Global Armored Vehicle Procurement and Upgrade Market - Key Trends & Drivers Summarized

Why Is Armored Vehicle Procurement a Strategic Priority for Modern Militaries and Security Forces?

Armored vehicle procurement has become a cornerstone of defense strategy for nations worldwide as they respond to evolving threats, asymmetric warfare scenarios, and the need to modernize legacy equipment. The rise in geopolitical tensions, cross-border conflicts, urban warfare, and terrorism has prompted military and paramilitary forces to prioritize investments in robust, mobile, and technologically advanced armored platforms. These vehicles play a critical role in force protection, troop mobility, reconnaissance, and combat support, making them indispensable across a wide range of mission profiles. Whether for battlefield operations, internal security, or peacekeeping missions, armored vehicles offer a combination of protection, firepower, and maneuverability that is unmatched by lighter platforms. Increasing defense budgets in regions such as Asia-Pacific, the Middle East, and Eastern Europe have accelerated procurement initiatives, with countries aiming to build or upgrade armored fleets to enhance operational readiness. Governments are also seeking to reduce dependence on foreign suppliers by fostering local manufacturing through defense offset policies and technology transfer agreements. The variety of platforms being procured includes main battle tanks, infantry fighting vehicles, armored personnel carriers, and mine-resistant ambush protected vehicles, each tailored to specific tactical needs. Procurement strategies are now emphasizing modularity, enabling forces to adapt platforms to multiple roles through mission-specific kits. In this dynamic environment, armored vehicle acquisition is no longer solely about increasing numerical strength but about enhancing survivability, mobility, and interoperability with other modern battlefield systems. The increasing frequency and complexity of security threats continue to make armored vehicle procurement a top-tier defense priority across continents.How Are Technological Advancements Shaping Modern Armored Vehicle Upgrade Programs?

Armored vehicle upgrade programs are being significantly shaped by rapid advancements in defense technology, with a growing emphasis on digitalization, survivability, and multi-domain integration. Many nations are opting to modernize their existing armored fleets instead of full-scale replacement, making upgrades a cost-effective and strategic alternative that can dramatically extend the life and relevance of current platforms. Modern upgrades often involve replacing outdated engines and transmissions to improve mobility, integrating next-generation armor systems such as reactive and composite materials, and retrofitting vehicles with advanced situational awareness tools like thermal imaging, laser warning receivers, and 360-degree camera systems. Enhanced communication suites that support real-time data sharing across units are being embedded to improve coordination on the battlefield. Electronics and computing hardware are upgraded to support battlefield management systems (BMS) and future integration with unmanned platforms. Additionally, counter-improvised explosive device (C-IED) measures, active protection systems (APS), and electronic warfare (EW) capabilities are being added to protect against modern threats such as drones, guided munitions, and IEDs. Many upgrade programs also focus on weapons systems, replacing conventional turrets with remote-controlled weapon stations or integrating anti-tank guided missiles (ATGMs) for expanded lethality. The inclusion of modular and open-architecture platforms in upgrades allows for the seamless integration of future technologies, reducing obsolescence risks. As hybrid warfare becomes the new norm, incorporating cyber defenses and electromagnetic spectrum resilience is also gaining importance. These technological enhancements are transforming older armored vehicles into digitally connected, highly survivable assets capable of operating in high-threat, high-tech combat environments.How Do Strategic Alliances, Industrial Partnerships, and Regional Needs Influence Procurement and Modernization Trends?

The procurement and upgrade of armored vehicles are increasingly shaped by strategic alliances, defense cooperation agreements, and regional operational needs that differ widely depending on the threat landscape and defense doctrines of individual countries. In many cases, countries are entering into bilateral or multilateral agreements to co-develop or co-produce armored vehicle platforms that cater to their unique requirements while also supporting domestic defense industries. NATO member states, for example, often align their procurement with alliance standards for interoperability, leading to joint programs or standardized platforms that can operate seamlessly across national forces. In the Asia-Pacific region, rising territorial tensions and military modernization efforts are leading to increased indigenous production supported by foreign technology partnerships, with countries like India, South Korea, and Indonesia investing heavily in armored vehicle development. In the Middle East, where operational conditions are often characterized by desert environments and asymmetric threats, nations are focusing on acquiring or upgrading vehicles with advanced cooling systems, C-IED capabilities, and high survivability features. African and Latin American countries are often more constrained by budget but are showing interest in affordable, versatile platforms and second-hand equipment that can be upgraded to meet current threat levels. International defense exhibitions and forums serve as critical venues for promoting armored vehicle solutions and fostering new industrial collaborations. Offset requirements and local content mandates are further pushing global defense contractors to invest in local production facilities and training programs, creating ecosystems that support long-term sustainment and technological growth. The interplay between regional security dynamics, alliance obligations, and industrial capability is creating a complex but fertile environment for both procurement and upgrade activity in the armored vehicle sector.What Is Fueling the Long-Term Growth of the Armored Vehicle Procurement and Upgrade Market?

The growth in the armored vehicle procurement and upgrade market is driven by several compelling factors, including the persistent global rise in defense spending, the evolving nature of military threats, and the rapid pace of technological advancement. One of the strongest growth drivers is the increasing demand for survivable and mobile platforms capable of operating in hybrid warfare scenarios that blend conventional and irregular tactics. As threats evolve to include drone swarms, cyberattacks, and urban insurgencies, armed forces are seeking more agile, networked, and heavily protected vehicles to maintain a tactical advantage. Additionally, geopolitical instability in regions such as Eastern Europe, East Asia, and the Middle East has led to intensified procurement cycles and pre-emptive modernization strategies. Another key factor is the obsolescence of Cold War-era armored fleets in many countries, which is driving both complete platform replacements and deep modernization efforts. Governments are prioritizing long-term capability development, focusing on vehicles that can be upgraded over time rather than replaced outright. Technological breakthroughs in areas such as artificial intelligence, composite armor, autonomous navigation, and electronic warfare are also enabling the next generation of armored vehicles to operate more effectively across multi-domain operations. The emergence of integrated defense systems that link ground vehicles with drones, satellites, and command centers is pushing the demand for more digitally capable platforms. Budgetary pressures and the high cost of new vehicle development are simultaneously boosting demand for upgrade programs that provide modern capabilities at a lower cost. Additionally, global defense firms are offering flexible financing, joint production agreements, and modular platforms to make armored solutions more accessible to a wider range of countries. These combined trends ensure sustained and dynamic growth in the armored vehicle procurement and upgrade market, driven by a blend of strategic necessity, technological innovation, and global defense cooperation.Scope of the Report

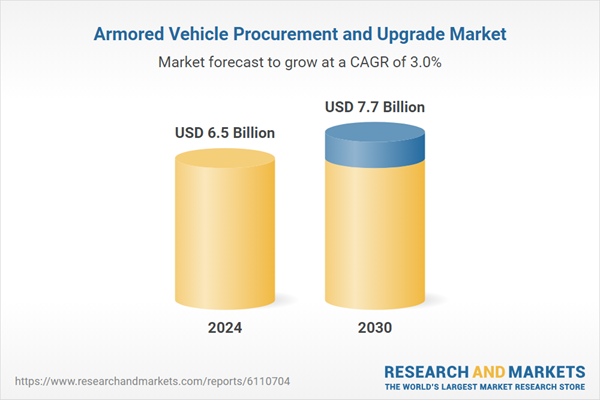

The report analyzes the Armored Vehicle Procurement and Upgrade market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Vehicle Type (Armored Personnel Carrier Vehicle, Infantry Fighting Vehicle, Mine-Resistant Ambush Protected Vehicle, Main Battle Tank Vehicle, Other Vehicle Types).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Armored Personnel Carrier Vehicle segment, which is expected to reach US$3.0 Billion by 2030 with a CAGR of a 3.0%. The Infantry Fighting Vehicle segment is also set to grow at 2.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.8 Billion in 2024, and China, forecasted to grow at an impressive 5.7% CAGR to reach $1.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Armored Vehicle Procurement and Upgrade Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Armored Vehicle Procurement and Upgrade Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Armored Vehicle Procurement and Upgrade Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BAE Systems, Denel SOC Ltd, Elbit Systems Ltd, FNSS Defence Systems, General Dynamics Land Systems and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Armored Vehicle Procurement and Upgrade market report include:

- BAE Systems

- Denel SOC Ltd

- Elbit Systems Ltd

- FNSS Defence Systems

- General Dynamics Land Systems

- Hanwha Aerospace

- INKAS Armored Vehicle Manufacturing

- International Armored Group

- Iveco Defence Vehicles

- Krauss-Maffei Wegmann (KMW)

- Lenco Armored Vehicles

- Navistar Defense

- Nexter Systems

- Norinco (China North Industries)

- Oshkosh Defense

- Otokar Otomotiv ve Savunma Sanayi

- Paramount Group

- Plasan Sasa Ltd

- Rheinmetall AG

- ST Engineering

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BAE Systems

- Denel SOC Ltd

- Elbit Systems Ltd

- FNSS Defence Systems

- General Dynamics Land Systems

- Hanwha Aerospace

- INKAS Armored Vehicle Manufacturing

- International Armored Group

- Iveco Defence Vehicles

- Krauss-Maffei Wegmann (KMW)

- Lenco Armored Vehicles

- Navistar Defense

- Nexter Systems

- Norinco (China North Industries)

- Oshkosh Defense

- Otokar Otomotiv ve Savunma Sanayi

- Paramount Group

- Plasan Sasa Ltd

- Rheinmetall AG

- ST Engineering

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 191 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.5 Billion |

| Forecasted Market Value ( USD | $ 7.7 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |