Global Environmental, Social and Governance (ESG) Finance Market - Key Trends & Drivers Summarized

How Is ESG Finance Reshaping Capital Allocation and Risk Assessment?

Environmental, Social and Governance (ESG) finance represents a growing movement to align financial decision-making with long-term sustainability, ethical governance, and social impact. ESG criteria are increasingly used by investors, asset managers, and lenders to evaluate the non-financial performance of organizations. These metrics provide insights into how companies manage risks related to climate change, labor practices, diversity, board accountability, and regulatory compliance.Financial institutions are integrating ESG factors into credit scoring, risk modeling, and portfolio construction to identify resilient and responsible investments. Companies that score well on ESG indicators are often viewed as more stable, forward-thinking, and better equipped to handle evolving regulatory and stakeholder expectations. As global attention shifts toward carbon neutrality and inclusive growth, ESG finance is being positioned not only as a risk mitigation tool, but also as a source of long-term value creation.

What Financial Products and Reporting Standards Are Supporting ESG Integration?

A wide range of financial instruments - such as green bonds, sustainability-linked loans, and ESG-focused mutual funds - are being developed to channel capital toward sustainable projects and responsible enterprises. These products often include performance-based conditions linked to carbon reduction targets, social outcomes, or governance reforms. Institutional investors and sovereign funds are increasingly setting portfolio-wide ESG mandates that influence asset selection and divestment strategies.Global reporting frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD), Global Reporting Initiative (GRI), and Sustainability Accounting Standards Board (SASB) are enabling more consistent ESG disclosures. Standardized metrics and assurance practices are helping investors compare ESG performance across companies and sectors. Additionally, data providers and fintech platforms are using AI and big data analytics to quantify ESG risks, aggregate third-party data, and score corporate ESG behavior, enabling better-informed financial decisions.

Which Stakeholders and Regions Are Accelerating ESG Finance Adoption?

Pension funds, development banks, and asset managers are among the most active stakeholders promoting ESG integration, driven by fiduciary responsibility and stakeholder pressure. Multinational corporations are embedding ESG criteria into supply chain finance, procurement practices, and capital budgeting decisions. Shareholder activism and customer expectations are encouraging businesses to adopt transparent ESG commitments as part of brand positioning and long-term strategy.Regions such as Europe, North America, and parts of Asia-Pacific are leading ESG finance adoption due to regulatory alignment, investor activism, and supportive government policies. The European Union’s Sustainable Finance Disclosure Regulation (SFDR) and taxonomy initiatives have significantly influenced global ESG reporting and investment behavior. In emerging markets, ESG finance is being used to attract foreign capital, support green infrastructure, and promote inclusive economic growth, although data limitations and regulatory inconsistencies remain barriers to full-scale adoption.

What Is Driving Growth in the Environmental, Social and Governance (ESG) Finance Market?

Growth in the ESG finance market is driven by several factors related to investor demand, regulatory alignment, and risk-adjusted performance. Institutional investors are shifting capital toward ESG-aligned funds to reduce exposure to climate risk, reputational damage, and governance failures. Regulatory developments requiring transparent ESG reporting and disclosure are compelling both public and private entities to adopt ESG frameworks in their financial planning and operations.The emergence of green and sustainability-linked financial instruments is enabling organizations to tie financing terms to measurable ESG outcomes, attracting capital from impact-focused investors. Digital platforms and data analytics are improving ESG risk visibility, helping financial institutions incorporate ESG insights into credit and investment decisions. Growing societal emphasis on environmental accountability, diversity, and ethical governance is reinforcing ESG finance as a mainstream approach to achieving sustainable growth and long-term value preservation.

Scope of the Report

The report analyzes the Environmental, Social and Governance (ESG) Finance market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Investment (Equity / Fixed Income / Mixed Allocation Investment, Fixed Income Investment, Mixed Allocation Investment, Other Investments); Transaction Type (Green Bond Transaction, Social Bond Transaction, Mixed Sustainability Bond Transaction, ESG Integrated Investment Funds Transaction, Other Transaction Types); Investor (Institutional Investors, Retail Investors); Vertical (Utilities Vertical, Transport & Logistics Vertical, Chemicals Vertical, Food & Beverages Vertical, Government Vertical, Other Verticals).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Equity / Fixed Income / Mixed Allocation segment, which is expected to reach US$5.2 Trillion by 2030 with a CAGR of a 8.6%. The Fixed Income Investment segment is also set to grow at 9.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.9 Trillion in 2024, and China, forecasted to grow at an impressive 13.0% CAGR to reach $2.4 Trillion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Environmental, Social and Governance (ESG) Finance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Environmental, Social and Governance (ESG) Finance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Environmental, Social and Governance (ESG) Finance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amundi, BlackRock, Inc., BNP Paribas, Citigroup, Credit Suisse (UBS) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 39 companies featured in this Environmental, Social and Governance (ESG) Finance market report include:

- Amundi

- BlackRock, Inc.

- BNP Paribas

- Citigroup

- Credit Suisse (UBS)

- Deutsche Bank AG

- Goldman Sachs

- HSBC

- JPMorgan Chase & Co.

- Mirova

- Morgan Stanley

- MSCI Inc.

- Nordea

- State Street Global Advisors (SSGA)

- Sustainalytics (Morningstar)

- UBS

- Vanguard Group

- Wells Fargo

- ISS ESG

- Trackinsight

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amundi

- BlackRock, Inc.

- BNP Paribas

- Citigroup

- Credit Suisse (UBS)

- Deutsche Bank AG

- Goldman Sachs

- HSBC

- JPMorgan Chase & Co.

- Mirova

- Morgan Stanley

- MSCI Inc.

- Nordea

- State Street Global Advisors (SSGA)

- Sustainalytics (Morningstar)

- UBS

- Vanguard Group

- Wells Fargo

- ISS ESG

- Trackinsight

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

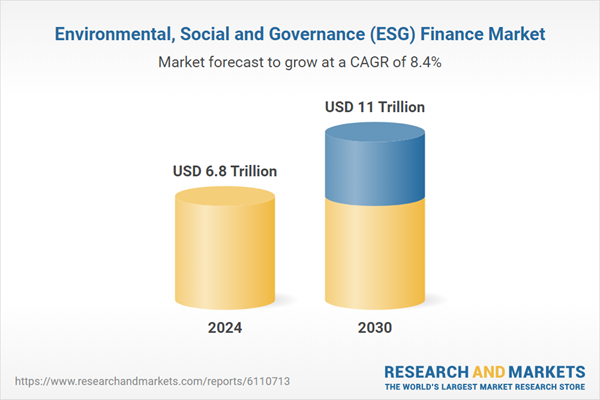

| Estimated Market Value ( USD | $ 6.8 Trillion |

| Forecasted Market Value ( USD | $ 11 Trillion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Global |