Global Acceleration and Yaw Rate Sensors Market - Key Trends & Drivers Summarized

How Are Acceleration and Yaw Rate Sensors Enhancing Modern Mobility and Safety Systems?

Acceleration and yaw rate sensors have become fundamental components in modern transportation systems, playing a critical role in improving vehicle dynamics, stability, and occupant safety. These sensors are responsible for detecting changes in speed, orientation, and rotational movement along multiple axes, providing real-time data to a vehicle’s electronic control units. This information is vital for activating and calibrating safety features such as electronic stability control (ESC), anti-lock braking systems (ABS), traction control, and advanced driver assistance systems (ADAS). As vehicles become more complex and autonomous functions are increasingly integrated, the need for precise and responsive inertial sensors has grown significantly. Acceleration sensors monitor the rate of change in velocity, while yaw rate sensors measure the vehicle’s angular velocity around its vertical axis, a key parameter in assessing whether a car is skidding or deviating from its intended path. Together, they enable better handling and control in emergency maneuvers, slippery conditions, or abrupt steering changes. These sensors also support semi-autonomous and fully autonomous systems by feeding accurate spatial data into machine learning algorithms and decision-making modules. In electric vehicles, where torque and balance are crucial, these sensors ensure smooth and safe performance across varied driving environments. Their role has expanded beyond passenger cars into commercial vehicles, drones, motorcycles, industrial equipment, and even personal mobility devices such as e-scooters. With their integration into increasingly intelligent platforms, acceleration and yaw rate sensors are becoming not just supportive tools but central pillars of the next generation of mobility.Why Are Automotive and Electronics Manufacturers Focusing on Innovation in Inertial Sensing Technologies?

Automotive and electronics manufacturers are placing a growing emphasis on innovation in inertial sensing technologies, particularly in acceleration and yaw rate sensors, to meet the evolving demands of safety, automation, and precision mobility. As vehicles become smarter and more connected, sensor technologies must deliver higher levels of accuracy, durability, and responsiveness. This is prompting a wave of research and development focused on miniaturization, power efficiency, and multi-axis functionality. MEMS (Micro-Electro-Mechanical Systems) technology has revolutionized the sensor industry, enabling compact, low-cost sensors that can be embedded in a variety of applications without sacrificing performance. Leading manufacturers are investing in next-generation sensor fusion techniques, where acceleration and yaw rate data are combined with information from GPS, gyroscopes, magnetometers, and cameras to generate a more comprehensive picture of vehicle behavior and environment. These improvements allow systems to better anticipate and respond to real-world driving challenges, such as sudden lane changes, tight cornering, or adverse weather conditions. Enhanced signal processing capabilities are also being developed to reduce noise, improve calibration, and enable real-time analytics for faster response times. Automotive OEMs are working closely with Tier 1 suppliers to integrate these sensors seamlessly into electronic control units and autonomous driving stacks. In addition, the rise of over-the-air updates and connected car platforms demands sensors that are not only high-performance but also secure and compatible with cloud-based systems. Outside of automotive applications, consumer electronics companies are adapting these sensors for wearables, robotics, and augmented reality devices, opening up new market opportunities. The convergence of mobility trends, safety regulations, and user expectations is driving sustained innovation in this space, making advanced inertial sensors an area of strategic focus across industries.What Application Areas Are Driving the Demand for Acceleration and Yaw Rate Sensors?

A diverse and expanding array of applications is driving the demand for acceleration and yaw rate sensors, with industries across transportation, industrial automation, aerospace, and consumer electronics increasingly incorporating these devices into their systems. In the automotive sector, these sensors are integral to vehicle dynamics control systems, supporting everything from basic safety features to complex autonomous driving functionalities. Their use is not limited to passenger vehicles; commercial trucks, buses, and agricultural machinery also rely on inertial sensors to maintain stability under load, navigate rough terrain, and automate various operational functions. In aviation and aerospace, acceleration and yaw rate sensors are critical for maintaining aircraft orientation, supporting flight control systems, and aiding navigation in both manned and unmanned aerial vehicles. Drones and UAVs, which require precise maneuverability, use these sensors for flight stabilization and positional awareness. In rail transport, these sensors help monitor track alignment, tilting behavior, and braking systems, contributing to safer and smoother rides. The industrial sector uses inertial sensors in robotics, manufacturing automation, and machine condition monitoring to track vibrations, movement, and mechanical deviations. In healthcare and sports technology, wearables equipped with these sensors track human motion, enabling gait analysis, fall detection, and performance monitoring. Consumer electronics like smartphones, tablets, and gaming devices also integrate these sensors to enhance user interface responsiveness and motion-based controls. Additionally, the growing popularity of micro-mobility solutions such as e-bikes and scooters is driving demand for compact, rugged sensors that ensure rider safety and device stability. With technological advancement enabling higher precision and affordability, the number of viable applications for acceleration and yaw rate sensors is expanding rapidly, cementing their relevance in both traditional and emerging sectors.What Key Factors Are Fueling the Growth of the Global Acceleration and Yaw Rate Sensors Market?

The growth of the global acceleration and yaw rate sensors market is fueled by several interconnected factors that reflect evolving technological, regulatory, and market dynamics. One of the primary drivers is the rising demand for advanced driver assistance systems and autonomous vehicle features, which require a dense array of high-performance sensors to ensure safety, reliability, and responsiveness. Stringent automotive safety regulations worldwide are compelling manufacturers to include stability control systems and motion detection technologies as standard offerings, further increasing sensor deployment. The rapid electrification of vehicles, driven by environmental goals and policy mandates, is also boosting demand for sensors that can manage torque distribution, regenerative braking, and dynamic chassis control in electric drivetrains. Miniaturization enabled by MEMS technology has lowered the size and cost barriers, making these sensors accessible for mass-market applications beyond automotive, including personal electronics and industrial automation. The proliferation of smart devices and connected infrastructure is creating an ecosystem where real-time motion data is crucial for system performance and user experience. Advancements in sensor fusion, edge computing, and artificial intelligence are enabling more sophisticated applications that rely heavily on inertial data, from smart cities to precision agriculture. Additionally, increased consumer expectations for convenience, performance, and safety are pressuring manufacturers to innovate continuously and incorporate intelligent sensing capabilities into their products. Global supply chain developments, including strategic partnerships between sensor makers and electronics integrators, are accelerating production scalability and geographic reach. Investment in R&D and the rise of Industry 4.0 are also contributing to the adoption of these sensors in manufacturing environments where operational efficiency and predictive maintenance are top priorities. All these factors together are creating a robust foundation for long-term growth in the acceleration and yaw rate sensors market, ensuring their continued integration across an expanding spectrum of industries and applications.Scope of the Report

The report analyzes the Acceleration and Yaw Rate Sensors market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Sensor Type (Piezoelectric Sensor, Micromechanical Sensor); Application (Aerospace Application, Automotive Application, Passenger Cars Application, Light Commercial Vehicles Application, Heavy Commercial Vehicles Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Piezoelectric Sensor segment, which is expected to reach US$5.3 Billion by 2030 with a CAGR of a 5.9%. The Micromechanical Sensor segment is also set to grow at 9.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.6 Billion in 2024, and China, forecasted to grow at an impressive 11.3% CAGR to reach $1.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Acceleration and Yaw Rate Sensors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Acceleration and Yaw Rate Sensors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Acceleration and Yaw Rate Sensors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Analog Devices, Inc., AVL List GmbH, Bosch Sensortec GmbH, CTS Corporation, Denso Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Acceleration and Yaw Rate Sensors market report include:

- Analog Devices, Inc.

- AVL List GmbH

- Bosch Sensortec GmbH

- CTS Corporation

- Denso Corporation

- Epson Toyocom Corporation

- Honeywell International Inc.

- Infineon Technologies AG

- InvenSense, Inc. (TDK)

- Kionix, Inc. (ROHM Group)

- Kistler Instrumente AG

- Melexis NV

- MEMSIC Semiconductor (Tinci Group)

- MiraMEMS Sensing Technology Co., Ltd.

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors N.V.

- Sensata Technologies

- STMicroelectronics

- TDK Corporation

- ZF Friedrichshafen AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Analog Devices, Inc.

- AVL List GmbH

- Bosch Sensortec GmbH

- CTS Corporation

- Denso Corporation

- Epson Toyocom Corporation

- Honeywell International Inc.

- Infineon Technologies AG

- InvenSense, Inc. (TDK)

- Kionix, Inc. (ROHM Group)

- Kistler Instrumente AG

- Melexis NV

- MEMSIC Semiconductor (Tinci Group)

- MiraMEMS Sensing Technology Co., Ltd.

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors N.V.

- Sensata Technologies

- STMicroelectronics

- TDK Corporation

- ZF Friedrichshafen AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 272 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

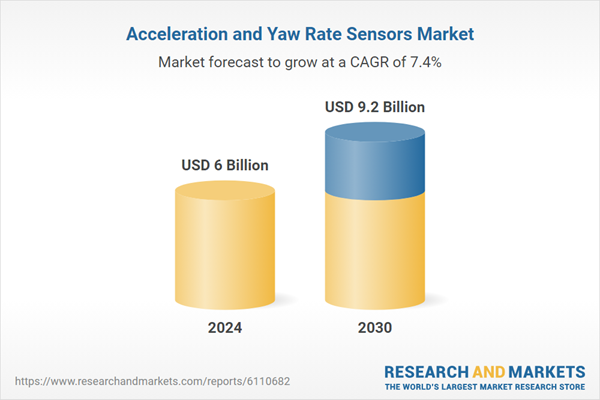

| Estimated Market Value ( USD | $ 6 Billion |

| Forecasted Market Value ( USD | $ 9.2 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |