Global Anthracite Coal Mining Market - Key Trends & Drivers Summarized

Why Does Anthracite Coal Hold a Unique Position in the Global Energy and Industrial Landscape?

Anthracite coal, often referred to as 'hard coal,' occupies a distinctive niche in the global coal hierarchy due to its high carbon content, superior energy density, and clean-burning properties compared to other coal types such as bituminous and lignite. This rare form of coal is formed under greater geological pressure over extended periods, resulting in a harder, more compact structure with fewer impurities. Its high carbon purity, typically exceeding 85 percent, makes it particularly valuable for applications that demand intense, consistent heat and minimal smoke or residue. Traditionally, anthracite has been used as a heating fuel in residential and commercial markets, especially in colder regions, where its efficiency and long burn time are valued. However, its significance extends well beyond heating. The metallurgical industry depends on anthracite as a reductant in processes like steelmaking and ferroalloy production. Its use in sintering and as a carbon additive in electric arc furnaces makes it an indispensable raw material for metal producers. Additionally, anthracite is used in water filtration systems due to its low volatile content and stable chemical structure. Despite a global transition toward cleaner energy sources, anthracite continues to find a role in niche industrial processes where alternatives remain limited or uneconomical. With its unique properties, anthracite maintains a strategic importance in energy security, manufacturing stability, and industrial resilience, especially in economies that still rely on coal for specialized energy and metallurgical applications.How Are Market Dynamics and Technological Advancements Reshaping Anthracite Coal Mining?

The anthracite coal mining sector is undergoing substantial transformation as a result of evolving market dynamics, technological advancements, and regulatory pressures. Unlike thermal coal, which has seen declining demand due to environmental concerns, anthracite mining continues to receive investment owing to its specialized industrial demand. However, the industry faces challenges such as limited geographic availability, deeper mining requirements, and rising operational costs. Countries like China, Russia, Ukraine, South Africa, and the United States hold most of the known anthracite reserves, making the market somewhat regionally concentrated. In response to these constraints, mining companies are increasingly turning to automation, digital monitoring, and geological mapping technologies to enhance extraction efficiency and ensure worker safety. Drones and AI-powered systems are being employed for real-time data collection, enabling smarter resource allocation and predictive maintenance for mining equipment. Innovations in drilling, ventilation, and material handling are helping reduce energy consumption and operational downtime in deep mining operations. Additionally, advancements in beneficiation processes are allowing miners to increase the yield of saleable coal from lower-grade deposits, extending the economic life of existing mines. These innovations are not only improving productivity but also supporting compliance with increasingly stringent environmental regulations. On the market front, demand forecasting tools and integrated logistics platforms are helping mining companies align production with downstream needs, reducing storage costs and mitigating price volatility. As the global supply chain continues to adapt to post-pandemic realities and geopolitical disruptions, strategic planning, transparency, and efficiency in anthracite coal mining have become more critical than ever.How Do Regional Policies and Industrial Demand Patterns Influence Anthracite Coal Markets?

The global market for anthracite coal is highly influenced by regional industrial needs, government policies, trade dynamics, and infrastructure capabilities. In countries like China, which remains the largest consumer and producer of anthracite, domestic demand is driven by steel production, cement manufacturing, and electricity generation in regions where alternatives are not viable. The Chinese government's push for higher-efficiency, lower-emission industrial practices has increased the relative attractiveness of anthracite over lower-grade coals. Meanwhile, in Eastern Europe, particularly in Ukraine and Russia, anthracite has long been a staple of metallurgical industries and thermal power plants. These regions continue to invest in upgrading their mining sectors, though geopolitical instability and shifting trade alliances have impacted export and supply chain reliability. In the United States, anthracite mining is primarily concentrated in Pennsylvania, where legacy operations still serve niche heating markets and industrial consumers. However, strict environmental regulations and competition from natural gas have reduced domestic consumption. In contrast, countries like India and South Korea, which lack significant anthracite reserves, rely heavily on imports to feed their growing steel and alloy industries. Import tariffs, port infrastructure, and long-term trade agreements play critical roles in shaping these flows. The international shipping sector and freight costs also influence price stability and supply continuity. Furthermore, government incentives for clean energy and carbon reduction policies are prompting some users to seek cleaner alternatives, even within the industrial sectors that depend on anthracite. As a result, the anthracite market is shaped not just by availability and extraction capability but also by a complex interplay of regional policy frameworks, industrial development goals, and geopolitical shifts that affect both demand and supply.What Is Driving the Continued Demand and Strategic Importance of Anthracite Coal?

The growth in the anthracite coal mining market is driven by several critical factors tied to industrial applications, resource security, technological adaptability, and persistent global reliance on carbon-intensive manufacturing processes. One of the most prominent growth drivers is the continued demand from the metallurgical sector, where anthracite serves as a crucial input in steel and ferroalloy production. Unlike other energy resources, anthracite’s role in these processes is structural and not easily replaced by renewables or natural gas, which reinforces its strategic importance. Additionally, developing economies with growing infrastructure and manufacturing bases are increasing their consumption of anthracite for cement production, metal smelting, and other energy-intensive processes. The limited global availability of high-grade anthracite also contributes to its value, with countries prioritizing domestic mining to reduce import dependence and ensure industrial stability. Meanwhile, the refinement of clean coal technologies and carbon capture initiatives has encouraged some governments to maintain a place for high-efficiency coal like anthracite within their energy portfolios. On the operational side, mining companies are capitalizing on digital tools, remote sensing, and sustainable waste management techniques to reduce environmental impact while maintaining output levels. The long-term nature of industrial contracts and the relatively inelastic demand for anthracite in specific sectors help stabilize pricing and investment confidence. Moreover, niche applications such as water purification, carbon products, and even military-grade fuel systems add diversity to demand sources. As countries balance industrial growth with environmental stewardship, anthracite coal continues to occupy a space of strategic relevance, supported by a blend of legacy infrastructure, irreplaceable industrial function, and technological evolution that makes its extraction and use more sustainable over time.Scope of the Report

The report analyzes the Anthracite Coal Mining market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Grade (Standard Grade Anthracite, High Grade Anthracite, Ultra-High Grade Anthracite); Mine Type (Shaft Mine, Drift Mine, Slope Mine, Surface Mine).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Standard Grade Anthracite segment, which is expected to reach US$43.5 Billion by 2030 with a CAGR of a 4.3%. The High Grade Anthracite segment is also set to grow at 2.0% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $17.3 Billion in 2024, and China, forecasted to grow at an impressive 6.4% CAGR to reach $15.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Anthracite Coal Mining Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Anthracite Coal Mining Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Anthracite Coal Mining Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Anju Coal Mining Co., Ltd., Atlantic Coal plc, Blaschak Coal Corporation, China Coal Energy Company Limited, China Shenhua Energy Company Limited and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Anthracite Coal Mining market report include:

- Anju Coal Mining Co., Ltd.

- Atlantic Coal plc

- Blaschak Coal Corporation

- China Coal Energy Company Limited

- China Shenhua Energy Company Limited

- Cokal Limited

- Feishang Anthracite Resources Ltd.

- Glencore plc

- Heilongjiang Longmay Mining Holding

- Jindal Steel & Power Limited

- JSW Steel Ltd (Barbil Operations)

- Lehigh Anthracite

- Midrex Technologies, Inc.

- Mongolia Energy Corporation

- NACCO Industries (North American Coal)

- New Hope Corporation

- Reading Anthracite Company

- Sadovaya Group

- Sibanthracite Group

- Yanzhou Coal Mining Company Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Anju Coal Mining Co., Ltd.

- Atlantic Coal plc

- Blaschak Coal Corporation

- China Coal Energy Company Limited

- China Shenhua Energy Company Limited

- Cokal Limited

- Feishang Anthracite Resources Ltd.

- Glencore plc

- Heilongjiang Longmay Mining Holding

- Jindal Steel & Power Limited

- JSW Steel Ltd (Barbil Operations)

- Lehigh Anthracite

- Midrex Technologies, Inc.

- Mongolia Energy Corporation

- NACCO Industries (North American Coal)

- New Hope Corporation

- Reading Anthracite Company

- Sadovaya Group

- Sibanthracite Group

- Yanzhou Coal Mining Company Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 272 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

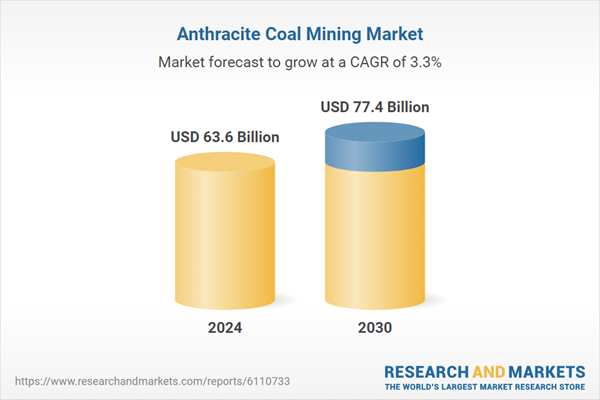

| Estimated Market Value ( USD | $ 63.6 Billion |

| Forecasted Market Value ( USD | $ 77.4 Billion |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Global |