Global Pressure Reducing Valves Market - Key Trends & Drivers Summarized

Why Are Pressure Reducing Valves Essential Across Modern Fluid Control Systems?

Pressure reducing valves (PRVs) are integral components in fluid systems designed to maintain consistent downstream pressure regardless of fluctuations in upstream supply. These valves are deployed in a wide range of sectors, including water distribution, steam systems, oil & gas pipelines, HVAC networks, chemical processing, and food & beverage manufacturing. Their core function is to ensure safety, operational efficiency, and process consistency by controlling excessive inlet pressures that could otherwise damage equipment or compromise system performance.In water distribution systems, PRVs help regulate city mains, safeguard residential and commercial plumbing fixtures, and reduce the risk of pipe bursts. In industrial settings, they enable precise control over pressure-sensitive processes, ensuring stability in applications like autoclaves, reactors, and distillation columns. Steam PRVs are also critical in maintaining optimal energy use and preventing pressure surges that could harm turbines or heat exchangers. Moreover, they are vital to medical gas delivery systems in hospitals and in compressed air lines used in high-precision manufacturing environments.

Global infrastructure modernization, especially in urban water management and industrial utility upgrades, is boosting the adoption of pressure reducing valves. With the rising need to extend asset life, minimize maintenance disruptions, and enhance fluid system safety, PRVs are no longer optional-they are foundational to fluid dynamics in both legacy and digitalized systems.

How Is Technology Enhancing the Efficiency and Intelligence of PRV Systems?

Recent advances in valve design, materials, and smart monitoring have significantly elevated the functionality and reliability of pressure reducing valves. Traditional PRVs operated purely on mechanical feedback through spring-loaded or diaphragm-actuated mechanisms. Today, however, digital PRVs equipped with electronic actuators, embedded sensors, and control modules are being introduced to provide real-time pressure control and system diagnostics.These smart PRVs can transmit data on flow rate, downstream pressure, valve position, and temperature to SCADA systems or industrial IoT platforms. As a result, they support predictive maintenance by identifying leakages, cavitation, or wear long before failure occurs. In municipal water systems, smart PRVs are being used to detect transient pressure spikes-common precursors to pipeline bursts or water loss-enabling utilities to proactively manage non-revenue water issues.

On the material front, corrosion-resistant alloys, advanced polymers, and elastomers are being used to extend valve life and performance under aggressive media such as saltwater, chemicals, or high-temperature steam. Energy-saving designs that reduce pressure loss across the valve are being prioritized, especially in high-volume systems. Modular configurations are also gaining popularity, allowing easy maintenance and field upgrades of actuators, seats, or trim components.

Which End-Use Segments and Regions Are Generating the Strongest Demand?

The building & construction sector remains the largest consumer of PRVs globally, with extensive deployment in residential, commercial, and high-rise buildings. Here, valves regulate water pressure across zones and prevent damage to fixtures and appliances. Industrial sectors such as power generation, chemicals, food processing, and pharmaceuticals follow closely, where precise control of steam, gases, or process fluids is mission-critical.The oil & gas industry utilizes high-performance PRVs for regulating pipeline flow, pressure relief in separator systems, and steam injection in enhanced oil recovery. In HVAC and district heating systems, PRVs are used to balance temperature zones and optimize system efficiency. Water utilities across urban municipalities are rapidly upgrading to pressure management zones (PMZs) using advanced PRVs to combat leakage and improve delivery consistency.

Regionally, North America and Western Europe remain mature markets with strong adoption of smart PRVs in municipal and industrial systems. Asia-Pacific, led by China, India, and Southeast Asia, is experiencing accelerated growth due to rising investments in smart city infrastructure, energy, and water supply. In Latin America and Africa, expanding urbanization and water management projects are creating opportunities for cost-effective mechanical PRV solutions tailored to local infrastructure.

What Is Driving Growth in the Global Pressure Reducing Valves Market?

The growth in the global pressure reducing valves market is driven by infrastructure upgrades, industrial automation, and the global push toward water conservation and energy efficiency. Governments and utilities are investing in smart water grids and pressure management programs to address aging infrastructure, rising urban populations, and climate-related water stress. PRVs are critical enablers of such programs.In industrial applications, the need for uninterrupted production, asset protection, and compliance with safety regulations is prompting companies to invest in reliable, low-maintenance valve solutions. Smart PRVs enhance system visibility and control, aligning with broader trends toward Industry 4.0 and digital twin implementation. Furthermore, the rise of decentralized water systems and renewable heating networks supports demand for compact and programmable valve systems.

Competitive pricing, availability of modular designs, and increased emphasis on leak detection and preventive maintenance are making PRVs attractive across mid-tier municipalities and industrial segments. As manufacturers continue to develop energy-efficient and digitally integrated solutions, the market for pressure reducing valves is poised for sustained expansion-supporting infrastructure resilience, utility optimization, and industrial process integrity.

Scope of the Report

The report analyzes the Pressure Reducing Valves market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Direct-Acting Valve, Pilot-Operated Valve); Operating Pressure (Below 300 PSIG Pressure, 301 - 600 PSIG Pressure, Above 600 PSIG Pressure); End-User (Oil & Gas End-User, Power Generation End-User, Chemical End-User, Water & Wastewater End-User, Metals & Mining End-User, Other End-Users).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Direct-Acting Valve segment, which is expected to reach US$3.5 Billion by 2030 with a CAGR of a 4.5%. The Pilot-Operated Valve segment is also set to grow at 2.0% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 7.1% CAGR to reach $993.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Pressure Reducing Valves Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Pressure Reducing Valves Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Pressure Reducing Valves Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

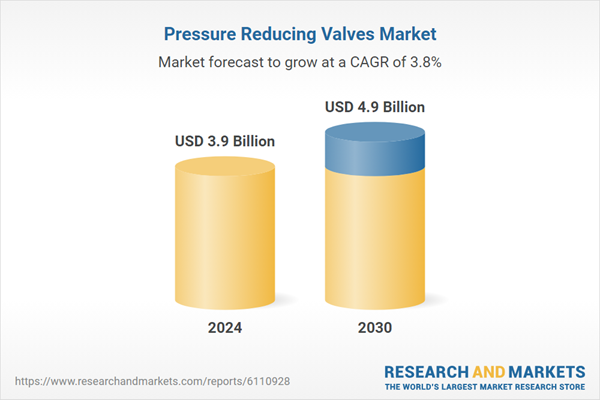

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Apollo Valves (Aalberts), Armstrong International, ARI Armaturen, BERMAD, Cla-Val and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 39 companies featured in this Pressure Reducing Valves market report include:

- Apollo Valves (Aalberts)

- Armstrong International

- ARI Armaturen

- BERMAD

- Cla-Val

- Crane Co.

- Danfoss Group

- Emerson Electric Co.

- Flomatic Corporation

- Forbes Marshall

- Honeywell International Inc.

- IMI plc

- Mueller Water Products

- Parker Hannifin Corporation

- Pentair plc

- Spirax Sarco Engineering plc

- TLV Co., Ltd.

- Watts Water Technologies

- Yoshitake Inc.

- Zurn Elkay Water Solutions

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Apollo Valves (Aalberts)

- Armstrong International

- ARI Armaturen

- BERMAD

- Cla-Val

- Crane Co.

- Danfoss Group

- Emerson Electric Co.

- Flomatic Corporation

- Forbes Marshall

- Honeywell International Inc.

- IMI plc

- Mueller Water Products

- Parker Hannifin Corporation

- Pentair plc

- Spirax Sarco Engineering plc

- TLV Co., Ltd.

- Watts Water Technologies

- Yoshitake Inc.

- Zurn Elkay Water Solutions

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 378 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.9 Billion |

| Forecasted Market Value ( USD | $ 4.9 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |