Global Suspension Springs Market - Key Trends & Drivers Summarized

What’s Changing the Anatomy of Vehicle Suspension Systems?

Suspension springs have long played a pivotal role in vehicle dynamics, acting as core components that manage weight distribution, absorb shocks, and maintain road grip. Traditionally, the industry relied heavily on coil springs made of high-tensile steel for their simplicity and durability. However, innovation in material science is reshaping this landscape. Modern designs are increasingly exploring composite materials, such as fiberglass-reinforced plastics, which offer a superior strength-to-weight ratio, enhanced corrosion resistance, and better performance consistency across varying temperature ranges. These advancements are leading to lighter vehicle builds without compromising structural integrity - particularly important in electric vehicles (EVs), where weight savings can directly enhance range and efficiency.The integration of active and semi-active suspension systems is also revolutionizing the role of suspension springs. Unlike traditional passive systems, these setups employ electronically controlled springs that adapt in real time to road conditions and driving behavior. This development is gaining traction in luxury, high-performance, and off-road vehicles, where enhanced ride quality and handling precision are critical selling points. By working in tandem with sensors and AI-based algorithms, these new suspension systems are moving closer to predictive damping, where road undulations are detected before they are encountered, and spring tension is adjusted proactively.

How Is Electrification Reengineering Suspension Spring Demands?

With the rapid adoption of electric vehicles, suspension spring technologies are undergoing significant recalibration. The unique weight distribution of EVs, typically heavier due to battery packs, demands stiffer and more load-bearing springs. Moreover, as EVs produce less vibration and noise than internal combustion vehicles, even minor suspension inconsistencies become more noticeable, pushing manufacturers to engineer springs that provide a smooth, refined, and nearly silent ride. This is prompting a shift toward dual-rate and progressive-rate springs that provide varying resistance based on the load and compression level, thereby optimizing both comfort and performance.Meanwhile, the commercial vehicle segment is seeing its own evolution. As last-mile delivery fleets and autonomous delivery vehicles become more common, the suspension systems must endure greater operational stresses under varying load conditions. Air springs and electronically controlled air suspension systems are increasingly favored in these contexts for their ability to adapt to diverse payloads. These smart suspension technologies extend the life of the spring system while improving fuel efficiency through better aerodynamics achieved by adjusting ride height on the go. As a result, OEMs are actively partnering with spring manufacturers to co-develop customized solutions that cater to niche mobility platforms and usage conditions.

Could Sustainability and Lightweighting Be the Game Changers?

Environmental regulations and carbon neutrality goals are compelling the automotive industry to rethink every component, including suspension springs. Lightweighting has emerged as a major trend, not only to improve fuel economy and EV range but also to reduce overall lifecycle emissions. This shift is propelling the use of advanced high-strength steel (AHSS) and carbon-fiber-based composites in suspension spring production. Though expensive, these materials offer significant weight reduction without sacrificing durability. OEMs and tier-one suppliers are exploring hybrid spring designs - metallic cores wrapped in composite shells - to strike a balance between cost and performance.Another noteworthy trend is the growing focus on recyclability and environmental compliance of suspension materials. Eco-friendly coatings and corrosion-resistant treatments are being introduced to extend product life and reduce the need for frequent replacements. Additionally, as the global supply chain becomes more digital and automated, predictive maintenance tools powered by IoT and machine learning are being integrated into vehicle suspension modules. These tools monitor the real-time performance of springs, alerting users of wear and tear before a failure occurs, thereby improving safety and reducing downtime. Together, these sustainability-driven innovations are helping spring manufacturers align with the broader shift toward green mobility and circular manufacturing practices.

What’s Accelerating the Growth in the Suspension Springs Market?

The growth in the suspension springs market is driven by several factors specific to technology evolution, end-use segments, and customization demands. One of the key drivers is the proliferation of electric and hybrid vehicles, which require suspension systems tailored to unique weight and load distribution characteristics. EV-specific suspension tuning is becoming a standard practice, with spring systems engineered to handle battery mass while maintaining ride smoothness and stability. Moreover, the demand for high-performance and luxury vehicles is escalating, particularly in emerging markets. These vehicles often incorporate advanced adaptive suspension systems that rely on premium-grade springs capable of delivering both comfort and performance, thus driving market expansion.The commercial vehicle sector - especially logistics, ride-hailing, and autonomous delivery fleets - is experiencing a surge in specialized suspension spring requirements. Air spring systems, known for their load-adjusting properties, are increasingly being deployed to manage dynamic payloads and reduce chassis wear. Additionally, there is strong demand from agricultural machinery, construction vehicles, and military transport systems for rugged and reliable suspension springs capable of withstanding extreme operational environments. Customization is also emerging as a critical growth catalyst. OEMs and aftermarket players alike are investing in modular spring platforms that can be tailored to specific vehicle architectures, usage patterns, and regulatory requirements. Lastly, regional manufacturing incentives and R&D investments in smart materials, such as shape memory alloys and tunable composites, are opening up new growth avenues for manufacturers committed to innovation-led differentiation.

Scope of the Report

The report analyzes the Suspension Springs market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Coil Springs, Leaf Springs, Air Springs, Other Types); Material (Steel Material, Composite Material, Other Materials); Distribution Channel (OEM Distribution Channel, Aftermarket Distribution Channel); End-Use (Passenger Cars End-Use, Light Commercial Vehicles End-Use, Heavy Commercial Vehicles End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Coil Springs segment, which is expected to reach US$3.2 Billion by 2030 with a CAGR of a 2.7%. The Leaf Springs segment is also set to grow at 2.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.7 Billion in 2024, and China, forecasted to grow at an impressive 6.1% CAGR to reach $1.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Suspension Springs Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Suspension Springs Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Suspension Springs Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Betts Spring Company, Century Spring Corp, Eaton Detroit Spring, Inc., Firestone Industrial Products Co., GKN Automotive and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Suspension Springs market report include:

- Betts Spring Company

- Century Spring Corp

- Eaton Detroit Spring, Inc.

- Firestone Industrial Products Co.

- GKN Automotive

- Hendrickson USA LLC

- Jamna Auto Industries Ltd.

- KW Automotive GmbH

- KYB Corporation

- Leggett & Platt, Inc.

- Lesjöfors Springs (Lesjöfors AB)

- Mitsubishi Steel Mfg. Co., Ltd.

- Mubea Coil Spring Systems

- NHK Spring Co., Ltd.

- Öhlins Racing AB

- Precision Coil Spring Company

- Rassini

- Sogefi S.p.A.

- S-Superior Spring Mfg. Co. Inc.

- Swift Springs (Tokyo Hatsujo)

- Tein, Inc.

- WP Suspension GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Betts Spring Company

- Century Spring Corp

- Eaton Detroit Spring, Inc.

- Firestone Industrial Products Co.

- GKN Automotive

- Hendrickson USA LLC

- Jamna Auto Industries Ltd.

- KW Automotive GmbH

- KYB Corporation

- Leggett & Platt, Inc.

- Lesjöfors Springs (Lesjöfors AB)

- Mitsubishi Steel Mfg. Co., Ltd.

- Mubea Coil Spring Systems

- NHK Spring Co., Ltd.

- Öhlins Racing AB

- Precision Coil Spring Company

- Rassini

- Sogefi S.p.A.

- S-Superior Spring Mfg. Co. Inc.

- Swift Springs (Tokyo Hatsujo)

- Tein, Inc.

- WP Suspension GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 466 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

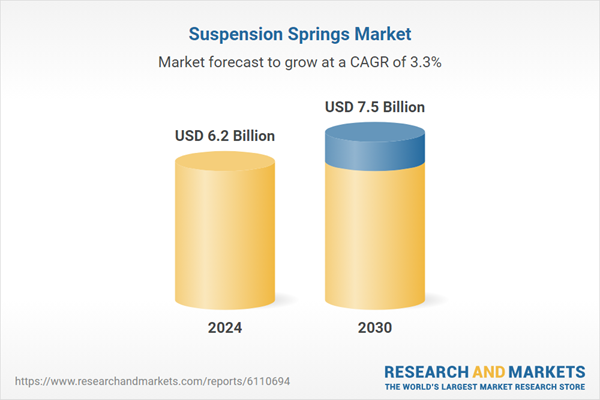

| Estimated Market Value ( USD | $ 6.2 Billion |

| Forecasted Market Value ( USD | $ 7.5 Billion |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Global |