Global Utility System Construction Market - Key Trends & Drivers Summarized

Why Is Utility System Construction Seeing a Strategic Push Across Infrastructure Projects?

Utility system construction has become a central focus of national and regional infrastructure programs as governments, developers, and utility operators strive to modernize essential services. This segment encompasses the design and development of systems for electricity transmission and distribution, natural gas networks, telecommunications, water supply, and wastewater treatment. Rising urbanization, grid decarbonization, and digital connectivity goals are creating demand for new underground and overhead utility installations as well as the reconstruction and expansion of aging utility networks. The push for resilient, future-ready infrastructure is also catalyzing investments in smart metering systems, fiber optics, and distributed energy integration.In the power sector, utility system construction is closely linked to the integration of renewable energy projects, transmission corridor development, and substation upgrades. Governments are allocating funding to connect offshore wind farms, rural electrification programs, and cross-border power trade frameworks, especially in North America, Europe, and Asia. In parallel, water and wastewater utilities are constructing new pipelines, pumping stations, and water reclamation systems to meet demand from expanding cities and climate resilience objectives. Natural gas utilities are investing in pipeline replacement programs, leak detection infrastructure, and hydrogen blending capabilities-all of which require sophisticated civil, mechanical, and electrical construction efforts.

What Technological Innovations Are Being Embedded Into Modern Utility Projects?

Modern utility system construction is being shaped by digital engineering tools, modular construction techniques, and GIS-based asset planning. Building Information Modeling (BIM) and digital twin technologies are enabling utility companies and EPC contractors to simulate project timelines, optimize routing, and reduce rework. These tools improve collaboration among stakeholders and allow for clash detection before physical works begin, which is particularly important in densely populated or utility-congested areas. The use of drones, ground-penetrating radar (GPR), and LIDAR scanning is also enhancing pre-construction surveys, asset mapping, and real-time progress monitoring.Construction automation is another emerging frontier. Robotic pipe welders, trenchless boring systems, and prefabricated substation components are streamlining the delivery of complex utility systems. In fiber optic networks and smart grid construction, field-deployable kits and modular nodes are accelerating timelines and improving scalability. Environmental performance is also a major consideration, prompting the use of eco-friendly materials, noise- and dust-minimizing machinery, and biodiversity-sensitive construction practices. As utilities face mounting pressure to build quickly while minimizing disruptions, such technologies are becoming integral to next-generation utility construction methodologies.

Which Regional Markets and Segments Are Seeing the Most Robust Utility Build-Outs?

The demand for utility system construction is intensifying in markets undergoing rapid infrastructure development and energy transition. In the United States, the Bipartisan Infrastructure Law and Inflation Reduction Act have unlocked billions of dollars for utility grid upgrades, water system renewal, and rural broadband expansion. This has created substantial opportunities for contractors specializing in electric transmission lines, gas pipeline modernization, and stormwater system construction. Similarly, the European Union’s Green Deal and REPowerEU plans are fueling large-scale utility projects to replace fossil-based systems with renewable-ready and hydrogen-compatible infrastructure.In Asia-Pacific, fast-growing economies such as India, China, Vietnam, and the Philippines are investing in urban utility corridors, industrial park utilities, and rural electrification. In the Middle East, utility system construction is integral to smart city projects like NEOM (Saudi Arabia) and Lusail (Qatar), which emphasize underground utility tunnels, smart grid integration, and desalination-backed water systems. Africa’s utility construction market is largely donor-driven but expanding quickly, with key priorities including off-grid solar distribution networks, clean water systems, and transmission backbone development under regional power pool frameworks.

What Forces Are Driving the Expansion of the Global Utility System Construction Market?

The growth in the utility system construction market is driven by several factors, including government-led infrastructure investments, decarbonization targets, and the digitalization of utility operations. The global focus on energy transition is pushing utilities to build transmission infrastructure capable of integrating variable renewable energy sources like solar and wind. At the same time, climate adaptation is increasing the need for undergrounding of power lines, upgrading stormwater drainage systems, and flood-proofing utility corridors-all of which require significant construction expertise.Population growth and urban sprawl are also generating sustained demand for utility expansion in both developed and developing countries. Urban masterplans are incorporating centralized utility tunnels, smart grid nodes, and green infrastructure-all of which require multidisciplinary construction approaches. Moreover, the private sector is investing in utility system construction for data centers, industrial clusters, and private grids. The availability of financing through public-private partnerships (PPPs), green bonds, and climate funds is further enhancing project viability. With regulatory frameworks now emphasizing resilience, sustainability, and digital readiness, the utility system construction market is poised to grow as a critical enabler of 21st-century infrastructure.

Scope of the Report

The report analyzes the Utility System Construction market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Service (Water & Sewer Line Construction Service, Oil & Gas Pipeline Construction Service, Power & Communications Line Construction Service); Equipment (Excavators Equipment, Loaders Equipment, Cranes Equipment, Other Equipment); Application (Residential Application, Commercial Application, Industrial Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Water & Sewer Line Construction Service segment, which is expected to reach US$244.3 Billion by 2030 with a CAGR of a 2.8%. The Oil & Gas Pipeline Construction Service segment is also set to grow at 3.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $89.4 Billion in 2024, and China, forecasted to grow at an impressive 5.8% CAGR to reach $77.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Utility System Construction Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Utility System Construction Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Utility System Construction Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amec Foster Wheeler (AtkinsRéalis), Amec Foster Wheeler (prior brand), AtkinsRéalis, Avantus, Balfour Beatty plc and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Utility System Construction market report include:

- Amec Foster Wheeler (AtkinsRéalis)

- Amec Foster Wheeler (prior brand)

- AtkinsRéalis

- Avantus

- Balfour Beatty plc

- Bechtel Corporation

- China Power Construction (Sinohydro)

- Clough Group (Webuild subsidiary)

- Fluor Corporation

- HITT Contracting

- IC Holding

- IEA (Infrastructure & Energy Alternatives)

- Jacobs Solutions

- KEC International

- MasTec, Inc.

- National Pipeline Contractors

- Petrofac Limited

- Quanta Services

- Rubicon Professional Services (RPS)

- Scatec ASA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amec Foster Wheeler (AtkinsRéalis)

- Amec Foster Wheeler (prior brand)

- AtkinsRéalis

- Avantus

- Balfour Beatty plc

- Bechtel Corporation

- China Power Construction (Sinohydro)

- Clough Group (Webuild subsidiary)

- Fluor Corporation

- HITT Contracting

- IC Holding

- IEA (Infrastructure & Energy Alternatives)

- Jacobs Solutions

- KEC International

- MasTec, Inc.

- National Pipeline Contractors

- Petrofac Limited

- Quanta Services

- Rubicon Professional Services (RPS)

- Scatec ASA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 368 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

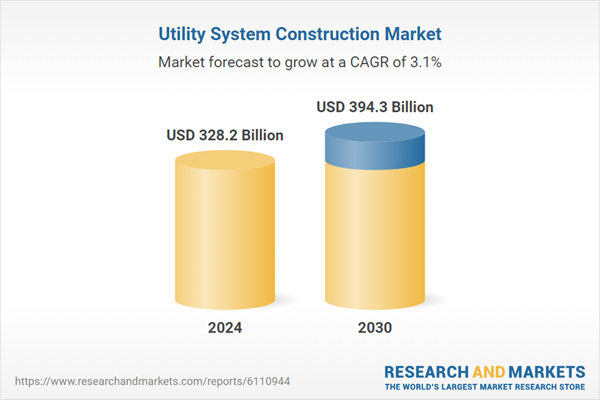

| Estimated Market Value ( USD | $ 328.2 Billion |

| Forecasted Market Value ( USD | $ 394.3 Billion |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Global |