Global Power Equipment Batteries Market - Key Trends & Drivers Summarized

Why Are Batteries Powering a New Wave of Equipment in Construction, Agriculture, and Landscaping?

Power equipment batteries-ranging from lithium-ion packs to nickel-metal hydride and lead-acid variants-are becoming integral to the global shift away from fuel-based engines in outdoor, industrial, and handheld power tools. Equipment segments such as electric lawnmowers, hedge trimmers, chainsaws, portable compressors, compact excavators, and handheld diagnostic tools are increasingly reliant on high-capacity, rechargeable batteries for mobility, zero-emission operation, and noise reduction.This transition is driven largely by electrification trends across small-to-medium equipment classes, where internal combustion engines are being phased out due to environmental regulations, rising fuel costs, and consumer demand for convenience. For instance, in landscaping and turf maintenance, battery-powered lawn care tools offer quieter operations, reduced maintenance, and lower total cost of ownership. Similarly, in agriculture and construction, battery packs are now used in compact tractors, tillers, concrete mixers, and surveying instruments to support semi-autonomous or operator-assisted functions.

The global rise in sustainable equipment use-fueled by green construction initiatives, smart agriculture policies, and carbon-neutral equipment mandates-is positioning battery-powered equipment as a cornerstone of future operational landscapes. Equipment batteries are no longer just accessories; they are becoming strategic enablers of productivity, compliance, and climate responsibility.

What Are the Key Battery Technologies and Their Performance Innovations?

Lithium-ion (Li-ion) batteries dominate the market due to their high energy density, longer life cycles, low self-discharge rate, and compatibility with fast charging systems. Innovations in thermal management, smart charging protocols, and battery management systems (BMS) are further enhancing their viability in power-intensive equipment. Lithium iron phosphate (LiFePO4) variants, in particular, are gaining popularity for their superior thermal stability and extended durability, especially in outdoor and rugged terrain applications.Nickel-metal hydride (NiMH) and sealed lead-acid (SLA) batteries, while lower in energy density, continue to serve legacy applications or cost-sensitive markets where the performance trade-off is acceptable. New developments in solid-state batteries and silicon-anode technologies offer prospects for higher capacity, faster recharge, and improved safety, with R&D investments being heavily concentrated in North America, China, and Germany.

Battery modularity is another major trend. OEMs are introducing interchangeable battery platforms that allow users to swap packs across different equipment categories-ranging from trimmers to tillers-using a common battery architecture. Coupled with app-based BMS tools that offer real-time status updates, usage history, and energy optimization insights, these innovations are driving user adoption and equipment fleet integration.

Which Sectors and Use Cases Are Accelerating Battery Demand for Equipment?

The landscaping and grounds maintenance segment leads battery adoption, with municipalities, schools, and facility managers switching to electric mowers, blowers, and edgers to comply with noise ordinances and emissions standards. Golf courses, parks, and stadiums are also leveraging battery-powered tools to reduce disturbance and ensure operator safety.The construction industry is gradually adopting battery-operated compact machinery such as light-duty excavators, lifting platforms, and concrete vibrators-particularly for indoor or confined space operations where ventilation is a concern. Agriculture is seeing the rise of battery-driven smart implements for seeding, spraying, and monitoring, especially among small and mid-sized farm operators looking for low-emission alternatives.

Geographically, Europe leads in battery-powered equipment use due to strong environmental legislation and urban emission limits. The U.S. market is expanding rapidly, driven by government incentives and growing consumer preference for battery-operated DIY tools. China and India are poised for long-term growth due to large labor markets and expanding mechanization needs in agriculture and construction.

What Is Driving Growth in the Global Power Equipment Batteries Market?

The growth in the global power equipment batteries market is driven by the accelerated electrification of small and mid-sized equipment across agriculture, construction, landscaping, and public services. As end-users prioritize quiet, efficient, and low-maintenance solutions, battery-powered equipment is replacing fuel-based systems in both professional and consumer settings.Stringent emissions laws, equipment noise regulations, and carbon reduction targets are compelling public agencies and large contractors to adopt zero-emission tools. Parallelly, advances in lithium-ion technology, charging infrastructure, and modular battery design are lowering barriers to adoption. OEM partnerships with battery developers are enabling the rapid introduction of high-performance, interchangeable battery platforms.

The integration of telematics and predictive analytics in smart BMS platforms is adding value through better asset utilization and downtime reduction. With decarbonization goals aligning with user convenience and regulatory pressure, battery solutions are becoming a foundational pillar for the future of equipment mobility, automation, and environmental compliance. The transition from niche to mainstream is already underway-and battery innovation will be central to how work is powered across multiple industries.

Scope of the Report

The report analyzes the Power Equipment Batteries market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Battery (Lithium-Ion Battery, Nickel-Cadmium Battery, Other Batteries); Equipment Type (Drillers, Chainsaws, Lawn Mowers, Impact Wrenches, Other Equipment Types); End-Use (Industrial End-Use, Commercial End-Use, Residential End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Lithium-Ion Battery segment, which is expected to reach US$5.6 Billion by 2030 with a CAGR of a 5.6%. The Nickel-Cadmium Battery segment is also set to grow at 4.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.8 Billion in 2024, and China, forecasted to grow at an impressive 5.0% CAGR to reach $1.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Power Equipment Batteries Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Power Equipment Batteries Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Power Equipment Batteries Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A123 Systems, BYD Company Ltd., Clarios (formerly Johnson Controls Power Solutions), Contemporary Amperex Technology Co. Ltd. (CATL), Duracell Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Power Equipment Batteries market report include:

- A123 Systems

- BYD Company Ltd.

- Clarios (formerly Johnson Controls Power Solutions)

- Contemporary Amperex Technology Co. Ltd. (CATL)

- Duracell Inc.

- East Penn Manufacturing Co.

- Enersys

- Exide Technologies

- GS Yuasa Corporation

- Hitachi Chemical Co., Ltd.

- Johnson Matthey Battery Systems

- LG Energy Solution

- Microvast Holdings, Inc.

- Panasonic Corporation

- Samsung SDI Co., Ltd.

- SK Innovation Co., Ltd.

- Sony Group Corporation (Murata for batteries)

- Toshiba Corporation

- VARTA AG

- Zhejiang Narada Power Source

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- A123 Systems

- BYD Company Ltd.

- Clarios (formerly Johnson Controls Power Solutions)

- Contemporary Amperex Technology Co. Ltd. (CATL)

- Duracell Inc.

- East Penn Manufacturing Co.

- Enersys

- Exide Technologies

- GS Yuasa Corporation

- Hitachi Chemical Co., Ltd.

- Johnson Matthey Battery Systems

- LG Energy Solution

- Microvast Holdings, Inc.

- Panasonic Corporation

- Samsung SDI Co., Ltd.

- SK Innovation Co., Ltd.

- Sony Group Corporation (Murata for batteries)

- Toshiba Corporation

- VARTA AG

- Zhejiang Narada Power Source

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 177 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

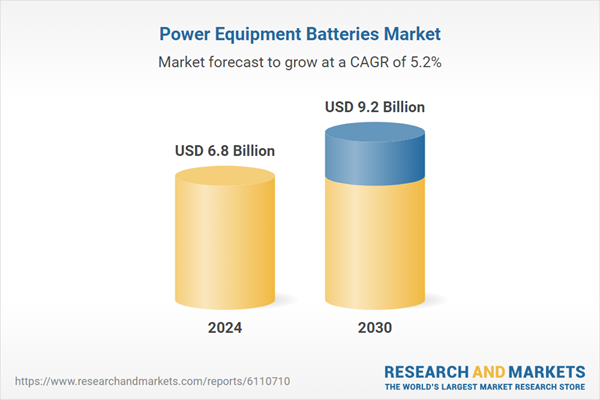

| Estimated Market Value ( USD | $ 6.8 Billion |

| Forecasted Market Value ( USD | $ 9.2 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |