Global Non-Sparking Tools Market - Key Trends & Drivers Summarized

Why Are Non-Sparking Tools Crucial in Hazardous Environments?

Non-sparking tools, also known as spark-resistant or safety tools, are essential in environments where flammable gases, vapors, liquids, or combustible dusts are present. These tools are specifically designed to eliminate the risk of ignition from mechanical impact or friction, which can lead to explosions or fires. Manufactured from non-ferrous metals such as beryllium-copper, aluminum-bronze, and brass, these tools do not generate heat or sparks upon contact with hard surfaces, making them ideal for industries such as petrochemicals, oil & gas, ammunition manufacturing, mining, grain handling, and pharmaceuticals.The growing emphasis on occupational safety, particularly in explosion-prone work zones defined under ATEX (Atmospheres Explosibles) and OSHA guidelines, has reinforced the importance of using non-sparking tools. Regulatory mandates across North America and Europe require the use of these tools in confined spaces, hazardous locations, and during maintenance activities in environments with high vapor pressure. Their use significantly reduces liability, insurance claims, and compliance violations. Additionally, safety audit-driven procurement in oil refineries and energy infrastructure has made non-sparking tools a routine requirement rather than an optional safeguard.

How Are Manufacturing Techniques and Materials Enhancing Product Performance?

Advancements in metallurgy and precision casting techniques are enabling the development of non-sparking tools that balance safety with strength, durability, and corrosion resistance. Traditionally, non-ferrous alloys were associated with inferior tensile strength compared to carbon or stainless steel. However, new alloy formulations such as nickel-aluminum bronze and beryllium-copper are now being engineered to meet both anti-sparking and high-stress performance requirements. These alloys provide resistance to wear, mechanical fatigue, and environmental degradation, making the tools suitable for frequent and prolonged use.Modern manufacturing techniques like investment casting, drop forging, and CNC machining are improving dimensional accuracy and surface finish, thereby reducing burrs or microscopic imperfections that could potentially cause micro-sparks. Furthermore, anti-magnetic and non-corrosive coatings are being introduced to extend tool life in marine, underground, and highly humid conditions. This is particularly relevant in saltwater-exposed oil rigs, shipbuilding yards, and underground mining tunnels, where conventional tools corrode rapidly, posing both functional and safety risks.

Tool ergonomics are also evolving, with anti-slip grips, insulated handles, and vibration-dampening materials enhancing user comfort and safety. Modular toolkits specifically designed for hot work permits and confined space entry are now available, integrating multiple tool types-spanners, hammers, pliers, and scrapers-within ATEX-rated toolboxes for certified hazardous work zones. Suppliers are also offering serialized tracking for inventory control, safety inspection logs, and digital certification systems to support quality assurance across operational sites.

Which Industries and Geographies Are Spearheading Adoption Trends?

The oil and gas sector continues to dominate the demand for non-sparking tools due to the constant risk of hydrocarbon vapor ignition in upstream, midstream, and downstream operations. From offshore rigs and FPSOs to onshore refineries and LNG terminals, maintenance crews rely on spark-proof hand tools to carry out mechanical tasks such as valve replacement, pipe fitting, and tank inspections. Chemical plants and paint manufacturing facilities, where volatile solvents and powders are used, are also major users of non-sparking tools to mitigate ignition hazards during equipment servicing and material handling.In mining and metal processing industries, non-sparking tools are indispensable for mechanical operations near flammable dusts, including coal, aluminum, and magnesium particles. Aerospace and defense applications are growing as well, with tool kits being integrated into hangars, munitions depots, and aircraft maintenance bays. Even food processing units with combustible flour or sugar dust environments are adopting these tools to meet HACCP compliance and mitigate the risk of dust explosions.

Geographically, North America and Europe are mature markets supported by stringent worker safety regulations and high institutional awareness. The U.S. leads in tool standardization, with ANSI and ASTM providing clear specifications. Europe’s compliance is driven by EN and ISO safety standards. Asia-Pacific is emerging as a high-growth region due to industrial expansion and increasing EHS (Environment, Health, and Safety) investments in countries such as India, China, and Indonesia. Middle Eastern countries with extensive petrochemical infrastructure, such as Saudi Arabia and UAE, are major importers of certified non-sparking toolkits.

What Is Fueling Growth in the Global Non-Sparking Tools Market?

The growth in the global non-sparking tools market is driven by several factors, including tightening safety regulations in hazardous industries, rising global investment in energy infrastructure, and increased awareness about explosion-proof tools among industrial stakeholders. As EHS protocols become central to operational compliance and insurance auditing, the deployment of certified tools is transitioning from niche adoption to mainstream safety practice.The expansion of chemical processing, oil exploration, and LNG transportation across Asia-Pacific and Africa is also fueling demand. With many developing nations adopting International Labour Organization (ILO)-aligned safety codes, tool procurement for industrial zones now includes mandatory non-sparking kits. Simultaneously, growth in renewable energy infrastructure, such as hydrogen storage and battery production, introduces new hazardous work environments where spark-free tools are critical.

Furthermore, the rise in workplace safety culture and global standardization initiatives is supporting market penetration. Companies are implementing tool standardization programs to minimize procurement risks and ensure compatibility across multiple sites. Distributors and e-commerce channels are expanding their portfolios of certified products with transparent certifications and field-specific assortments. These market dynamics collectively ensure a robust growth trajectory for non-sparking tools across industrial, defense, and specialty sectors.

Scope of the Report

The report analyzes the Non-Sparking Tools market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (General Purpose Tools, Striking & Cutting Tools, Digging Tools, Other Products); Raw Material (Copper Alloys, Brass, Bronze, Other Raw Materials); Distribution Channel (Offline Distribution Channel, Online Distribution Channel); End-Use (Industrial End-Use, Construction End-Use, Residential End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the General Purpose Tools segment, which is expected to reach US$286.1 Million by 2030 with a CAGR of a 1.5%. The Striking & Cutting Tools segment is also set to grow at 1.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $136.4 Million in 2024, and China, forecasted to grow at an impressive 3.6% CAGR to reach $103.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Non-Sparking Tools Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Non-Sparking Tools Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Non-Sparking Tools Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

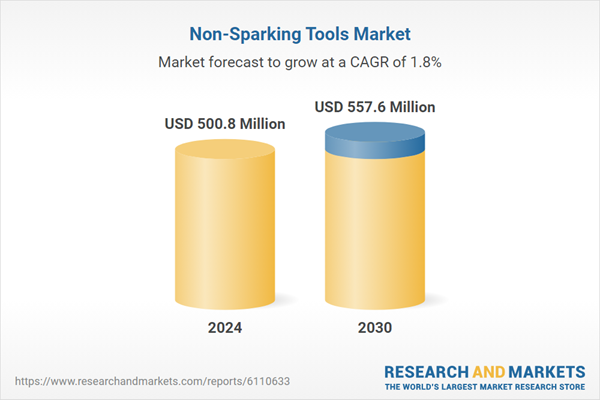

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ampco Safety Tools, Bahco (SNA Europe), Barcaloo (Altelix), Botou Safety Tools Group Co., Ltd., Carltsoe Safety Tools ApS and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Non-Sparking Tools market report include:

- Ampco Safety Tools

- Bahco (SNA Europe)

- Barcaloo (Altelix)

- Botou Safety Tools Group Co., Ltd.

- Carltsoe Safety Tools ApS

- CS Unitec, Inc.

- EGA Master

- Facom (Stanley Black & Decker)

- Feathertouch Safety Tools Pvt. Ltd.

- Force Tools Co., Ltd.

- Hans Tools

- Hebei Botou Safety Tools Co., Ltd.

- Hebei Junda Safety Tools

- Klein Tools

- Lindstrom Tools (Apex Tools)

- M.T.I. Tools Co., Ltd.

- Picard Hammers

- Proto Industrial Tools

- Sankosha Co., Ltd.

- Titan Tools

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ampco Safety Tools

- Bahco (SNA Europe)

- Barcaloo (Altelix)

- Botou Safety Tools Group Co., Ltd.

- Carltsoe Safety Tools ApS

- CS Unitec, Inc.

- EGA Master

- Facom (Stanley Black & Decker)

- Feathertouch Safety Tools Pvt. Ltd.

- Force Tools Co., Ltd.

- Hans Tools

- Hebei Botou Safety Tools Co., Ltd.

- Hebei Junda Safety Tools

- Klein Tools

- Lindstrom Tools (Apex Tools)

- M.T.I. Tools Co., Ltd.

- Picard Hammers

- Proto Industrial Tools

- Sankosha Co., Ltd.

- Titan Tools

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 466 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 500.8 Million |

| Forecasted Market Value ( USD | $ 557.6 Million |

| Compound Annual Growth Rate | 1.8% |

| Regions Covered | Global |