Global Latex-Saturated Paper Market - Key Trends & Drivers Summarized

Why Is Latex-Saturated Paper Gaining Ground Across Technical and Specialty Applications?

Latex-saturated paper is gaining traction as a versatile, high-performance substrate used in a diverse array of industrial, commercial, and consumer product applications. This paper type is manufactured by impregnating base paper with latex emulsions-typically synthetic rubber-based binders like styrene-butadiene or acrylonitrile-butadiene-to improve durability, flexibility, chemical resistance, and dimensional stability. The resultant composite material combines the printability and eco-friendliness of paper with the enhanced mechanical and barrier properties of plastics, making it a preferred solution for both disposable and durable end uses.The rise in demand for paper-based solutions that can replace plastic without compromising strength or resistance to moisture and chemicals is fueling interest in latex-saturated papers. These materials are used in products such as labels, signage, sandpaper backings, masking tapes, automotive filters, gaskets, and laminated office supplies. Importantly, they can be easily die-cut, laminated, coated, or printed on, making them highly adaptable across industries. As sustainability regulations tighten globally and manufacturers seek to reduce plastic dependency, latex-saturated paper is emerging as a viable middle ground, offering enhanced performance while maintaining biodegradability and recyclability in certain configurations.

How Are Material Science and Process Innovations Enhancing Product Versatility?

Recent innovations in latex chemistry, fiber optimization, and coating technologies are significantly enhancing the performance characteristics of latex-saturated papers. Manufacturers are developing custom latex formulations that optimize tensile strength, water resistance, porosity, and thermal stability based on the application. For instance, high-tack latexes are used for abrasive backings and industrial tapes, whereas low-odor, heat-resistant binders are chosen for automotive interior components and air filter media. The type of base paper-kraft, glassine, cotton, or cellulose blends-also contributes to performance variability, allowing producers to tailor combinations for precise end-use requirements.Advanced saturation processes now include multi-stage impregnation, controlled drying, and calendering steps that enhance saturation uniformity and surface smoothness. Some grades also incorporate secondary treatments such as flame retardancy, UV stabilization, or anti-static coatings to meet safety and durability standards in sectors like aviation, electronics, and public infrastructure. Hybrid structures that blend latex-saturated paper with metal foils, plastic films, or nonwoven layers are being used to create multi-functional composites for emerging applications like EMI shielding, battery separators, and flexible sensors.

Sustainability-focused innovations are also gaining momentum. Manufacturers are exploring bio-based latexes derived from renewable feedstocks to reduce environmental impact. Waterborne latex systems and formaldehyde-free processing have been introduced to meet stricter environmental, health, and safety (EHS) standards. Additionally, enhanced recyclability protocols are being developed to facilitate material recovery and reuse in circular manufacturing systems. These process and material innovations are broadening the functional envelope of latex-saturated paper and driving adoption across high-value and regulated end-use markets.

Which End-Use Markets Are Driving Demand for Latex-Saturated Paper Products?

The market for latex-saturated paper is being driven by growth in several core application segments, most notably in construction, automotive, retail, abrasives, and industrial tapes. In the construction sector, latex-saturated papers are used in roofing underlayments, vapor barriers, wall liners, and masking tapes-products that require strength, water resistance, and dimensional stability under harsh conditions. In automotive applications, they are utilized in filtration systems, soundproofing elements, insulation pads, and trim components, where formability and environmental durability are critical.Abrasive backing remains a cornerstone application, where latex-saturated paper offers a balanced combination of flexibility and strength for coated abrasive products used in woodworking, metal finishing, and automotive refinishing. The growth of DIY markets and rising production of engineered furniture and modular structures are boosting abrasive product demand, thereby reinforcing the latex-saturated paper supply chain. In the industrial tape segment, saturation papers are used for both single-coated and double-coated products-ranging from packaging and masking tapes to specialty tapes for electronics, insulation, and surface protection.

Office supplies and consumer goods also represent a significant use case, especially in products like file folders, tabs, and index cards that require tear resistance, printability, and prolonged use. Additionally, demand for water-resistant tags and labels-used in horticulture, apparel, industrial logistics, and marine environments-is supporting the use of latex-saturated paper in printing and converting applications. The emergence of smart packaging and track-and-trace technologies is further enhancing this demand, as latex-saturated papers provide reliable adhesion and print performance under variable conditions.

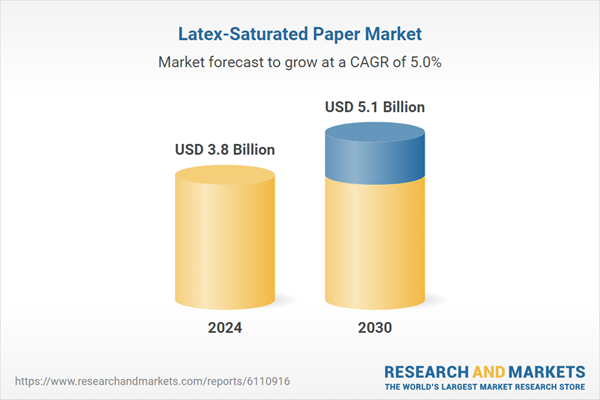

What Is Fueling the Growth of the Global Latex-Saturated Paper Market?

The growth in the global latex-saturated paper market is driven by several factors including increasing demand for performance-enhanced paper materials, rising environmental concerns over plastic use, and sustained expansion across construction, industrial, and packaging sectors. Latex-saturated paper serves as a functional alternative to plastic-based substrates in many applications, offering biodegradability and recyclability in specific configurations while maintaining key strength and barrier properties. This dual advantage is particularly compelling for converters and manufacturers looking to align with evolving environmental regulations and corporate sustainability goals.The expansion of the e-commerce and logistics industry is supporting growth in tags, labels, and industrial tape products that often rely on latex-saturated substrates. Similarly, growth in manufacturing, infrastructure, and auto production-particularly in emerging economies-is generating consistent demand for abrasives, filtration media, and masking tapes. Government-backed building programs, green building standards, and vehicle electrification initiatives are further reinforcing the industrial footprint of latex-saturated papers.

On the supply side, improved manufacturing technologies, regional latex production hubs, and integrated paper-chemical supply chains are helping reduce costs and improve global availability. Customization capabilities, such as the ability to develop application-specific grammages, saturant blends, and surface treatments, are allowing suppliers to address niche requirements and reduce substitution risk. The rising use of technical paper in high-performance and safety-critical environments, alongside emerging applications in electronics, healthcare, and wearables, is expected to open new avenues for latex-saturated paper. Collectively, these drivers are shaping a robust growth trajectory for the global market.

Scope of the Report

The report analyzes the Latex-Saturated Paper market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Composition (Cellulosic Fibers, Non-Cellulosic Fibers); Basis Weight (Below 50 GSM Weight, 50 - 100 GSM Weight, 100 - 150 GSM Weight, 150 - 200 GSM Weight, Above 200 GSM Weight); Application (Construction Products Application, Packaging Applications Application, Publishing & Bookbinding Application, Veneer Backing Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cellulosic Fibers segment, which is expected to reach US$3.6 Billion by 2030 with a CAGR of a 5.8%. The Non-Cellulosic Fibers segment is also set to grow at 3.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.0 Billion in 2024, and China, forecasted to grow at an impressive 9.2% CAGR to reach $1.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Latex-Saturated Paper Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Latex-Saturated Paper Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Latex-Saturated Paper Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ahlstrom, Arjowiggins, Binders Inc., BPM Inc., Chiyoda Corp. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Latex-Saturated Paper market report include:

- Ahlstrom

- Arjowiggins

- Binders Inc.

- BPM Inc.

- Chiyoda Corp.

- Clearwater Paper Corporation

- Domtar Corporation

- Dunn Paper

- Expera Specialty Solutions

- FiberMark (a division of Neenah)

- Glatfelter Corporation

- Henan Hengda Paper Co., Ltd.

- Kanzaki Specialty Papers Inc.

- Mondi Group

- Munksjö

- Neenah, Inc.

- P.H. Glatfelter Company

- Pudumjee Paper Products

- Sappi Limited

- Schweitzer-Mauduit International

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ahlstrom

- Arjowiggins

- Binders Inc.

- BPM Inc.

- Chiyoda Corp.

- Clearwater Paper Corporation

- Domtar Corporation

- Dunn Paper

- Expera Specialty Solutions

- FiberMark (a division of Neenah)

- Glatfelter Corporation

- Henan Hengda Paper Co., Ltd.

- Kanzaki Specialty Papers Inc.

- Mondi Group

- Munksjö

- Neenah, Inc.

- P.H. Glatfelter Company

- Pudumjee Paper Products

- Sappi Limited

- Schweitzer-Mauduit International

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 383 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.8 Billion |

| Forecasted Market Value ( USD | $ 5.1 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |