Global Power Management Services Market - Key Trends & Drivers Summarized

Why Are Power Management Services Gaining Ground Across Industries and Infrastructures?

Power Management Services (PMS) have become essential across manufacturing, commercial, utility, and infrastructure environments, as enterprises increasingly focus on energy efficiency, reliability, and carbon footprint reduction. These services encompass a range of offerings-from load optimization, energy procurement, and grid interaction, to real-time monitoring, preventive maintenance, and compliance reporting. As businesses become more digitized and energy-reliant, PMS enables the intelligent orchestration of power resources, ensuring operational resilience, sustainability, and cost savings.Industries like data centers, pharmaceuticals, mining, and food processing operate with high energy loads and mission-critical equipment. Even a momentary disruption or energy imbalance can result in significant losses or safety issues. Here, PMS providers offer real-time diagnostics, peak load management, automated switching systems, and customized energy audits to ensure power stability. Furthermore, commercial buildings, smart cities, hospitals, and transport hubs leverage these services to optimize HVAC, lighting, and backup systems based on occupancy and usage data.

The widespread shift toward renewable energy sources, distributed energy resources (DER), and electric mobility further expands the need for power management. PMS ensures that solar PV, wind, battery storage, and grid power are seamlessly balanced, dispatched, and monetized in hybrid environments. Additionally, the global drive toward net-zero targets and ESG compliance has forced energy-intensive sectors to view power not just as an operational cost, but a strategic asset requiring active management.

How Are Digital Technologies Transforming the Power Management Services Landscape?

The adoption of smart technologies such as Internet of Things (IoT), Artificial Intelligence (AI), Digital Twins, and edge computing is significantly reshaping how power management services are designed and delivered. Traditional reactive service models are rapidly being replaced with predictive, autonomous, and analytics-driven frameworks. Central to this transformation is the rise of Energy Management Systems (EMS) that enable real-time data capture, load forecasting, anomaly detection, and remote optimization.Smart meters and IoT sensors deployed across industrial campuses feed granular data on power quality, voltage fluctuations, energy drift, and machine health into cloud-based platforms. AI algorithms then analyze patterns to forecast energy spikes, detect anomalies, and recommend corrective action. In high-risk verticals like chemical processing or aviation MROs, these systems trigger automated shutdowns or load redistribution to prevent grid failure.

Digital twin technology, which mirrors real-world energy infrastructure in a simulated environment, is enabling utilities and facility managers to model different power usage scenarios, test responses to demand surges, and plan upgrades without real-world risks. Edge analytics further ensures that decisions related to equipment switching or grid integration can be taken locally with ultra-low latency, improving system autonomy.

Cybersecurity is also a rising priority, as critical infrastructure becomes more connected. Service providers are integrating secure communication protocols, encrypted firmware updates, and access controls to safeguard grid-facing PMS installations from cyber threats. The synergy of digitization, intelligence, and security is creating a next-generation PMS paradigm that is decentralized, dynamic, and defensible.

Which Sectors and Regions Are Accelerating Adoption of Power Management Services?

Large-scale energy consumers such as industrial manufacturing, oil & gas refineries, data centers, and healthcare systems are the most active users of PMS. These sectors face high regulatory compliance demands, operate 24/7, and require real-time visibility into energy efficiency and equipment reliability. Data centers, in particular, are investing in PMS to reduce Power Usage Effectiveness (PUE), manage cooling loads, and balance backup systems like diesel gensets and UPS batteries.Smart campuses, airports, rail networks, and public infrastructure are also key growth areas. With distributed and digital building systems-elevators, HVAC, EV charging, lighting-requiring tight synchronization, PMS acts as the central nervous system that coordinates energy delivery, tracks carbon credits, and supports green building certifications. Retail chains and QSRs use PMS to standardize energy performance across multisite operations.

Geographically, North America and Western Europe are mature markets with high digital penetration and strong policy backing for clean energy transition. Asia-Pacific is experiencing rapid growth, especially in China, India, and Southeast Asia, where grid instability, urban expansion, and energy access gaps make PMS essential. In the Middle East and Africa, PMS is increasingly deployed in industrial free zones, smart city initiatives, and solar-integrated infrastructure.

What Is Driving Growth in the Global Power Management Services Market?

The growth in the global power management services market is driven by rising energy costs, increasing integration of renewables, grid modernization efforts, and the strategic imperative for businesses to reduce emissions and improve uptime. As global electricity demand surges, and power infrastructure becomes more decentralized and digital, PMS is evolving from a backend support system into a strategic enabler of operational excellence and sustainability.Corporate climate goals and ESG frameworks are pushing enterprises to monitor Scope 2 emissions, improve power factor correction, and reduce wastage-all of which require the continuous oversight that PMS provides. The rise of DERs, including on-site solar, microgrids, and battery energy storage systems (BESS), is creating complex power flows that demand intelligent orchestration.

Service providers are increasingly offering PMS as subscription-based or outcome-based models, removing CapEx barriers and enabling scalable adoption. Government mandates on energy efficiency, building codes, and smart city incentives are also boosting demand, particularly in infrastructure-heavy economies. As power becomes a competitive differentiator and resilience imperative, the market for Power Management Services is poised for long-term expansion across industrial, commercial, and institutional segments.

Scope of the Report

The report analyzes the Power Management Services market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Module (Power Monitoring Module, Load Shedding Module, Power Simulation Module, General Controls Module, Energy Cost Accounting Module, Switching & Safety Management Module); Application (Residential Application, Commercial Application, Industrial Application); End-User (Oil & Gas End-Users, Marine End-Users, Metals & Mining End-Users, Data Centers End-Users, Other End-Users).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Power Monitoring Module segment, which is expected to reach US$2.2 Billion by 2030 with a CAGR of a 4.7%. The Load Shedding Module segment is also set to grow at 7.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.8 Billion in 2024, and China, forecasted to grow at an impressive 8.8% CAGR to reach $1.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Power Management Services Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Power Management Services Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Power Management Services Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., AECOM, Black & Veatch, Capgemini Engineering, Cisco Systems, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Power Management Services market report include:

- ABB Ltd.

- AECOM

- Black & Veatch

- Capgemini Engineering

- Cisco Systems, Inc.

- Cummins Inc.

- Eaton Corporation

- Electric Power Engineers

- Emerson Electric Co.

- Engie SA

- General Electric (GE Vernova)

- Honeywell International Inc.

- Itron Inc.

- Johnson Controls

- Leidos Holdings, Inc.

- Mitsubishi Electric Corp.

- Schneider Electric SE

- Siemens Energy AG

- Tata Power-DDL

- WSP Global Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- AECOM

- Black & Veatch

- Capgemini Engineering

- Cisco Systems, Inc.

- Cummins Inc.

- Eaton Corporation

- Electric Power Engineers

- Emerson Electric Co.

- Engie SA

- General Electric (GE Vernova)

- Honeywell International Inc.

- Itron Inc.

- Johnson Controls

- Leidos Holdings, Inc.

- Mitsubishi Electric Corp.

- Schneider Electric SE

- Siemens Energy AG

- Tata Power-DDL

- WSP Global Inc.

Table Information

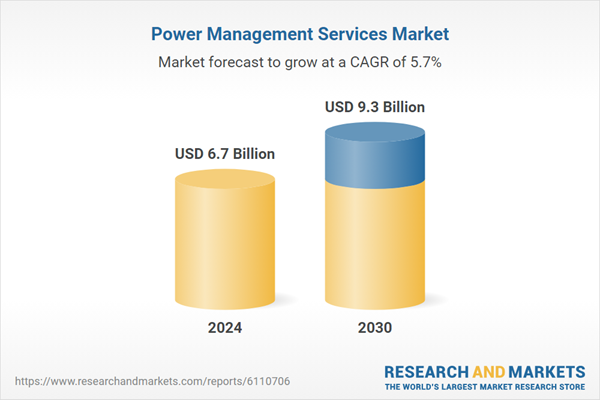

| Report Attribute | Details |

|---|---|

| No. of Pages | 389 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.7 Billion |

| Forecasted Market Value ( USD | $ 9.3 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |