Global Piper Pepper Market - Key Trends & Drivers Summarized

Why Is Demand for Piper Pepper Surging Across Culinary, Medicinal, and Industrial Applications?

Piper pepper, particularly Piper nigrum (black pepper), is witnessing a resurgence in global demand due to its multipurpose appeal in food, nutraceuticals, traditional medicine, and functional ingredient markets. Widely known as the “King of Spices,” black pepper and its derivatives-white, green, and red peppercorns-hold immense culinary value. Beyond the kitchen, its phytochemical composition, especially the active compound piperine, has sparked scientific interest for its antioxidant, anti-inflammatory, and bioavailability-enhancing properties.In the food industry, growing demand for ethnic, aromatic, and spicy foods across North America and Europe is catalyzing pepper consumption. Black pepper is a core component in meat rubs, spice blends, ready-to-eat meals, sauces, and plant-based protein flavorings. In parallel, clean-label and organic trends are reinforcing interest in naturally grown, non-irradiated, and sustainably sourced pepper varieties, with single-origin and fair-trade labeling gaining prominence among premium consumers.

In the wellness and healthcare sectors, piperine’s ability to enhance the bioavailability of curcumin and other bioactives has led to its inclusion in nutraceutical formulations. Traditional medicine systems like Ayurveda, Siddha, and Traditional Chinese Medicine (TCM) have long used Piper species in digestive, respiratory, and immunity-boosting remedies. This convergence of culinary and medicinal utility makes Piper pepper a dynamic ingredient across multiple value chains.

How Are Processing Innovations and Value-Added Formats Shaping the Market?

Processing innovations in the Piper pepper market are enabling differentiation and premiumization. Advanced drying techniques-such as solar drying with moisture control, freeze-drying, and vacuum drying-are improving the retention of essential oils and flavor profiles. Mechanical cleaning, grading, and sorting technologies ensure consistent size and purity, which is essential for high-end culinary and pharmaceutical applications.Value-added formats such as pepper essential oils, oleoresins, and microencapsulated piperine are expanding the market beyond conventional spice usage. Piperine extract, in particular, is being incorporated into sports nutrition supplements, pain relief balms, and functional beverages. Standardized piperine content is a key requirement for nutraceutical-grade extracts, and producers are responding with high-purity, lab-tested offerings aimed at export and specialty markets.

Sustainability certification, residue-free processing, and transparent supply chain traceability are becoming mandatory, especially in the EU and U.S. markets. Blockchain platforms and AI-driven quality control mechanisms are now being integrated into pepper sourcing and post-harvest workflows to meet stringent food safety and sustainability mandates. These advancements are not only elevating quality standards but also improving farmer incomes through better price realization.

Which Growing Regions and End-Use Sectors Are Driving Demand for Piper Pepper?

India, Vietnam, Indonesia, Brazil, and Sri Lanka remain the major producers of black pepper globally, with Vietnam leading in volume and export share. India, with its regional diversity and GI-tagged variants like Malabar and Tellicherry pepper, is gaining recognition in gourmet and specialty markets. Meanwhile, emerging cultivation in Africa (notably Madagascar and Nigeria) is introducing new sourcing geographies and improving global supply resilience.In the food processing industry, rising demand for seasoning blends, pickles, processed meats, and savory snacks is supporting steady consumption. Quick-service restaurants (QSRs), cloud kitchens, and plant-based food manufacturers are increasing their use of black pepper as a natural flavor enhancer. Piperine’s role as a thermogenic and bioenhancer is also making it popular in weight management and wellness-focused formulations.

Pharmaceutical and herbal product manufacturers are increasingly exploring Piper species for their adaptogenic, immunomodulatory, and anti-carcinogenic effects. Piper longum and Piper betle are being researched alongside Piper nigrum for their distinct phytochemical profiles. Asia-Pacific remains the largest consumer region, while the U.S. and EU are seeing higher value-per-ton imports due to their demand for certified, high-grade products.

What Is Driving Growth in the Global Piper Pepper Market?

The growth in the global Piper pepper market is driven by increasing demand for natural and functional ingredients, rising interest in traditional medicine systems, diversification of product formats, and sustained culinary usage across global cuisines. The spice’s cross-functional utility-as a seasoning, health booster, and bioavailability enhancer-is opening doors to both mass-market and niche segments.Health-conscious consumers are seeking botanical-based solutions for immunity, digestion, and metabolism support, placing piperine-rich products in high demand. E-commerce expansion and DTC nutraceutical brands are further accelerating access to premium black pepper extracts and supplements. In parallel, spice traceability, organic certification, and climate-resilient sourcing are improving the credibility and sustainability of global supply chains.

Technological innovations in farming, drying, and processing are enhancing quality while reducing post-harvest losses. Digital integration and smart logistics are strengthening global trade linkages. As food, pharma, and wellness sectors converge in their preference for high-performance, clean-label ingredients, Piper pepper is poised to expand its market influence across culinary, therapeutic, and functional ingredient landscapes.

Scope of the Report

The report analyzes the Piper Pepper market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (White Pepper / Piper, Red Pepper / Piper, Black Pepper / Piper, Green Pepper / Piper); Nature (Organic Nature, Conventional Nature); Form (Whole Form, Powdered Form); Application (Food & Beverages Application, Personal Care Products Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the White Pepper / Piper segment, which is expected to reach US$4.1 Billion by 2030 with a CAGR of a 3.2%. The Red Pepper / Piper segment is also set to grow at 5.0% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.1 Billion in 2024, and China, forecasted to grow at an impressive 7.1% CAGR to reach $2.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Piper Pepper Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Piper Pepper Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Piper Pepper Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Allied Biotech (Herbal Creations), AVS Organics, Bio Source Naturals Pvt Ltd, Cinch Chemicals Pvt. Ltd., Dabur India Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Piper Pepper market report include:

- Allied Biotech (Herbal Creations)

- AVS Organics

- Bio Source Naturals Pvt Ltd

- Cinch Chemicals Pvt. Ltd.

- Dabur India Ltd.

- DD Agro Foods Pvt. Ltd.

- Dixon’s Agro International

- Green Jeeva LLC

- Hubei Bioway Biotech Co. Ltd

- Jeena & Company

- Jeeva Organics

- Kalys Herbals

- KDAC Chemicals Pvt. Ltd.

- Krishi Rasayan Group

- MD Biotech

- Pisum Food Services Pvt. Ltd.

- Rana Agro Products

- Shree Arawari Agro Foods

- Star Laboratories

- Union Kupagro Pvt. Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allied Biotech (Herbal Creations)

- AVS Organics

- Bio Source Naturals Pvt Ltd

- Cinch Chemicals Pvt. Ltd.

- Dabur India Ltd.

- DD Agro Foods Pvt. Ltd.

- Dixon’s Agro International

- Green Jeeva LLC

- Hubei Bioway Biotech Co. Ltd

- Jeena & Company

- Jeeva Organics

- Kalys Herbals

- KDAC Chemicals Pvt. Ltd.

- Krishi Rasayan Group

- MD Biotech

- Pisum Food Services Pvt. Ltd.

- Rana Agro Products

- Shree Arawari Agro Foods

- Star Laboratories

- Union Kupagro Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 457 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

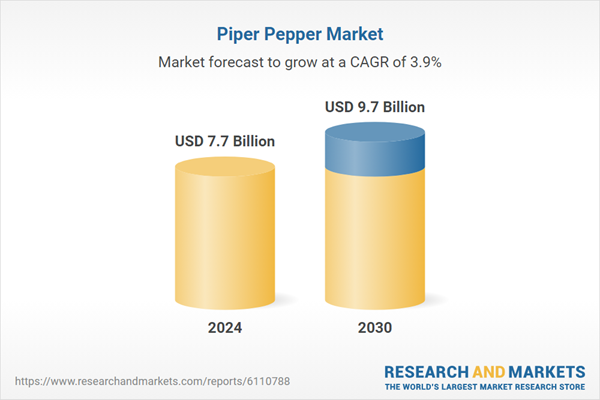

| Estimated Market Value ( USD | $ 7.7 Billion |

| Forecasted Market Value ( USD | $ 9.7 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |