Global Artificial Intelligence (AI) in Pharma and Biotech Market - Key Trends & Drivers Summarized

How Is AI Revolutionizing the Drug Discovery and Development Lifecycle?

Artificial Intelligence is dramatically reshaping the pharmaceutical and biotechnology industries by accelerating and optimizing the entire drug discovery and development process. Traditional drug development is an expensive, time-consuming endeavor that often takes over a decade and costs billions of dollars to bring a single new drug to market. AI is changing this paradigm by enabling the rapid analysis of massive datasets, such as genomics, proteomics, and clinical trial records, to identify viable drug targets and predict the behavior of chemical compounds. Machine learning algorithms can sift through thousands of potential molecules and rank them based on predicted efficacy, toxicity, and bioavailability, thereby streamlining the preclinical screening phase. Generative AI models are even capable of designing novel molecular structures that meet specified therapeutic requirements. Moreover, AI is improving the selection and validation of biomarkers, helping researchers match drugs to the right patient populations more effectively. These innovations not only speed up early-stage R&D but also reduce the risk of failure in costly late-stage trials. Natural language processing tools are being used to analyze scientific literature, patents, and clinical databases to uncover previously overlooked insights. By integrating real-world evidence and historical data, AI enhances predictive modeling, supports hypothesis generation, and allows for more informed go/no-go decisions during development. The net result is a more agile and data-driven drug discovery model, reducing time to market and improving the chances of clinical success. AI’s role in drug development is no longer experimental; it is becoming an essential tool for pharmaceutical innovation, helping companies bring new treatments to patients faster and more efficiently.What Role Is AI Playing in Clinical Trials, Personalized Medicine, and Regulatory Compliance?

AI is making a profound impact on clinical trial management, personalized medicine, and regulatory workflows, areas that are traditionally laden with complexity, variability, and inefficiency. In clinical trials, AI is being deployed to optimize patient recruitment, one of the biggest bottlenecks in trial execution. By analyzing electronic health records, genetic data, and social determinants of health, AI systems can identify eligible patients faster and predict their likelihood of adherence and response to treatment. AI also supports adaptive trial designs, where protocols are modified in real-time based on incoming data, improving trial efficiency and statistical power. For personalized medicine, AI is crucial in deciphering the biological uniqueness of individual patients and matching them with targeted therapies. Algorithms analyze genomic sequences, protein expressions, and even microbiome profiles to predict drug response and minimize adverse effects, paving the way for more customized treatment plans. In regulatory affairs, AI helps ensure compliance by automating the monitoring of guideline updates, safety alerts, and labeling requirements across different markets. Intelligent document processing tools are being used to prepare submissions, identify inconsistencies, and streamline interactions with regulatory agencies such as the FDA and EMA. Pharmacovigilance is another area benefiting from AI, where machine learning systems are used to detect adverse event signals from disparate data sources, including social media, clinical notes, and post-marketing reports. These capabilities reduce manual workload and enhance the accuracy and timeliness of safety assessments. By transforming the clinical, personalized, and regulatory landscape, AI is not only accelerating the path from lab to patient but also ensuring that treatments are safer, more effective, and more tailored to individual needs.How Are Pharma and Biotech Companies Integrating AI into Their Business Models and R&D Infrastructure?

Pharma and biotech companies are increasingly embedding AI into their core business strategies and R&D infrastructure to stay competitive in an innovation-driven landscape. Large pharmaceutical firms are forming strategic partnerships with AI startups and tech companies to co-develop platforms for target identification, compound screening, and trial optimization. These collaborations enable access to specialized expertise and proprietary datasets that can significantly accelerate R&D timelines. Many companies are also establishing internal AI centers of excellence, hiring data scientists, bioinformaticians, and computational chemists to integrate AI capabilities across departments. Cloud-based platforms and high-performance computing are being adopted to handle the massive volume of data generated from genomics, clinical studies, and digital health applications. AI-driven platforms are being used for portfolio prioritization, helping decision-makers assess which assets to advance or shelve based on predictive analytics. On the manufacturing side, AI supports process optimization, quality control, and predictive maintenance, ensuring consistent product quality and reducing operational costs. In sales and marketing, AI tools analyze market trends, prescription patterns, and customer feedback to develop personalized engagement strategies for healthcare providers and patients. Additionally, AI is playing a growing role in digital therapeutics and companion diagnostics, enabling the development of integrated treatment solutions that combine traditional drugs with software-driven monitoring and behavioral interventions. This shift toward AI-centric business models is not limited to large enterprises. Emerging biotech firms are using AI from day one to differentiate themselves, build leaner operations, and attract investment. As AI matures, it is becoming a strategic enabler that cuts across every phase of the pharmaceutical value chain, fostering a culture of innovation, speed, and precision.What Is Driving the Sustained Global Growth of AI in the Pharma and Biotech Market?

The growth in the artificial intelligence in pharma and biotech market is driven by a combination of rising healthcare demands, expanding datasets, technological innovation, and a favorable regulatory and investment environment. The global burden of chronic and complex diseases such as cancer, Alzheimer’s, and rare genetic disorders is creating an urgent need for faster and more effective therapeutic solutions. AI helps meet this need by accelerating drug discovery and improving treatment precision. The widespread adoption of electronic health records, genomic sequencing, and wearable health devices has created a vast and growing pool of structured and unstructured data that fuels AI models. Technological advancements in natural language processing, machine learning, and neural networks have made it possible to analyze this data in ways that were previously unimaginable, unlocking insights that guide drug development, clinical decision-making, and market access strategies. Government initiatives and public-private partnerships aimed at fostering AI innovation in life sciences are also supporting growth, providing funding and policy support for research and deployment. Venture capital investment in AI-focused biotech startups continues to surge, reflecting strong confidence in the market potential of AI-driven drug development. The emergence of precision medicine and the push for patient-centric healthcare are further reinforcing the demand for AI tools that enable personalized treatment strategies. Global pharmaceutical companies are also under pressure to reduce costs and improve R&D efficiency, making AI a compelling solution for sustaining innovation. As more success stories emerge, such as AI-discovered drug candidates entering clinical trials, the credibility and adoption of AI in the life sciences continue to grow. These factors are collectively fueling a robust and sustained expansion of the AI market within the pharma and biotech sectors, signaling a new era of data-driven, technology-enabled healthcare innovation.Scope of the Report

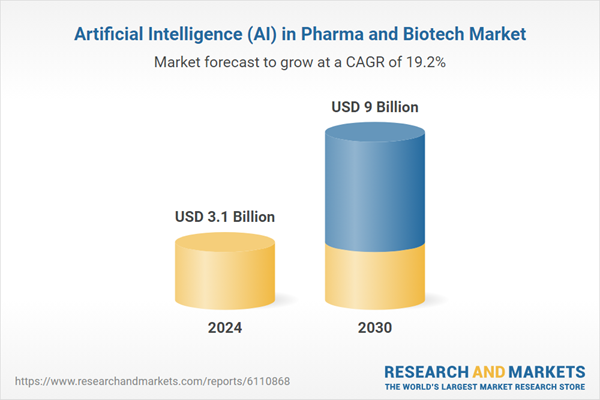

The report analyzes the Artificial Intelligence (AI) in Pharma and Biotech market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Application (Drug Discovery & Development Application, Clinical Trials & Optimization Application, Predictive Maintenance & Quality Control Application, Drug Target Identification Application, Disease Diagnosis & Prognosis Application, Other Applications); End-User (Pharma & Biotech Companies End-User, Academic & Contract Research Organizations End-User, Other End-Users).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Drug Discovery & Development Application segment, which is expected to reach US$2.6 Billion by 2030 with a CAGR of a 17.9%. The Clinical Trials & Optimization Application segment is also set to grow at 17.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $822.8 Million in 2024, and China, forecasted to grow at an impressive 18.3% CAGR to reach $1.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Artificial Intelligence (AI) in Pharma and Biotech Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Artificial Intelligence (AI) in Pharma and Biotech Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Artificial Intelligence (AI) in Pharma and Biotech Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AbbVie, AstraZeneca, Biogen, Boehringer Ingelheim, CureMetrix and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Artificial Intelligence (AI) in Pharma and Biotech market report include:

- AbbVie

- AstraZeneca

- Biogen

- Boehringer Ingelheim

- CureMetrix

- Exscientia

- Flatiron Health

- GSK

- IBM Watson Health

- Insilico Medicine

- Johnson & Johnson

- Lilly

- Medtronic

- Merck & Co.

- NVIDIA

- PathAI

- Recursion Pharmaceuticals

- Sanofi

- Tempus

- Zymergen

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AbbVie

- AstraZeneca

- Biogen

- Boehringer Ingelheim

- CureMetrix

- Exscientia

- Flatiron Health

- GSK

- IBM Watson Health

- Insilico Medicine

- Johnson & Johnson

- Lilly

- Medtronic

- Merck & Co.

- NVIDIA

- PathAI

- Recursion Pharmaceuticals

- Sanofi

- Tempus

- Zymergen

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 142 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.1 Billion |

| Forecasted Market Value ( USD | $ 9 Billion |

| Compound Annual Growth Rate | 19.2% |

| Regions Covered | Global |