Global Blood Gas Monitors Market - Key Trends & Drivers Summarized

Why Are Blood Gas Monitors Essential for Critical and Acute Patient Care?

Blood gas monitors have become indispensable tools in the diagnosis and management of critically ill patients, particularly those suffering from respiratory, metabolic, and cardiovascular disorders. These devices measure critical parameters such as partial pressures of oxygen (pO2) and carbon dioxide (pCO2), pH levels, bicarbonate concentration, and blood oxygen saturation, which are essential for evaluating a patient’s acid-base balance and respiratory function. Blood gas analysis plays a vital role in intensive care units, emergency departments, operating rooms, and neonatal care where timely and accurate information can be a matter of life and death. Conditions such as sepsis, acute respiratory distress syndrome, chronic obstructive pulmonary disease, and kidney failure often require continuous monitoring to adjust ventilator settings or guide fluid and electrolyte management. The importance of real-time monitoring was especially evident during the COVID-19 pandemic, where rapid assessment of oxygenation status was crucial for patients experiencing respiratory compromise. Portable and point-of-care blood gas monitors are now widely used in ambulance services, field hospitals, and outpatient clinics, allowing for faster decision-making and improved patient outcomes. These devices not only reduce the burden on central laboratories but also enhance workflow efficiency by providing immediate results at the patient’s bedside. As healthcare systems focus more on precision medicine and rapid diagnostics, blood gas monitors are proving essential for enabling targeted and responsive interventions across all levels of critical care.How Are Technological Innovations Enhancing the Accuracy and Efficiency of Blood Gas Monitoring?

Technological innovation is revolutionizing the functionality, speed, and usability of blood gas monitors, making them more accurate, compact, and suited for a broader range of clinical environments. Recent advancements include the integration of multi-parameter sensors capable of measuring electrolytes, lactate, and hematocrit alongside traditional blood gas components, offering a more comprehensive metabolic profile in a single test. The development of cartridge-based systems and disposable sensor modules has significantly reduced the need for calibration and maintenance, improving reliability and reducing operator error. Connectivity features such as wireless data transmission, touchscreen interfaces, and integration with electronic health records are now standard in many devices, enabling seamless documentation and real-time clinical decision-making. Point-of-care devices are becoming increasingly sophisticated, offering results in under a minute with minimal blood sample volumes, which is particularly important in neonatal and pediatric care. Artificial intelligence and machine learning are being incorporated into data interpretation software to detect trends and suggest clinical actions, further aiding medical staff in high-pressure environments. Portable monitors equipped with rechargeable batteries and durable construction are being deployed in ambulatory settings and remote locations where access to laboratory infrastructure is limited. As manufacturers continue to improve user interface design, analytical precision, and environmental adaptability, blood gas monitors are evolving into intelligent, multifunctional platforms that go far beyond their traditional role, enhancing clinical workflows and patient safety across various healthcare scenarios.What Regional and Clinical Trends Are Influencing the Adoption of Blood Gas Monitoring Devices?

The adoption of blood gas monitoring technology is influenced by regional healthcare priorities, infrastructure development, and clinical specialization, resulting in a dynamic and diversified global market. In North America and Western Europe, where critical care services and emergency medical response are highly developed, blood gas monitors are deeply embedded into routine clinical practice. High rates of chronic respiratory conditions, a growing elderly population, and widespread use of mechanical ventilation contribute to consistent demand for these devices. In these regions, hospitals and clinics prioritize compact, integrated systems that align with electronic medical records and clinical decision support tools. In Asia-Pacific, the rapid expansion of healthcare infrastructure in countries like China, India, and Indonesia is creating opportunities for the deployment of cost-effective, portable monitoring solutions in rural and peri-urban areas. Local governments are investing in intensive care unit capacity and trauma care centers, which naturally increase the demand for blood gas analysis. In Latin America and Africa, access to central laboratories may be limited, making point-of-care monitors especially valuable in emergency departments, ambulances, and field clinics. In all regions, neonatal and pediatric care units are seeing an uptick in blood gas monitor usage due to the high sensitivity of infants to changes in oxygen and acid-base balance. Furthermore, the increasing adoption of home care services and mobile health units in both developed and emerging markets is expanding the reach of blood gas monitors beyond hospital walls. These regional and clinical trends are collectively shaping a robust, multi-tiered market landscape with diverse adoption patterns across public and private healthcare sectors.What Are the Primary Drivers Behind the Growth of the Blood Gas Monitors Market?

The growth in the blood gas monitors market is driven by a convergence of clinical demand, technological progress, demographic change, and evolving healthcare delivery models. A primary driver is the increasing global incidence of chronic and acute respiratory conditions, cardiovascular disorders, and metabolic imbalances that require continuous and precise monitoring of blood gas levels. The growing use of mechanical ventilation and dialysis in intensive care settings further reinforces the need for real-time blood gas analysis to guide therapy and ensure patient safety. The rising number of surgeries, particularly those involving anesthesia and cardiopulmonary support, also contributes to the demand for intraoperative and postoperative blood gas monitoring. Technological advances that enhance speed, accuracy, and portability have made these devices more attractive for emergency medical services, outpatient clinics, and even home healthcare, thus broadening their applications. The COVID-19 pandemic heightened awareness of respiratory health and emphasized the need for rapid oxygenation monitoring, significantly accelerating the adoption of blood gas analyzers worldwide. Increasing investments in healthcare infrastructure, particularly in emerging economies, are also driving market expansion by enabling access to modern diagnostic tools. Furthermore, the integration of digital health technologies, such as remote monitoring and cloud-based data management, is making blood gas monitors a key component of connected and proactive healthcare systems. As the emphasis on early diagnosis, personalized care, and efficient hospital workflows continues to rise, the demand for reliable and accessible blood gas monitoring solutions is expected to grow steadily across both advanced and resource-limited healthcare environments.Scope of the Report

The report analyzes the Blood Gas Monitors market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Pulse Oximeters, Point-of-Care Blood Gas Analyzers, Arterial Blood Gas Sampling kits, Laboratory Blood Gas Analyzers, Other Product Types); Type (Portable Type, Desktop Type); End-User (Hospitals End-User, Ambulatory Surgery Centers End-User, Diagnostic Centers End-User, Other End-Users).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Pulse Oximeters segment, which is expected to reach US$2.0 Billion by 2030 with a CAGR of a 3.7%. The Point-of-Care Blood Gas Analyzers segment is also set to grow at 2.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.0 Billion in 2024, and China, forecasted to grow at an impressive 6.4% CAGR to reach $932.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Blood Gas Monitors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Blood Gas Monitors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Blood Gas Monitors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, ABL Medical, Alere Inc. (now part of Abbott), Becton, Dickinson and Company (BD), bioMérieux SA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Blood Gas Monitors market report include:

- Abbott Laboratories

- ABL Medical

- Alere Inc. (now part of Abbott)

- Becton, Dickinson and Company (BD)

- bioMérieux SA

- Criticare Technologies Inc.

- Danaher Corporation

- EKF Diagnostics

- Erba Mannheim

- F. Hoffmann-La Roche Ltd.

- i-SENS Inc.

- Instrumentation Laboratory (Werfen)

- Medica Corporation

- Nova Biomedical Corporation

- OPTI Medical Systems

- Radiometer Medical ApS (Danaher)

- Samsung Medison Co., Ltd.

- Siemens Healthineers

- Spacelabs Healthcare

- Werfen Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- ABL Medical

- Alere Inc. (now part of Abbott)

- Becton, Dickinson and Company (BD)

- bioMérieux SA

- Criticare Technologies Inc.

- Danaher Corporation

- EKF Diagnostics

- Erba Mannheim

- F. Hoffmann-La Roche Ltd.

- i-SENS Inc.

- Instrumentation Laboratory (Werfen)

- Medica Corporation

- Nova Biomedical Corporation

- OPTI Medical Systems

- Radiometer Medical ApS (Danaher)

- Samsung Medison Co., Ltd.

- Siemens Healthineers

- Spacelabs Healthcare

- Werfen Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 371 |

| Published | February 2026 |

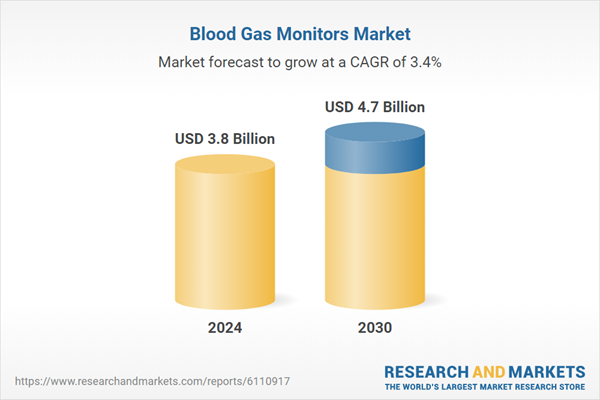

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.8 Billion |

| Forecasted Market Value ( USD | $ 4.7 Billion |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Global |