Global Mobile Positioning System Market - Key Trends & Drivers Summarized

What Is Driving the Expanding Role of Mobile Positioning Systems in Connected Ecosystems?

Mobile positioning systems have evolved from basic location-tracking tools into central pillars of today’s hyperconnected digital infrastructure. These systems use a combination of GPS, cell tower triangulation, Wi-Fi signal mapping, Bluetooth beacons, and inertial sensors to determine the real-time location of mobile devices, vehicles, and assets with high precision. Their role has expanded beyond traditional navigation and now underpins applications in logistics, smart cities, augmented reality (AR), emergency services, and personalized marketing. As mobility, automation, and location-aware services proliferate, demand for real-time positioning intelligence is accelerating across both consumer and enterprise landscapes.The advent of 5G and IoT ecosystems is pushing the boundaries of what mobile positioning systems can achieve. Low-latency data transmission, edge computing capabilities, and ultra-dense connectivity allow for sub-meter accuracy and real-time responsiveness-essential for applications such as autonomous vehicles, drone operations, and industrial robotics. Furthermore, demand is rising for indoor positioning capabilities in settings like shopping malls, warehouses, hospitals, and airports, where GPS alone is insufficient. In these environments, hybrid positioning systems that combine sensor fusion, magnetic mapping, and beacon-based triangulation offer critical enhancements to location accuracy and service reliability.

What Technological Innovations Are Enhancing Precision, Speed, and Context Awareness?

Recent technological developments are enabling mobile positioning systems to deliver greater accuracy, context awareness, and predictive intelligence. Multi-constellation GNSS (Global Navigation Satellite Systems), which integrate GPS, GLONASS, Galileo, and BeiDou, provide enhanced positioning reliability in geographies with variable satellite visibility. Differential GPS and RTK (Real-Time Kinematic) correction technologies offer centimeter-level accuracy, especially in geodetic and high-precision use cases such as land surveying, agriculture, and drone mapping.Machine learning algorithms are being deployed to predict user movement and correct positioning anomalies by leveraging historical data, behavioral patterns, and sensor inputs. Sensor fusion platforms integrate data from accelerometers, gyroscopes, magnetometers, and barometers to augment GPS signals-enabling more reliable navigation in tunnels, subways, or urban canyons. In retail and public infrastructure environments, Bluetooth Low Energy (BLE) beacons and ultra-wideband (UWB) signals are being used to create indoor navigation systems capable of real-time spatial awareness and user engagement.

Augmented reality applications, smart wearables, and location-based gaming are also fueling demand for highly responsive and low-drift positioning systems. These applications often rely on visual-inertial odometry, where computer vision systems complement inertial sensors to map user position in complex environments. Cloud-based location APIs and SDKs from Google, Apple, HERE, and Mapbox have opened the door for developers to integrate real-time location services into a broad array of apps, further democratizing access to mobile positioning functionality.

Which Industries and Use Cases Are Shaping Market Growth Trajectories?

The logistics and transportation sectors are major beneficiaries of mobile positioning systems. Fleet operators rely on GPS-integrated telematics to optimize delivery routes, monitor driver behavior, and ensure regulatory compliance. Real-time geofencing and location-based dispatching are used to improve last-mile delivery and reduce idle time. In urban transportation, mobile positioning supports shared mobility services, dynamic fare calculations, and multimodal transit coordination. Location-aware APIs also power ride-hailing, bike-sharing, and micro-mobility platforms, which require real-time data synchronization between users, vehicles, and back-end servers.Emergency response services, including law enforcement, fire departments, and disaster relief agencies, depend heavily on accurate mobile positioning to locate individuals, coordinate responders, and map incident zones. Healthcare providers are leveraging location data for contact tracing, patient movement tracking, and asset monitoring within hospitals. In consumer-facing sectors like retail, hospitality, and entertainment, mobile positioning is central to proximity marketing, personalized promotions, and immersive in-store navigation experiences.

Agricultural operations increasingly use GPS-enabled machinery for precision planting, fertilization, and harvesting. Construction firms deploy GNSS-guided earthmoving equipment for automated grading and site preparation. Drone-based surveying and mapping, enabled by RTK-GPS and terrain recognition systems, are rapidly gaining adoption in mining, forestry, and real estate. Additionally, smart city initiatives around the world incorporate mobile positioning data to manage traffic flows, parking availability, and energy consumption dynamically.

What Is Fueling Growth in the Global Mobile Positioning System Market?

The growth in the global mobile positioning system market is driven by several factors, including the widespread adoption of smartphones, the rise of location-based services, and the digital transformation of industries relying on real-time asset tracking. The exponential increase in mobile device penetration has created a massive demand pool for location-aware applications-ranging from navigation and fitness tracking to mobile payments and contextual advertising. As users expect seamless, personalized experiences across digital platforms, the relevance of precise location data has never been greater.The deployment of 5G infrastructure and edge computing architectures is enabling ultra-low-latency positioning systems, critical for emerging applications like autonomous driving, robotic surgery, and industrial automation. Regulatory mandates for emergency location sharing in calls (such as E911 in the U.S. and AML in the EU) are also mandating improvements in location accuracy. Moreover, businesses are increasingly investing in analytics platforms that incorporate spatial intelligence to enhance operational efficiency, customer insights, and safety outcomes.

Rising adoption of wearable devices, smart tags, and connected appliances is expanding the location intelligence market into homes, factories, and public spaces. Partnerships between telecom operators, cloud service providers, and geolocation platform vendors are fostering innovation in location APIs, SDKs, and cloud-based positioning-as-a-service offerings. As new verticals like augmented reality, precision agriculture, and industrial metaverse gain traction, the mobile positioning system market is expected to see sustained, diversified growth across the next decade.

Scope of the Report

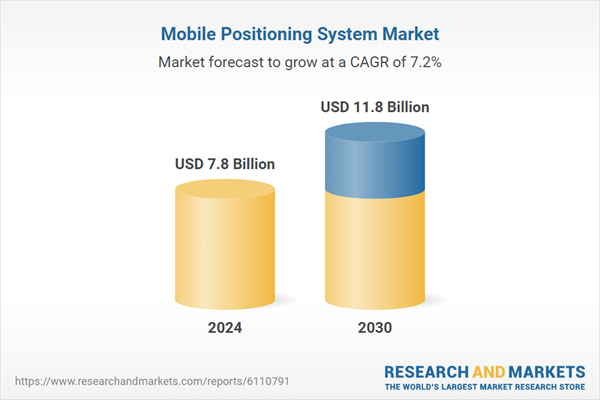

The report analyzes the Mobile Positioning System market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Technology (Global Positioning System Technology, Galileo Technology, GLONASS Technology, Beidou Technology, Wi-Fi Positioning System Technology, Other Technologies); Device Type (Smartphones, Tablets, Wearable Devices, Automotive Systems, Internet of Things Devices, Drones); Application (Emergency Services Application, Fleet Management Application, Navigation & Mapping Application, Geofencing Application, Asset Tracking Application, Location-based Services Application); End-User (Transportation & Logistics End-User, Retail & E-Commerce End-User, Healthcare End-User, Aerospace & Defense End-User, Automotive End-User, Smart Cities End-User).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Global Positioning System Technology segment, which is expected to reach US$4.0 Billion by 2030 with a CAGR of a 8.7%. The Galileo Technology segment is also set to grow at 7.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.1 Billion in 2024, and China, forecasted to grow at an impressive 11.5% CAGR to reach $2.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Mobile Positioning System Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Mobile Positioning System Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Mobile Positioning System Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Apple Inc., Broadcom Inc., CalAmp Corp., China Mobile Ltd., Cisco Systems, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Mobile Positioning System market report include:

- Apple Inc.

- Broadcom Inc.

- CalAmp Corp.

- China Mobile Ltd.

- Cisco Systems, Inc.

- Continental AG

- Garmin Ltd.

- Google LLC

- HERE Technologies

- Huawei Technologies Co., Ltd.

- Intel Corporation

- Nokia Corporation

- Qualcomm Incorporated

- Samsung Electronics Co., Ltd.

- Septentrio N.V.

- Skyhook Wireless, Inc.

- Sony Corporation

- STMicroelectronics N.V.

- Telit Cinterion

- Trimble Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Apple Inc.

- Broadcom Inc.

- CalAmp Corp.

- China Mobile Ltd.

- Cisco Systems, Inc.

- Continental AG

- Garmin Ltd.

- Google LLC

- HERE Technologies

- Huawei Technologies Co., Ltd.

- Intel Corporation

- Nokia Corporation

- Qualcomm Incorporated

- Samsung Electronics Co., Ltd.

- Septentrio N.V.

- Skyhook Wireless, Inc.

- Sony Corporation

- STMicroelectronics N.V.

- Telit Cinterion

- Trimble Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 509 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.8 Billion |

| Forecasted Market Value ( USD | $ 11.8 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |