Global Powership Market - Key Trends & Drivers Summarized

Why Are Powerships Reshaping the Global Approach to Mobile Electricity Generation?

Powerships, or floating power plants, have rapidly emerged as a strategic solution for countries and regions experiencing energy shortfalls, outdated infrastructure, or unreliable grid systems. These vessels, typically converted from cargo ships or purpose-built barges, are fitted with gas turbines, diesel engines, and combined-cycle units capable of generating anywhere from 30 MW to over 500 MW. The mobile and plug-and-play nature of powerships offers an agile, deployable solution that drastically reduces lead times compared to land-based power plants.Their most critical value lies in bridging the power gap during emergencies, post-disaster recovery, and in developing economies with chronic electricity deficits. Countries such as Lebanon, Ghana, Indonesia, Pakistan, and Mozambique have signed long-term contracts with powership operators to stabilize grid reliability and manage peak demand. These floating assets are connected to national grids via subsea cables, offering immediate baseload or peaking power. The ability to relocate, scale operations, and transition between fuel types-such as HFO, LNG, and dual-fuel systems-makes powerships highly versatile.

Moreover, powerships play a key role in energy diplomacy and foreign policy for countries that lease or supply them. They offer not just energy, but strategic influence, enabling operators to extend infrastructure, create energy corridors, and secure long-term partnerships. As energy security becomes a matter of geopolitical and economic urgency, the role of powerships as rapid deployment tools is becoming increasingly significant.

What Technological and Operational Innovations Are Enhancing Powership Capabilities?

Modern powerships are designed with advanced propulsion, emissions control, and digital monitoring systems, transforming them from emergency stopgaps into long-term energy solutions. The newest generations feature combined cycle technology, which pairs gas turbines with steam turbines to increase thermal efficiency-reaching as high as 55-60%. This shift towards higher efficiency not only reduces fuel costs but also mitigates emissions, aligning with environmental compliance requirements set by regulators and financiers.LNG integration is a notable trend, with several powerships now using floating storage regasification units (FSRUs) to supply cleaner-burning natural gas. This development significantly reduces sulfur dioxide, nitrogen oxides, and particulate emissions compared to heavy fuel oil. Additionally, hybrid powerships that integrate battery storage or solar modules are under exploration, enabling smoother frequency regulation and ramping support.

Digitalization is also playing a key role. Operators deploy remote performance monitoring, predictive maintenance tools, and AI-based fuel optimization algorithms to enhance uptime and reduce operational risks. Maritime safety systems and compliance with IMO and MARPOL regulations are also improving, making powerships more acceptable in environmentally sensitive or regulated waters.

Which Markets Are Relying on Powerships and How Is the Regional Landscape Evolving?

Emerging markets in Africa, South Asia, Southeast Asia, and Latin America dominate powership deployment. Ghana and Senegal were among the early adopters, using powerships to fill energy supply gaps caused by underinvestment in land-based generation and transmission. In Asia, Indonesia-with its archipelagic geography-is an ideal market, where floating power plants are used to serve island communities that would otherwise remain off-grid or diesel-reliant.In the Middle East, Iraq and Lebanon have turned to powerships during reconstruction or political instability. These contracts typically span 5-15 years and offer fixed tariffs, making them attractive to governments seeking stability in supply. Europe has limited but strategic usage-mainly during nuclear plant outages or renewable energy transition gaps in the Balkans and Eastern Europe.

Companies such as Karpowership (Turkey), Siemens Energy, Wärtsilä, and General Electric are active in this space, offering turnkey solutions and build-own-operate-transfer (BOOT) models. These operators provide not only the vessel but also the crew, fuel logistics, maintenance, and integration support, thus offloading infrastructure burdens from host countries. The regional landscape is now shifting toward LNG-based powerships, which offer better environmental performance and eligibility for green financing.

What Is Driving Growth in the Global Powership Market?

The growth in the global powership market is driven by rising electricity demand in underserved regions, the need for rapid deployment of generation capacity, and the increasing frequency of extreme weather events disrupting grid infrastructure. As climate risks, population growth, and urbanization put pressure on national energy systems, powerships offer a scalable, immediate response without requiring complex land acquisition or multi-year permitting processes.Additionally, the drive toward universal electrification, particularly in Africa and Southeast Asia, is creating strong demand for modular and movable power solutions. Financing structures supported by export credit agencies, development banks, and public-private partnerships have made powership projects more accessible for low- and middle-income countries.

Shifts in the global LNG market are further fueling powership demand. With LNG prices becoming more competitive and infrastructure becoming more mobile, the operating cost profile of gas-powered powerships is becoming increasingly attractive. Moreover, energy transition agendas that prioritize reducing diesel and coal usage are reinforcing interest in powerships as interim or complementary assets to larger renewable rollouts.

As energy resilience, climate adaptability, and off-grid electrification become defining energy themes of the next decade, the powership market is poised for expansion across coastal and island economies as well as in disaster-prone or post-conflict regions.

Scope of the Report

The report analyzes the Powership market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Oil-Fired Powership, Gas-Fired Powership); Application (Civil Application, Military Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Oil-Fired Powership segment, which is expected to reach US$8.8 Billion by 2030 with a CAGR of a 21.5%. The Gas-Fired Powership segment is also set to grow at 15.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 26.8% CAGR to reach $2.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Powership Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Powership Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Powership Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., AET (MISC Berhad Group), BW Offshore, CIMC Raffles Offshore, DAEWOO Shipbuilding & Marine Eng. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Powership market report include:

- ABB Ltd.

- AET (MISC Berhad Group)

- BW Offshore

- CIMC Raffles Offshore

- DAEWOO Shipbuilding & Marine Eng.

- General Electric (GE Vernova)

- Hyundai Heavy Industries

- Hyundai Mipo Dockyard

- Kawasaki Heavy Industries

- Keppel Offshore & Marine

- Karpowership (Karadeniz Group)

- MAN Energy Solutions

- Mitsubishi Heavy Industries

- MOL (Mitsui O.S.K. Lines)

- MTU Friedrichshafen (Rolls-Royce Power Systems)

- Samsung Heavy Industries

- Sembcorp Marine Ltd.

- Siemens Energy AG

- Wärtsilä Corporation

- Yanmar Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- AET (MISC Berhad Group)

- BW Offshore

- CIMC Raffles Offshore

- DAEWOO Shipbuilding & Marine Eng.

- General Electric (GE Vernova)

- Hyundai Heavy Industries

- Hyundai Mipo Dockyard

- Kawasaki Heavy Industries

- Keppel Offshore & Marine

- Karpowership (Karadeniz Group)

- MAN Energy Solutions

- Mitsubishi Heavy Industries

- MOL (Mitsui O.S.K. Lines)

- MTU Friedrichshafen (Rolls-Royce Power Systems)

- Samsung Heavy Industries

- Sembcorp Marine Ltd.

- Siemens Energy AG

- Wärtsilä Corporation

- Yanmar Co., Ltd.

Table Information

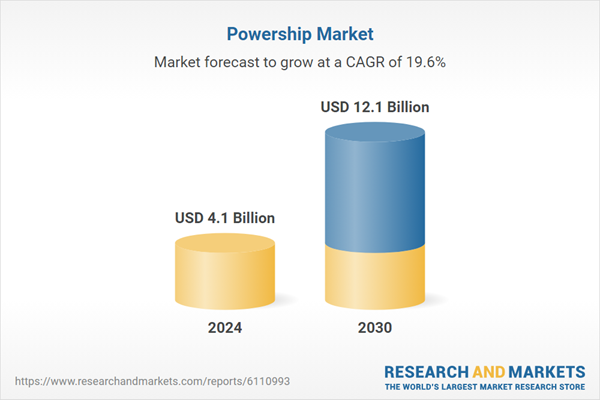

| Report Attribute | Details |

|---|---|

| No. of Pages | 275 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.1 Billion |

| Forecasted Market Value ( USD | $ 12.1 Billion |

| Compound Annual Growth Rate | 19.6% |

| Regions Covered | Global |