Global Pink Hydrogen Market - Key Trends & Drivers Summarized

Why Is Pink Hydrogen Emerging as a Strategic Link Between Nuclear Energy and Decarbonized Hydrogen Production?

Pink hydrogen-produced via electrolysis powered by nuclear energy-has emerged as a strategically vital subsegment of the clean hydrogen economy. Unlike green hydrogen, which is generated using renewable sources like wind or solar, pink hydrogen leverages nuclear power’s consistent baseload generation to operate electrolysis units at stable, high efficiency. This positioning makes pink hydrogen particularly valuable in energy systems where nuclear capacity is significant and grid stability is a priority.With hydrogen being increasingly recognized as a cornerstone for decarbonizing hard-to-abate sectors such as steelmaking, heavy transportation, refining, and chemical manufacturing, pink hydrogen offers an advantage in scalability, reliability, and carbon neutrality. It provides a clean hydrogen pathway with minimal land footprint and without the intermittency challenges associated with solar or wind. In countries like France, the United States, Russia, and Canada, where nuclear power already contributes significantly to the national energy mix, pink hydrogen is gaining institutional and commercial support as a complementary route to green and blue hydrogen.

Furthermore, pink hydrogen production can be aligned with off-peak nuclear power generation, optimizing reactor utilization and enhancing grid balancing. The dual benefit of decarbonizing hydrogen while improving nuclear asset economics is creating a powerful policy and market case for pink hydrogen. With global hydrogen demand expected to multiply by 2050 under net-zero scenarios, pink hydrogen is becoming a critical vector in national hydrogen roadmaps.

What Role Are Technology and Infrastructure Advancements Playing in Scaling Pink Hydrogen?

The viability of pink hydrogen is closely tied to technological advancements in high-temperature electrolysis (HTE), solid oxide electrolysis cells (SOECs), and thermochemical hydrogen production techniques. SOECs, in particular, offer higher efficiencies (up to 90%) by utilizing both electricity and high-grade heat, which nuclear reactors can supply. These systems reduce energy consumption per kilogram of hydrogen, making pink hydrogen more competitive than traditional alkaline or PEM electrolysis under certain conditions.Research institutions and pilot programs are already validating the integration of nuclear reactors with electrolyzers. For instance, the U.S. Department of Energy’s Idaho National Laboratory (INL) is partnering with major utilities to demonstrate high-temperature steam electrolysis at nuclear facilities. Similarly, EDF and Framatome in France are investing in integrated nuclear-hydrogen platforms to evaluate technical feasibility, safety, and economic models at scale.

In parallel, advancements in hydrogen storage, compression, and transport-such as metal hydrides, liquid organic hydrogen carriers (LOHCs), and ammonia conversion-are addressing the downstream challenges of hydrogen logistics. These improvements are essential to making pink hydrogen viable not only at the production site but throughout the supply chain, especially for export-oriented applications.

Which Countries and Sectors Are Likely to Drive Pink Hydrogen Adoption?

Pink hydrogen adoption is likely to be concentrated in countries with strong nuclear infrastructure and decarbonization mandates. France, with its heavy reliance on nuclear power, has positioned pink hydrogen as a pillar in its national hydrogen strategy. Its integration into industrial clusters-particularly in steel, chemicals, and transport-is being actively promoted through public-private partnerships. Canada, with its CANDU reactors and hydrogen innovation clusters, is similarly poised to become a pink hydrogen hub.In the U.S., states like Illinois and Pennsylvania are exploring pink hydrogen pilot programs leveraging existing nuclear power plants. The Bipartisan Infrastructure Law and the Inflation Reduction Act have introduced incentives and grants for clean hydrogen projects, explicitly including nuclear-powered electrolysis. In Japan and South Korea, pink hydrogen is under evaluation for its role in hydrogen-based mobility, including fuel cell vehicles and hydrogen-powered trains.

Industrially, sectors that demand high-purity hydrogen and operate near nuclear plants-such as ammonia production, oil refining, and specialty chemicals-are expected to be early adopters. Steelmakers are also looking into pink hydrogen for replacing coking coal in direct reduced iron (DRI) processes. Given that pink hydrogen does not rely on variable renewables, it offers an operationally consistent solution for high-load, high-uptime industrial applications.

What Is Driving Growth in the Global Pink Hydrogen Market?

The growth in the global pink hydrogen market is driven by increasing focus on full-spectrum hydrogen diversification, rising investments in nuclear innovation, and policy incentives promoting low-carbon hydrogen production. As governments and industries move toward net-zero emissions targets, pink hydrogen is emerging as a pragmatic solution where nuclear energy is already a dominant or growing part of the grid.The capacity to produce hydrogen at scale using stable, non-intermittent energy sources addresses a critical limitation of green hydrogen. Coupled with improvements in electrolysis efficiency and modularization, pink hydrogen is gaining momentum as part of multi-vector energy transition strategies. Infrastructure investments, carbon pricing mechanisms, and clean hydrogen tax credits are improving its financial viability relative to grey and blue hydrogen alternatives.

Moreover, international collaboration in nuclear-hydrogen integration-such as joint R&D between Europe, North America, and East Asia-is creating pathways for knowledge transfer and shared infrastructure. As public opinion shifts toward recognizing nuclear energy’s role in climate mitigation, pink hydrogen stands to benefit from regulatory alignment, project de-risking, and global demand for decarbonized fuels. With rising global momentum, pink hydrogen is poised to secure a key position in the evolving hydrogen economy.

Scope of the Report

The report analyzes the Pink Hydrogen market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Form (Liquid Form, Gas Form); Application (Transportation Application, Petrochemical Application, Chemical Application, Steel Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Liquid Form segment, which is expected to reach US$25.1 Billion by 2030 with a CAGR of a 33.7%. The Gas Form segment is also set to grow at 26.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.6 Billion in 2024, and China, forecasted to grow at an impressive 30.1% CAGR to reach $4.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Pink Hydrogen Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Pink Hydrogen Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Pink Hydrogen Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Air Liquide, Air Products and Chemicals Inc., Constellation Energy Group, Exelon Corporation, GE Hitachi Nuclear Energy and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Pink Hydrogen market report include:

- Air Liquide

- Air Products and Chemicals Inc.

- Constellation Energy Group

- Exelon Corporation

- GE Hitachi Nuclear Energy

- Hydrogen Systems (Denmark)

- Iberdrola SA

- ITM Power plc

- Linde Plc

- Nel ASA

- NuScale Power

- OKG Aktiebolag

- Plug Power Inc.

- Rolls-Royce Holdings plc

- Sembcorp Industries

- SGH2 Energy

- Siemens Energy

- SK Ecoplant

- Toshiba Corporation

- Toshiba Energy Systems & Solutions Corp.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Air Liquide

- Air Products and Chemicals Inc.

- Constellation Energy Group

- Exelon Corporation

- GE Hitachi Nuclear Energy

- Hydrogen Systems (Denmark)

- Iberdrola SA

- ITM Power plc

- Linde Plc

- Nel ASA

- NuScale Power

- OKG Aktiebolag

- Plug Power Inc.

- Rolls-Royce Holdings plc

- Sembcorp Industries

- SGH2 Energy

- Siemens Energy

- SK Ecoplant

- Toshiba Corporation

- Toshiba Energy Systems & Solutions Corp.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 139 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

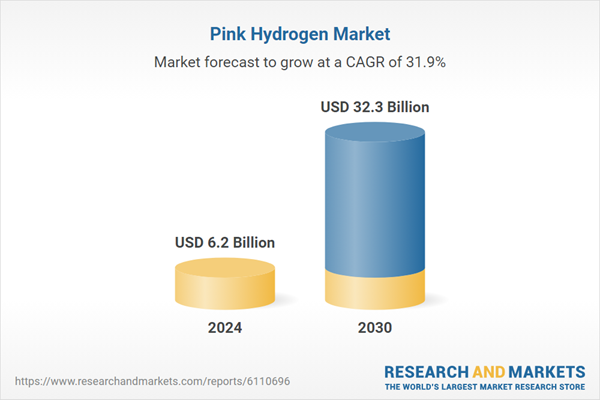

| Estimated Market Value ( USD | $ 6.2 Billion |

| Forecasted Market Value ( USD | $ 32.3 Billion |

| Compound Annual Growth Rate | 31.9% |

| Regions Covered | Global |