Global Ethyl Soyate Ester Market - Key Trends & Drivers Summarized

Why Is Ethyl Soyate Ester Gaining Preference in Industrial Applications?

Ethyl soyate ester, a derivative of soybean oil and ethanol, is widely used as a bio-based solvent in industrial cleaning, agricultural formulations, and ink removal processes. Known for its low toxicity, biodegradability, and strong solvency power, ethyl soyate ester is an eco-friendly alternative to petroleum-based solvents. Its ability to dissolve greases, oils, adhesives, and resins makes it suitable for precision cleaning and degreasing applications across manufacturing, maintenance, and automotive settings.Its mild odor, high flash point, and favorable environmental profile support usage in products that require safer workplace handling and reduced VOC emissions. Industries are adopting ethyl soyate ester not only for its performance but also to comply with tightening environmental regulations and workplace safety standards. It is particularly favored in government facilities, printing operations, and facilities seeking green certifications.

How Are Formulations and Regulations Shaping Product Use and Acceptance?

Formulators are leveraging ethyl soyate ester’s compatibility with other solvents and surfactants to create blends tailored for specific cleaning or dispersing applications. Its solvency properties can be enhanced or moderated depending on the targeted residue, making it a flexible component in customized solutions. In agriculture, it is being incorporated into herbicide carriers and adjuvants for improved active ingredient dispersion and leaf surface adhesion.Regulatory acceptance by environmental agencies in the U.S. and Europe has improved its marketability, especially where low-toxicity and non-flammable characteristics are mandated. Ethyl soyate ester also qualifies for use in environmentally preferable purchasing (EPP) programs, helping institutional buyers meet sustainability criteria. As industries face increasing scrutiny over hazardous air pollutants, demand is shifting toward non-volatile, plant-derived solvents with favorable exposure profiles.

Which End-Use Sectors Are Leading Adoption of Ethyl Soyate Ester?

Industrial and institutional cleaning remains the largest segment using ethyl soyate ester due to its performance and safety profile. Metal fabrication, aerospace maintenance, and electronics assembly facilities are key users, particularly in surface preparation and degreasing processes. Printers and ink manufacturers also incorporate it in press wash products for its efficacy in pigment and resin removal without damaging equipment.In agriculture, its role as a carrier solvent for crop protection chemicals is gaining momentum, especially in organic and reduced-risk formulations. Some emerging applications include use as a reactive diluent in coatings and lubricants, where its bio-based origin supports environmental compliance. Universities, municipal maintenance departments, and military operations are deploying ethyl soyate ester across various cleaning protocols in line with green procurement mandates.

What Is Driving Growth in the Ethyl Soyate Ester Market?

Growth in the ethyl soyate ester market is driven by several factors related to sustainability mandates, industrial safety requirements, and solvent reformulation trends. Increasing restrictions on VOCs and hazardous solvents are pushing industries to seek compliant, bio-based alternatives. Ethyl soyate ester’s strong solvency characteristics and favorable biodegradability profile are positioning it as a substitute in regulated cleaning and agricultural formulations.Rising interest in renewable chemicals and circular production models is encouraging use of soybean-derived solvents in manufacturing processes. Institutional and government-led procurement policies that prioritize green products are expanding the commercial base for ethyl soyate ester. As demand grows for safer, high-performance solvent systems across multiple sectors, this compound is gaining traction as a viable industrial input with both performance and regulatory advantages.

Scope of the Report

The report analyzes the Ethyl Soyate Ester market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Grade (Industrial Grade, Cosmetic Grade); Application (Lubricants Application, Fuels Application, Cosmetics Application, Printing Inks Application); End-Use (Food & Beverages End-Use, Cosmetics End-Use, Automotive End-Use, Printing End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Industrial Grade segment, which is expected to reach US$289.1 Million by 2030 with a CAGR of a 4.1%. The Cosmetic Grade segment is also set to grow at 6.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $90.6 Million in 2024, and China, forecasted to grow at an impressive 7.8% CAGR to reach $87.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Ethyl Soyate Ester Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Ethyl Soyate Ester Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Ethyl Soyate Ester Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

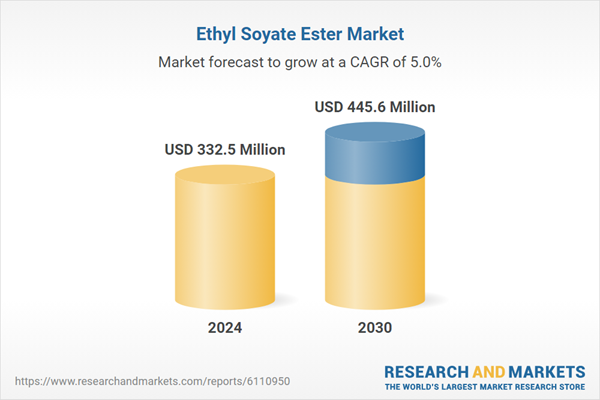

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AGP (Ag Processing Inc.), Archer Daniels Midland (ADM), BASF SE, Bio-Diesel Oils India Pvt Ltd, Cargill, Incorporated and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Ethyl Soyate Ester market report include:

- AGP (Ag Processing Inc.)

- Archer Daniels Midland (ADM)

- BASF SE

- Bio-Diesel Oils India Pvt Ltd

- Cargill, Incorporated

- ChemPoint (a Univar Solutions Company)

- Covalent Chemical LLC

- EcoGreen Oleochemicals

- Emco Dyestuff Pvt. Ltd.

- Exen Chem Co., Ltd.

- GF Biochemicals

- Kedia Organic Chemicals Pvt. Ltd.

- Krishi Oils Limited

- Methylester (Vance Group)

- PMC Biogenix Inc.

- Spectrum Chemical Mfg. Corp.

- Stepan Company

- Vertec Biosolvents Inc.

- VVF Ltd.

- Zhejiang Xinhua Chemical Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AGP (Ag Processing Inc.)

- Archer Daniels Midland (ADM)

- BASF SE

- Bio-Diesel Oils India Pvt Ltd

- Cargill, Incorporated

- ChemPoint (a Univar Solutions Company)

- Covalent Chemical LLC

- EcoGreen Oleochemicals

- Emco Dyestuff Pvt. Ltd.

- Exen Chem Co., Ltd.

- GF Biochemicals

- Kedia Organic Chemicals Pvt. Ltd.

- Krishi Oils Limited

- Methylester (Vance Group)

- PMC Biogenix Inc.

- Spectrum Chemical Mfg. Corp.

- Stepan Company

- Vertec Biosolvents Inc.

- VVF Ltd.

- Zhejiang Xinhua Chemical Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 383 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 332.5 Million |

| Forecasted Market Value ( USD | $ 445.6 Million |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |