Global Long Range Radars Market - Key Trends & Drivers Summarized

Why Are Long Range Radars Gaining Strategic Importance Across Military and Civilian Applications?

Long range radars play a critical role in surveillance, tracking, target acquisition, and early warning systems by detecting airborne, maritime, and ground-based threats at extended distances-often exceeding 300 kilometers. Their strategic utility spans multiple defense and security domains, including missile defense, airspace monitoring, border protection, coastal surveillance, and ballistic threat detection. As geopolitical tensions escalate and nations modernize their defense postures, investments in long range radar systems are being prioritized across NATO countries, Asia-Pacific militaries, and Middle Eastern defense establishments.Civilian applications are also emerging prominently, particularly in air traffic control, weather forecasting, and space surveillance. The growing need for continuous and precise monitoring of airspace and orbital environments, especially with the rise of commercial satellite launches and near-Earth object tracking, is driving demand from non-defense sectors. Long range radars provide the situational awareness necessary for decision-making across domains with minimal latency and high fidelity, making them indispensable for national defense, disaster preparedness, and civilian safety.

How Are Radar Technologies Evolving to Deliver Superior Detection and Discrimination?

The market is being reshaped by substantial technological advancements in radar architecture, signal processing, and component miniaturization. Active Electronically Scanned Array (AESA) technology has become the backbone of next-generation long range radars, offering electronic beam steering, multi-target tracking, and enhanced clutter suppression. These systems, unlike mechanically scanned arrays, can instantaneously shift focus between multiple targets, adapt to jamming threats, and offer superior reliability due to fewer moving parts.The use of Gallium Nitride (GaN) semiconductors in radar transmit/receive modules has significantly improved power efficiency, thermal stability, and signal amplification, allowing for longer range coverage without proportionally increasing size or power draw. Digital beamforming and adaptive waveform generation are enabling dynamic range resolution enhancement and improved target discrimination in clutter-heavy or complex terrain. Multi-band and multi-static radar configurations are also gaining traction to achieve resilience against stealth technologies, low radar cross-section (RCS) threats, and electronic countermeasures.

AI and machine learning are increasingly embedded into radar signal processing units, enabling real-time anomaly detection, predictive target behavior analysis, and automated threat classification. Additionally, networked radar arrays with sensor fusion capabilities are being deployed for integrated air and missile defense (IAMD), where multiple radars and sensors work collaboratively to deliver a holistic and layered defense shield. These innovations are redefining the performance expectations and deployment strategies of long range radar systems globally.

Which Platforms and Deployment Scenarios Are Driving Radar Installations?

Long range radars are being integrated across diverse platforms, from fixed ground stations and mobile truck-mounted units to shipborne and airborne systems. Ground-based early warning radars remain foundational to national missile defense strategies, particularly in countries like the U.S., India, Israel, China, and Russia. Systems such as the AN/TPY-2, Green Pine, and Ground Master 400 are deployed to detect ballistic missile launches, aircraft incursions, and UAV threats at high altitudes and across vast ranges.Maritime deployments are growing, with naval forces integrating long range radars into destroyers, frigates, and aircraft carriers for surface and air threat detection. Radar systems such as the SMART-L and SAMPSON are used to detect low-flying missiles and provide long-horizon tracking for naval task forces. Airborne early warning and control (AEW&C) aircraft are equipped with long range radars that provide 360-degree surveillance, enabling battlefield management, air policing, and force coordination in contested airspace.

Civilian applications include weather monitoring systems like Doppler long range radars used for cyclone tracking and storm prediction, especially in regions prone to extreme weather events. Air navigation service providers are deploying long range primary surveillance radars (PSRs) and secondary surveillance radars (SSRs) for flight monitoring across en route air corridors and remote regions. With increasing commercial satellite activity, radar installations for space situational awareness (SSA) are also gaining momentum to monitor orbital debris and ensure collision avoidance.

What Is Fueling Growth in the Long Range Radars Market Globally?

The growth in the global long range radars market is driven by several factors, including escalating defense spending, rising asymmetric warfare threats, modernization of aging radar fleets, and expanded use cases in civilian domains. The proliferation of ballistic missiles, hypersonic weapons, and stealth aircraft is compelling governments to deploy sophisticated radar systems that offer extended detection range, faster target processing, and high reliability in contested electromagnetic environments.The increase in border surveillance, anti-drone operations, and counter-UAS strategies is also boosting radar demand in regions with high geopolitical instability or insurgency threats. Military alliances such as NATO are investing in interoperable radar networks as part of joint airspace control and IAMD frameworks, creating sustained opportunities for multinational radar manufacturers. In addition, export demand for long range radar systems from countries with limited indigenous capability is creating new market segments across Africa, Southeast Asia, and Latin America.

Simultaneously, growth in civilian aviation and meteorological monitoring is stimulating radar deployment at airports, meteorological centers, and disaster management agencies. Regulatory frameworks such as ICAO standards and space traffic management guidelines are reinforcing radar infrastructure investments across both public and private stakeholders. As technological barriers to performance diminish and procurement models evolve to favor modularity and rapid deployment, the long range radar market is set for robust expansion through the end of the decade.

Scope of the Report

The report analyzes the Long Range Radars market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Platform (Airborne Platform, Ground-based Platform, Naval Platform).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Airborne Platform segment, which is expected to reach US$5.1 Billion by 2030 with a CAGR of a 4.3%. The Ground-based Platform segment is also set to grow at 2.0% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.8 Billion in 2024, and China, forecasted to grow at an impressive 6.7% CAGR to reach $1.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Long Range Radars Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Long Range Radars Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Long Range Radars Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Airbus Defence and Space, ASELSAN, BAE Systems, Bharat Electronics Limited (BEL), China Electronics Technology Group Corporation (CETC) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Long Range Radars market report include:

- Airbus Defence and Space

- ASELSAN

- BAE Systems

- Bharat Electronics Limited (BEL)

- China Electronics Technology Group Corporation (CETC)

- Elbit Systems

- General Atomics

- General Dynamics Mission Systems

- HENSOLDT

- Indra Sistemas

- Israel Aerospace Industries (IAI)

- Leonardo S.p.A.

- Lockheed Martin

- L&T Defence

- Northrop Grumman

- Raytheon Technologies

- Reutech Radar Systems

- Rheinmetall AG

- Saab AB

- Thales Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airbus Defence and Space

- ASELSAN

- BAE Systems

- Bharat Electronics Limited (BEL)

- China Electronics Technology Group Corporation (CETC)

- Elbit Systems

- General Atomics

- General Dynamics Mission Systems

- HENSOLDT

- Indra Sistemas

- Israel Aerospace Industries (IAI)

- Leonardo S.p.A.

- Lockheed Martin

- L&T Defence

- Northrop Grumman

- Raytheon Technologies

- Reutech Radar Systems

- Rheinmetall AG

- Saab AB

- Thales Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

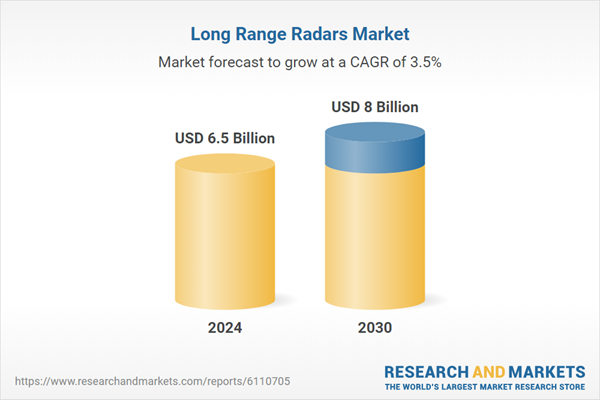

| Estimated Market Value ( USD | $ 6.5 Billion |

| Forecasted Market Value ( USD | $ 8 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |