Global Laboratory Equipment And Disposables Market - Key Trends & Drivers Summarized

Why Are Laboratory Equipment and Disposables Fundamental to the Expanding Scientific Ecosystem?

The laboratory equipment and disposables market forms the operational backbone of scientific research, diagnostics, and industrial testing, serving as the essential infrastructure across a wide range of disciplines. Equipment includes benchtop instruments, centrifuges, incubators, analytical balances, water purification units, and sterilization systems, while disposables cover plasticware, glassware, filtration devices, pipette tips, vials, gloves, and other single-use items. The increased volume of laboratory testing-spurred by the COVID-19 pandemic, growing R&D intensity, and rising public health awareness-has sharply expanded demand for both durable equipment and consumables.Scientific workflows are increasingly driven by precision, contamination control, and throughput, all of which depend heavily on the quality and reliability of foundational lab products. The growth of life sciences, molecular diagnostics, biopharmaceuticals, and personalized medicine has led to a greater emphasis on automation-compatible equipment and certified disposables. Moreover, the expansion of academic-industry research collaborations and public-private partnerships is fostering global demand for scalable, reproducible, and regulation-compliant laboratory setups. These dynamics are making lab equipment and disposables more than just operational necessities-they are now strategic assets in driving discovery and commercialization.

How Are Innovation, Automation, and Sustainability Reshaping Lab Product Design?

Product innovation is transforming lab equipment and disposables from passive tools into smart, adaptable, and digitally integrated solutions. Benchtop equipment is increasingly being fitted with programmable interfaces, remote monitoring capabilities, and cloud connectivity. Smart centrifuges, temperature-controlled shakers, and programmable ovens are supporting high-throughput experiments while enabling precise control over operating conditions. Disposables are likewise becoming smarter, with barcoded pipette tips, color-coded caps, and RFID-tagged storage vials enabling traceability, inventory control, and LIMS integration.The sustainability imperative is driving major changes in product design and lifecycle management. Laboratories, traditionally high in plastic and energy consumption, are under pressure to reduce environmental impact. Vendors are launching eco-friendly disposable lines made from biodegradable materials or recyclable polymers. Reusable equipment is being designed for energy efficiency, minimal maintenance, and reduced calibration downtime. Closed-loop recycling programs for single-use plasticware and refillable reagent systems are gaining traction, particularly in North America and Europe. These sustainable practices are increasingly factored into purchasing decisions, especially in government-funded and academic labs.

Automation compatibility is another key design parameter. Equipment and consumables must now support robotic liquid handling, automated sample prep, and multiplex assays. Standardized footprints, ergonomic features, and low-retention designs are making it easier to integrate lab products into fully automated workflows. Manufacturers are also responding with ready-to-use kits that combine compatible instruments, reagents, and disposables for specific assays-simplifying logistics and reducing setup times. The convergence of instrumentation, software, and consumables is setting a new benchmark for operational efficiency and product interoperability.

Which End-Use Sectors and Geographies Are Driving Demand Expansion?

The demand for lab equipment and disposables spans multiple end-use segments including healthcare diagnostics, academic research, pharmaceutical manufacturing, environmental testing, and food safety labs. Clinical laboratories are among the largest users of both equipment and disposables, with high daily consumption of pipette tips, sample tubes, gloves, and reagent bottles. Hospital networks and diagnostics chains are driving centralized procurement models, supported by LIS platforms and warehouse inventory automation. High-frequency testing in immunology, hematology, microbiology, and molecular diagnostics ensures sustained demand for a diverse range of disposable labware.In the biopharmaceutical sector, quality control, process analytics, and cleanroom protocols necessitate precise and contamination-free equipment and consumables. As biomanufacturing scales globally, demand for single-use bioprocessing components, aseptic connectors, and sterile filtration devices is increasing in tandem. Meanwhile, academic institutions and government labs are investing in multipurpose lab setups that can support cross-disciplinary research in materials science, molecular biology, and nanotechnology. This diversity in applications ensures a robust demand environment across product categories.

Geographically, Asia-Pacific is emerging as the fastest-growing market, driven by increased R&D funding, expanding diagnostic capacity, and growing pharmaceutical exports. Countries like China, India, and South Korea are witnessing a rapid buildout of biotech parks and research clusters, necessitating large-scale procurement of lab equipment and consumables. North America and Europe continue to lead in innovation-driven procurement, with institutions prioritizing smart labs, automation, and sustainability. Latin America, Africa, and the Middle East are experiencing steady demand growth fueled by healthcare access programs, disease surveillance initiatives, and academic research expansion.

What Is Fueling Market Growth for Laboratory Equipment and Disposables Worldwide?

The growth in the global laboratory equipment and disposables market is driven by several factors, including rising investments in life sciences research, increased diagnostic testing, and demand for standardized, high-throughput laboratory workflows. Government-sponsored health initiatives, pharmaceutical innovation pipelines, and educational reforms are collectively contributing to lab expansions across continents. The COVID-19 pandemic further highlighted the need for resilient lab infrastructure, leading to capital infusion in both public and private sectors.Strategic consolidation among suppliers, coupled with the rise of e-commerce and direct-to-lab platforms, is simplifying procurement and expanding product access. Subscription-based equipment leasing, bundled consumable packs, and vendor-managed inventory services are reducing operational complexity for laboratories. Global players are also expanding regional manufacturing and distribution hubs to mitigate supply chain disruptions and ensure rapid fulfillment.

As laboratories transition toward data-driven operations and integrated diagnostics, demand is rising for equipment and disposables that are compliant, traceable, and automation-ready. Certifications, sustainability credentials, and performance warranties are now influencing procurement decisions as much as price and availability. This combination of technological evolution, regulatory alignment, and diversified end-use applications is expected to keep the laboratory equipment and disposables market on a high-growth trajectory in the years to come.

Scope of the Report

The report analyzes the Laboratory Equipment and Disposables market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Incubators, Laminar Flow Hood Equipment, Micromanipulation System, Centrifuges, Other Equipment); Disposables (Pipettes Disposables, Tips Disposables, Tubes Disposables, Other Disposables).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Incubators segment, which is expected to reach US$16.9 Billion by 2030 with a CAGR of a 4.9%. The Laminar Flow Hood Equipment segment is also set to grow at 6.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $9.3 Billion in 2024, and China, forecasted to grow at an impressive 9.4% CAGR to reach $9.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Laboratory Equipment and Disposables Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Laboratory Equipment and Disposables Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Laboratory Equipment and Disposables Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Anton Paar GmbH, Brand GmbH + Co KG, DKK-TOA Corporation, ECH Elektrochemie Halle GmbH, Emerson Electric Co. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Laboratory Equipment and Disposables market report include:

- Anton Paar GmbH

- Brand GmbH + Co KG

- DKK-TOA Corporation

- ECH Elektrochemie Halle GmbH

- Emerson Electric Co.

- Gilson Inc.

- Hanna Instruments Inc.

- Hiranuma Sangyo Co., Ltd.

- Hirschmann Laborgeräte GmbH

- Hitech Instruments Co., Ltd.

- Jasco Inc.

- Kyoto Electronics Manufacturing

- Labindia Instruments Pvt. Ltd.

- Mettler-Toledo International Inc.

- Metrohm AG

- Sartorius AG

- Shanghai INESA Scientific

- SI Analytics GmbH

- Thermo Fisher Scientific Inc.

- Xylem Inc. (incl. SI Analytics)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Anton Paar GmbH

- Brand GmbH + Co KG

- DKK-TOA Corporation

- ECH Elektrochemie Halle GmbH

- Emerson Electric Co.

- Gilson Inc.

- Hanna Instruments Inc.

- Hiranuma Sangyo Co., Ltd.

- Hirschmann Laborgeräte GmbH

- Hitech Instruments Co., Ltd.

- Jasco Inc.

- Kyoto Electronics Manufacturing

- Labindia Instruments Pvt. Ltd.

- Mettler-Toledo International Inc.

- Metrohm AG

- Sartorius AG

- Shanghai INESA Scientific

- SI Analytics GmbH

- Thermo Fisher Scientific Inc.

- Xylem Inc. (incl. SI Analytics)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 294 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

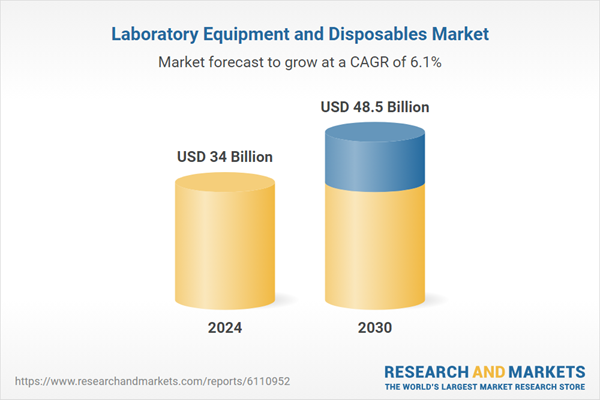

| Estimated Market Value ( USD | $ 34 Billion |

| Forecasted Market Value ( USD | $ 48.5 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |