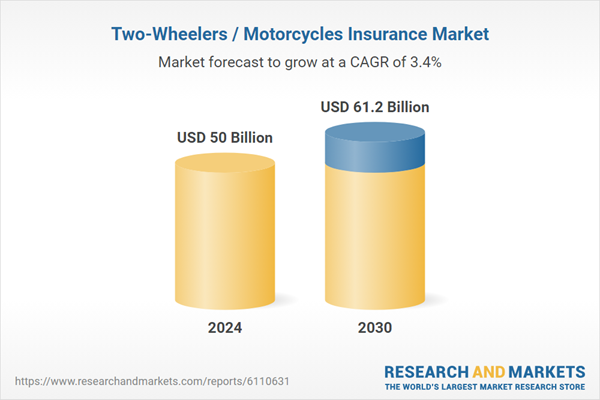

| Report Attribute | Details |

|---|---|

| No. of Pages | 277 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 50 Billion |

| Forecasted Market Value ( USD | $ 61.2 Billion |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Global |