Global Large Satellites Market - Key Trends & Drivers Summarized

Why Are Large Satellites Reclaiming Strategic Importance in the Evolving Space Economy?

Large satellites, typically defined as those with masses exceeding 500 kilograms, are reclaiming their central role in the global space ecosystem, offering unparalleled capabilities in payload capacity, coverage area, data transmission, and mission longevity. Despite the growing attention given to small and micro satellites in recent years, large satellites remain the cornerstone of critical applications such as global communications, Earth observation, weather forecasting, scientific research, and national defense. Their ability to host multiple payloads, operate at geostationary or medium Earth orbits, and deliver high-power performance makes them indispensable in both commercial and governmental space missions.Unlike small satellites which are often limited by size, power, and bandwidth constraints, large satellites provide robust platforms for broadcasting, remote sensing, and intercontinental communication infrastructure. Major operators-including Intelsat, Eutelsat, and SES-continue to deploy large GEO satellites for high-throughput communication services spanning broadband internet, direct-to-home television, and maritime/aviation connectivity. In the defense sector, large reconnaissance and surveillance satellites offer extended operational lifespans, hardened systems for radiation tolerance, and secure communications, making them critical to national security architectures. Their reliability and scalability continue to attract investment from government agencies and large commercial consortia aiming to maintain strategic orbital assets.

How Are Technological Advancements and Modular Architectures Enhancing Large Satellite Capabilities?

The capabilities of large satellites have been significantly enhanced by advances in modular satellite architectures, electric propulsion systems, and on-board data processing. Satellite manufacturers such as Airbus, Boeing, Lockheed Martin, and Thales Alenia Space are designing modular satellite buses that allow multiple configurations using standardized components, thereby reducing manufacturing time and enabling multi-mission adaptability. Platforms such as Boeing’s 702X and Airbus’ Eurostar Neo support high-throughput payloads, onboard switching, and digital beamforming, empowering satellites to dynamically allocate bandwidth and tailor service coverage.Electric propulsion is another transformative development, significantly reducing launch mass and enabling more fuel-efficient orbital adjustments and station keeping. This has allowed large satellites to carry heavier payloads or extend mission durations without increasing launch costs. Furthermore, onboard AI processors and edge computing capabilities are allowing satellites to pre-process imagery or telemetry data before transmission to Earth, reducing bandwidth consumption and improving response times for time-sensitive applications such as disaster management or military intelligence.

The integration of large satellites with inter-satellite links and cloud-based ground infrastructure is supporting the transition to flexible, software-defined space assets. Multi-orbit network architectures are increasingly involving large GEO satellites as backbones that interface with LEO or MEO constellations to ensure seamless global connectivity. These trends are contributing to a renaissance in large satellite engineering, transforming them into intelligent, scalable, and interoperable platforms suited for next-generation space services.

Which Application Domains and Mission Types Are Propelling Market Demand?

Large satellites are witnessing sustained demand across a spectrum of application domains including broadband communications, Earth monitoring, defense surveillance, meteorology, and deep-space exploration. High-capacity communication satellites dominate in geostationary orbits, offering continuous coverage to fixed regions and servicing growing bandwidth needs for high-definition video streaming, rural internet access, and mobility services for aircraft and maritime fleets. National governments and telecom companies are leveraging these satellites to bridge digital divides, especially in underserved regions of Africa, South America, and Central Asia.In Earth observation, large satellites provide the high-resolution optical, radar, and hyperspectral data needed for environmental monitoring, agricultural planning, mineral exploration, and climate modeling. These satellites support frequent revisit cycles, data fusion capabilities, and long-term trend analysis, which are critical for policy-making and global monitoring initiatives such as Copernicus and Landsat. Their ability to host multiple sensor types on a single platform makes them ideal for integrated applications such as land cover change analysis, urban development tracking, and disaster response planning.

Defense and intelligence missions also heavily rely on large satellites for secure communications, early-warning systems, signals intelligence (SIGINT), and persistent surveillance. Militarized satellite platforms are designed with redundant systems, hardened electronics, and high-bandwidth encryption, ensuring resilience under hostile or contested space environments. Moreover, flagship scientific missions-like NASA’s James Webb Space Telescope or ESA’s Sentinel-6-demonstrate the unique role large satellites play in astrophysics, climate science, and space-based instrumentation. These high-profile missions underscore the unmatched scientific and strategic value of large satellite platforms.

What Is Driving Growth in the Global Large Satellites Market?

The growth in the global large satellites market is driven by several factors including rising global demand for broadband connectivity, renewed government investment in space infrastructure, and technological convergence across payload design, propulsion, and mission flexibility. As the demand for uninterrupted, high-speed communication services surges-especially in the wake of hybrid work, telemedicine, and virtual education-large communication satellites are being deployed to complement terrestrial networks and ensure redundancy in global data transmission.Geopolitical developments and space militarization are pushing defense budgets toward advanced satellite-based ISR (Intelligence, Surveillance, and Reconnaissance) systems. Space is now viewed as a critical domain of warfare, and countries are investing in sovereign satellite constellations to ensure strategic autonomy, secure communication channels, and real-time surveillance. Meanwhile, Earth observation and climate resilience programs are expanding, with governments and global institutions commissioning large observation satellites to support sustainability initiatives, disaster prediction, and food security.

Private sector involvement, particularly via public-private partnerships, is enhancing the economic viability of large satellite missions. Modular bus designs, digital payloads, and electric propulsion are lowering lifecycle costs, while dedicated heavy-lift launchers such as Falcon Heavy, Ariane 6, and upcoming systems like Blue Origin’s New Glenn are improving payload deployment economics. Additionally, regulatory support, export control easing, and standardized insurance structures are making it easier for nations and enterprises to invest in large satellites. Together, these factors are driving sustained growth in large satellite production, deployment, and mission diversification.

Scope of the Report

The report analyzes the Large Satellites market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Orbit Class (GEO Orbit Class, LEO Orbit Class, MEO Orbit Class); Propulsion Tech (Electric Propulsion Tech, Gas-based Propulsion Tech, Liquid Fuel Propulsion Tech); Application (Communications Application, Earth Observation Application, Navigation Application, Space Observation Application, Other Applications); End-User (Commercial End-User, Military & Government End-User, Other End-Users).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the GEO Orbit Class segment, which is expected to reach US$67.4 Billion by 2030 with a CAGR of a 7.7%. The LEO Orbit Class segment is also set to grow at 9.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $19.2 Billion in 2024, and China, forecasted to grow at an impressive 12.6% CAGR to reach $24.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Large Satellites Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Large Satellites Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Large Satellites Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Airbus Defence and Space, Boeing Defense, Space & Security, China Aerospace Science and Technology Corporation (CASC), Israel Aerospace Industries (IAI), L3Harris Technologies and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Large Satellites market report include:

- Airbus Defence and Space

- Boeing Defense, Space & Security

- China Aerospace Science and Technology Corporation (CASC)

- Israel Aerospace Industries (IAI)

- L3Harris Technologies

- Leonardo S.p.A.

- Lockheed Martin Space Systems

- Maxar Technologies

- Mitsubishi Electric Corporation

- Northrop Grumman Innovation Systems

- OHB System AG

- Raytheon Technologies (RTX)

- Rocket Lab

- Safran Electronics & Defense

- Sierra Space

- SpaceX

- Surrey Satellite Technology Ltd (SSTL)

- TAS (Thales Alenia Space)

- Viasat Inc.

- York Space Systems

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airbus Defence and Space

- Boeing Defense, Space & Security

- China Aerospace Science and Technology Corporation (CASC)

- Israel Aerospace Industries (IAI)

- L3Harris Technologies

- Leonardo S.p.A.

- Lockheed Martin Space Systems

- Maxar Technologies

- Mitsubishi Electric Corporation

- Northrop Grumman Innovation Systems

- OHB System AG

- Raytheon Technologies (RTX)

- Rocket Lab

- Safran Electronics & Defense

- Sierra Space

- SpaceX

- Surrey Satellite Technology Ltd (SSTL)

- TAS (Thales Alenia Space)

- Viasat Inc.

- York Space Systems

Table Information

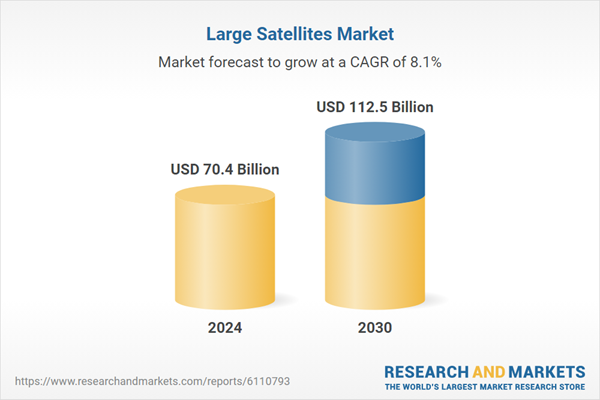

| Report Attribute | Details |

|---|---|

| No. of Pages | 476 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 70.4 Billion |

| Forecasted Market Value ( USD | $ 112.5 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |