Global Hypermarkets Market - Key Trends & Drivers Summarized

How Are Hypermarkets Evolving to Meet Changing Consumer Preferences?

Hypermarkets, known for offering a wide range of products under one roof, are evolving in response to shifting consumer expectations and retail competition. Modern shoppers seek convenience, product variety, and value-driven pricing, prompting hypermarkets to reconfigure store layouts, introduce private label products, and enhance in-store services. Food, apparel, electronics, household goods, and personal care products are now strategically curated to appeal to both budget-conscious and brand-loyal consumers.Consumer demand for fresh and health-oriented products is reshaping hypermarket assortments. Dedicated organic produce sections, ready-to-eat meals, and wellness aisles are becoming standard features. To enhance foot traffic and shopper retention, many hypermarkets are incorporating cafes, pharmacy counters, and digital service kiosks. These developments are aimed at transforming hypermarkets into multifunctional spaces that combine shopping with leisure, wellness, and financial services.

How Is Technology Reshaping the In-Store and Online Experience?

Digital transformation is playing a major role in redefining hypermarket operations. Self-checkout systems, electronic shelf labels, and AI-driven inventory systems are improving efficiency while enhancing customer experience. Loyalty programs integrated with mobile apps provide personalized discounts and real-time product recommendations. Data analytics tools are being used to optimize shelf space, forecast demand, and manage perishable goods, reducing waste and increasing profitability.Hypermarkets are also adopting omnichannel strategies to stay competitive. Many now offer online ordering, curbside pickup, and home delivery through their own platforms or third-party services. Mobile apps with product search, live stock updates, and digital wallets are facilitating seamless shopping experiences. These integrations are particularly relevant in urban markets where time-sensitive and tech-savvy shoppers expect high-speed service and product availability without visiting the store.

Where Are Hypermarkets Expanding, and What Shapes Their Regional Performance?

Hypermarkets remain strong in suburban and emerging urban regions where space availability and consumer demand for consolidated shopping formats align. In Asia Pacific and Latin America, rising disposable incomes and urbanization are driving hypermarket development in tier 2 and tier 3 cities. These markets offer growth potential due to growing middle-class populations, demand for packaged foods, and increasing preference for organized retail.In mature markets such as Western Europe and North America, hypermarkets face intense competition from discount chains, e-commerce platforms, and convenience stores. To maintain relevance, retailers are resizing stores, focusing on product localization, and partnering with local suppliers. Regional preferences, such as demand for ethnic foods or eco-labeled goods, influence merchandising strategies. Hypermarkets are also introducing energy-efficient infrastructure and sustainable sourcing practices to align with consumer values.

What Is Driving Growth in the Hypermarkets Market?

Growth in the hypermarkets market is driven by several factors including rising demand for one-stop retail formats, integration of digital shopping tools, and expansion into emerging urban centers with rising consumption. Store innovations such as self-checkout, electronic pricing systems, and in-store service diversification are improving operational efficiency and enhancing the customer experience. Investments in real-time analytics, mobile platforms, and hybrid retail models are allowing hypermarkets to compete with online and discount rivals while preserving foot traffic.End-use expansion into services such as pharmacy, electronics repair, and fresh meal counters is broadening revenue streams and increasing dwell time. In developing regions, urban growth, rising consumer spending, and greater preference for organized retail are accelerating new store openings. Meanwhile, sustainability-focused upgrades such as LED lighting, energy-efficient refrigeration, and waste reduction systems are reinforcing long-term viability. These developments are enabling hypermarkets to adapt and grow as versatile retail anchors across a wide range of geographies and consumer segments.

Scope of the Report

The report analyzes the Hypermarkets market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Ownership (Retail Supply Chain Ownership, Independent Retailer Ownership); Application (Consumer Electronics Application, Furniture Application, Food & Beverages Application, Toys & Stationery Application, Personal Care Application, Cosmetic Application, Home Textile Application, Dresses Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Retail Supply Chain Ownership segment, which is expected to reach US$539.5 Billion by 2030 with a CAGR of a 2.4%. The Independent Retailer Ownership segment is also set to grow at 1.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $204.7 Billion in 2024, and China, forecasted to grow at an impressive 3.8% CAGR to reach $157.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hypermarkets Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hypermarkets Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hypermarkets Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ahold Delhaize, Aldi (Nord/Süd), Asda, Auchan, Carrefour and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Hypermarkets market report include:

- Ahold Delhaize

- Aldi (Nord/Süd)

- Asda

- Auchan

- Carrefour

- Costco

- DMart (Avenue Supermarts)

- E.Leclerc

- Kaufland (Schwarz Group)

- Lidl (Schwarz Group)

- Loblaw

- Makro (SHV Holdings)

- Metro AG

- RT-Mart

- Sam’s Club

- Schwarz Group

- Target

- Tesco

- Walmart

- Woolworths (Australia)

- Aeon

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ahold Delhaize

- Aldi (Nord/Süd)

- Asda

- Auchan

- Carrefour

- Costco

- DMart (Avenue Supermarts)

- E.Leclerc

- Kaufland (Schwarz Group)

- Lidl (Schwarz Group)

- Loblaw

- Makro (SHV Holdings)

- Metro AG

- RT-Mart

- Sam’s Club

- Schwarz Group

- Target

- Tesco

- Walmart

- Woolworths (Australia)

- Aeon

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 289 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

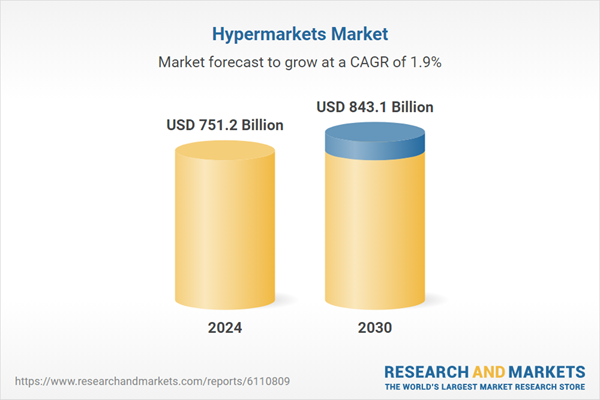

| Estimated Market Value ( USD | $ 751.2 Billion |

| Forecasted Market Value ( USD | $ 843.1 Billion |

| Compound Annual Growth Rate | 1.9% |

| Regions Covered | Global |