Global Precision Tools Market - Key Trends & Drivers Summarized

Why Are Precision Tools Central to Modern Engineering and Manufacturing Workflows?

Precision tools-ranging from micrometers, calipers, and dial indicators to advanced torque wrenches, micro-drills, and grinding devices-play an irreplaceable role in maintaining tolerances and quality in high-stakes manufacturing operations. These tools are not merely instruments of measurement or cutting but are integral to upholding product consistency, safety standards, and system performance in sectors such as aerospace, automotive, medical device manufacturing, semiconductor fabrication, and high-precision machining.At the heart of their value is the ability to enable controlled material removal, ultra-fine measurement, and repeatable accuracy, particularly in tight-tolerance assemblies. Whether it is drilling micro-holes in printed circuit boards, shaping orthopedic implants, or grinding turbine blades, precision tools ensure consistency at micron or even sub-micron scales. As modern product designs continue to shrink in size but grow in complexity, precision tools have become indispensable in quality assurance, prototyping, and mass production settings.

Moreover, with global supply chains becoming more fragmented and lead times compressed, OEMs and subcontractors are under increasing pressure to deliver high-spec components quickly and cost-effectively. Precision tools allow them to achieve first-pass yield with minimal rework or scrap, particularly in operations involving exotic materials, tight geometries, or customer-specific tolerances.

How Are Innovations in Materials and Digitalization Reshaping the Tooling Landscape?

The precision tools market is undergoing a significant transformation fueled by innovations in materials science, sensor integration, and digital manufacturing ecosystems. Cutting tools made from polycrystalline diamond (PCD), cubic boron nitride (CBN), or ceramic composites now offer unmatched hardness, wear resistance, and thermal stability-enabling extended tool life and improved surface finishes even on superalloys and heat-treated metals.On the measurement side, traditional analog tools are being replaced by digital micrometers, laser-based calipers, and 3D coordinate measuring machines (CMMs) with sub-micron resolution. These instruments now offer Bluetooth or Wi-Fi connectivity, allowing measurement data to be transferred in real time to quality management systems or cloud dashboards. This digitization is key in smart factory environments where traceability, statistical process control (SPC), and closed-loop feedback are essential.

Robotics and CNC machining centers are also increasingly equipped with automated tool changers and in-line tool wear monitors. These smart systems assess cutting edge conditions, adjust feed rates, and flag anomalies-greatly reducing downtime and increasing yield. Integration with digital twins allows predictive simulations of tooling behavior under variable loads and speeds, supporting better tooling strategies and optimized component design.

Which Industries and End-Use Markets Are Driving Demand for High-Precision Tooling?

Demand for precision tools is highly diversified, with core demand centers emerging from aerospace and defense, automotive and EV manufacturing, healthcare devices, semiconductor and electronics, and heavy machinery. In aerospace, tight tolerances, lightweight composite materials, and safety-critical components necessitate high-performance tools for drilling, milling, and measurement. Similarly, the rise of electric vehicles has led to an increase in precision components such as motor cores, battery housings, and sensor mounts-all requiring intricate tooling solutions.In the medical device sector, orthopedic implants, stents, surgical tools, and diagnostic equipment require not only precise shaping but also burr-free finishes and sterile machining-driving demand for micro-tools with coated surfaces and bio-compatible finishes. In semiconductor fabrication, extreme miniaturization has made high-precision tooling essential for etching, dicing, and bonding chip components at nano-level accuracy.

Emerging economies such as India, Vietnam, and Mexico are becoming growth engines for mid-range and affordable precision tools as they evolve into global manufacturing hubs. Meanwhile, regions like Germany, Japan, South Korea, and the U.S. continue to invest in ultra-high-end tooling solutions for advanced machining and metrology.

What Is Driving Growth in the Global Precision Tools Market?

The growth in the global precision tools market is driven by rising global standards in product quality, ongoing automation of manufacturing systems, and the increasing complexity of end-use components. As products-from smartphones to aircraft engines-become more intricate, miniaturized, and material-diverse, the need for tools that can deliver consistent, micron-level accuracy has surged.The migration toward Industry 4.0 is also contributing significantly. Precision tools integrated with IoT sensors, AI-driven monitoring, and real-time analytics now form the backbone of digital manufacturing environments. They not only facilitate tighter control over machining operations but also contribute to lean production goals by minimizing errors and material waste.

Furthermore, the reshoring of manufacturing in North America and Europe, coupled with geopolitical shifts and labor shortages, is amplifying investments in high-efficiency precision tooling systems. In parallel, the rise of medical and electronics manufacturing in Asia-Pacific is ensuring robust demand across both premium and budget-friendly tool categories. As machining continues to blend with smart technologies, precision tools are transitioning from standalone instruments to system-level enablers of competitive manufacturing.

Scope of the Report

The report analyzes the Precision Tools market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Machine Type (Lathe Machines, Milling Machines, Drilling Machines, Other Machine Types); Technology (Conventional Technology, Computerized Numerical Control Technology); End-Use (Automotive End-Use, General Engineering, Aerospace & Defense End-Use, Power & Energy End-Use, Construction Equipment End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Lathe Machines segment, which is expected to reach US$47.5 Billion by 2030 with a CAGR of a 9.3%. The Milling Machines segment is also set to grow at 14.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $18.8 Billion in 2024, and China, forecasted to grow at an impressive 15.2% CAGR to reach $27.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Precision Tools Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Precision Tools Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Precision Tools Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BIG DAISHOWA Seiki Co., Ltd., CERATIZIT Group, DMG MORI AG, Dormer Pramet, EROWA AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Precision Tools market report include:

- BIG DAISHOWA Seiki Co., Ltd.

- CERATIZIT Group

- DMG MORI AG

- Dormer Pramet

- EROWA AG

- FANUC Corporation

- Guhring Inc.

- Hexagon AB

- Iscar Ltd.

- JTEKT Corporation (formerly Koyo)

- Kennametal Inc.

- Kyocera Corporation

- Mapal Dr. Kress KG

- Mitsubishi Materials Corp.

- Renishaw plc

- Sandvik Coromant

- Seco Tools AB

- Star Micronics Co., Ltd.

- Sumitomo Electric Hardmetal

- Walter Tools

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BIG DAISHOWA Seiki Co., Ltd.

- CERATIZIT Group

- DMG MORI AG

- Dormer Pramet

- EROWA AG

- FANUC Corporation

- Guhring Inc.

- Hexagon AB

- Iscar Ltd.

- JTEKT Corporation (formerly Koyo)

- Kennametal Inc.

- Kyocera Corporation

- Mapal Dr. Kress KG

- Mitsubishi Materials Corp.

- Renishaw plc

- Sandvik Coromant

- Seco Tools AB

- Star Micronics Co., Ltd.

- Sumitomo Electric Hardmetal

- Walter Tools

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 385 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

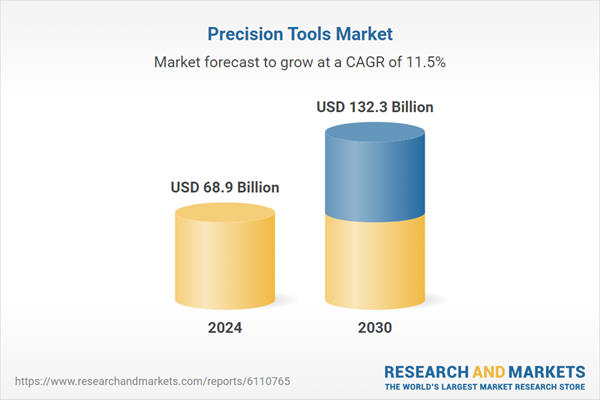

| Estimated Market Value ( USD | $ 68.9 Billion |

| Forecasted Market Value ( USD | $ 132.3 Billion |

| Compound Annual Growth Rate | 11.5% |

| Regions Covered | Global |