Global Autonomous Outdoor Vehicles Market: Key Trends & Drivers Summarized

How Are Autonomous Outdoor Vehicles Revolutionizing Operational Efficiency Across Industries?

Autonomous outdoor vehicles are redefining the way industries approach mobility, productivity, and safety in open and often rugged environments. These vehicles, designed to operate without direct human control in outdoor settings, are now being deployed across sectors such as agriculture, mining, construction, defense, logistics, and municipal services. Unlike traditional automation used in controlled environments, autonomous outdoor vehicles must navigate variable terrains, changing weather conditions, and dynamic obstacles, which requires a sophisticated fusion of sensors, machine learning, GPS, and computer vision technologies. Agricultural robots, for instance, are being used for precision spraying, seeding, and harvesting, significantly reducing labor dependency and enhancing yield accuracy. In mining and construction, autonomous haul trucks and bulldozers are operating in hazardous zones, improving safety by keeping human workers out of high-risk areas. The logistics sector is exploring outdoor autonomous delivery vehicles and drones to manage last-mile delivery more efficiently. Key technological advancements such as LiDAR, real-time kinematic positioning, and edge computing have enabled these vehicles to perceive their environment with high accuracy and make split-second decisions. Their ability to operate continuously, even in low-visibility or harsh weather conditions, provides substantial operational advantages. In urban infrastructure, autonomous street sweepers and snowplows are beginning to supplement municipal fleets, helping cities manage public spaces more efficiently. As these applications grow, the scope and capability of autonomous outdoor vehicles continue to expand, positioning them as a transformative solution for industries that depend heavily on repetitive, labor-intensive, and terrain-specific tasks.What Challenges Are Being Addressed Through Technological Innovation in Outdoor Autonomy?

Developing fully autonomous vehicles, capable of operating effectively in uncontrolled outdoor environments, presents a range of technical and operational challenges that are being actively addressed through innovation. The unpredictable nature of outdoor terrains requires these vehicles to be equipped with advanced perception systems that can identify and respond to objects, slopes, vegetation, and other environmental factors in real time. Traditional GPS navigation is often insufficient in dense forests, mountainous areas, or urban canyons, which has driven the development of more robust positioning systems such as RTK-GPS, visual odometry, and sensor fusion strategies that combine LiDAR, radar, and inertial measurement units. Machine learning algorithms are now capable of processing large volumes of sensory data to recognize terrain types, classify obstacles, and optimize route planning on the fly. Durability and power supply are other critical concerns, especially in remote or off-grid environments where vehicles must operate for extended periods without recharging or maintenance. Battery technology improvements and the integration of solar charging panels are beginning to address some of these limitations. Additionally, connectivity remains a hurdle, particularly for vehicles operating outside areas with strong cellular or Wi-Fi coverage. To overcome this, developers are incorporating edge computing capabilities that allow the vehicle to function autonomously without constant reliance on cloud data. Safety protocols, redundancy systems, and fail-safe mechanisms are also being integrated to ensure that the vehicles can safely shut down or return to base if a system fault is detected. Regulatory frameworks and operational guidelines are still catching up, but pilot programs and collaborative testing with local authorities are helping shape standards. Through these innovations, the core challenges of autonomous outdoor mobility are being incrementally resolved, paving the way for broader deployment and reliability.How Are Different Industry Verticals Utilizing Outdoor Autonomy for Competitive Advantage?

The application of autonomous outdoor vehicles is rapidly expanding across multiple industry verticals, each leveraging the technology to gain efficiency, lower operational costs, and reduce risk exposure. In agriculture, large-scale farms are adopting autonomous tractors, drones, and robotic harvesters to optimize crop cycles, conduct soil analysis, and manage irrigation with precision. These systems are particularly valuable in regions facing labor shortages or seasonal workforce variability. The mining industry has embraced autonomous haul trucks and drilling machines to maximize output and enhance worker safety in environments that are often dangerous and remote. Construction companies are increasingly deploying autonomous earth movers, pavers, and site inspection robots to improve project timelines and reduce the number of on-site personnel. In the defense sector, unmanned ground vehicles are being used for reconnaissance, logistics support, and perimeter patrol in both combat and humanitarian scenarios. Outdoor delivery robots and autonomous courier vehicles are being trialed by logistics companies and retail giants to address the growing demand for contactless and timely last-mile delivery services. Municipalities are exploring autonomous street cleaners, waste collection vehicles, and snow removal systems to modernize public services and improve operational efficiency during off-peak hours. In the energy sector, autonomous vehicles are being used to inspect pipelines, wind farms, and remote solar installations without human intervention. The environmental and conservation space is also beginning to deploy autonomous vehicles for wildlife monitoring, reforestation, and terrain mapping. Across all these applications, organizations are reporting enhanced data accuracy, improved operational uptime, and significant reductions in both human error and overhead costs, validating the strong value proposition of autonomous outdoor vehicles.Which Trends and Market Dynamics Are Driving the Growth of the Autonomous Outdoor Vehicle Segment?

The growth in the autonomous outdoor vehicles market is driven by several interconnected trends that span technological advancement, industry needs, and economic shifts. One of the primary drivers is the persistent shortage of skilled labor across sectors such as agriculture, construction, and logistics, prompting organizations to invest in autonomous solutions that can maintain productivity with minimal human oversight. Advancements in artificial intelligence, sensor miniaturization, and low-cost computing hardware have made it feasible to deploy complex autonomous systems at scale. The proliferation of 5G and edge computing is enabling faster data transmission and real-time decision-making, which are essential for vehicles operating in unpredictable outdoor environments. Rising safety expectations, especially in high-risk industries like mining and defense, are encouraging companies to replace manual operations with robotic alternatives. Environmental concerns and sustainability goals are also playing a role, as autonomous vehicles tend to operate with optimized fuel usage or electrified drivetrains that reduce emissions and energy consumption. Government funding, pilot initiatives, and public-private partnerships are providing the financial and regulatory support needed to test and refine autonomous outdoor systems in real-world conditions. Increased investment from venture capital and corporate R&D arms is accelerating product development and commercialization timelines. Moreover, the rise of smart infrastructure, digital twins, and geographic information systems is creating an ecosystem in which autonomous vehicles can be integrated more seamlessly with existing operations. As user familiarity grows and technology continues to mature, autonomous outdoor vehicles are evolving from experimental solutions into essential tools for modern, efficient, and resilient operations across multiple sectors.Scope of the Report

The report analyzes the Autonomous Outdoor Vehicles market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Unmanned Aerial Vehicles, Unmanned Ground Vehicles, Unmanned Marine Vehicles); Automation Level (Level 1 Automation, Level 2 Automation, Level 3 Automation, Level 4 Automation, Level 5 Automation); Application (Agriculture Application, Mining Application, Construction Application, Logistics Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Unmanned Aerial Vehicles segment, which is expected to reach US$20.3 Billion by 2030 with a CAGR of a 39.6%. The Unmanned Ground Vehicles segment is also set to grow at 34.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.2 Billion in 2024, and China, forecasted to grow at an impressive 35.5% CAGR to reach $4.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Autonomous Outdoor Vehicles Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Autonomous Outdoor Vehicles Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Autonomous Outdoor Vehicles Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

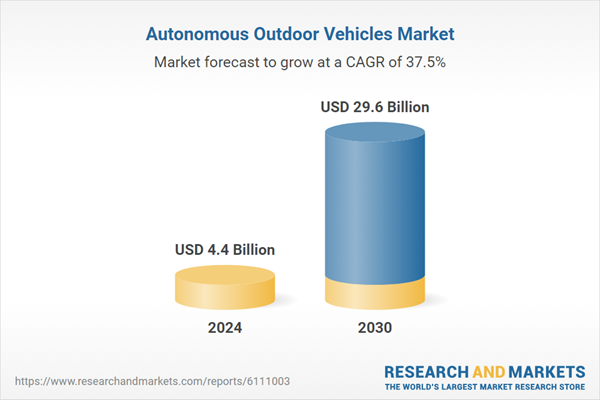

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AgXeed B.V., Autonomous Solutions Inc. (ASI), Bear Flag Robotics (John Deere), Blue River Technology (John Deere), Clearpath Robotics (OTTO Motors) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Autonomous Outdoor Vehicles market report include:

- AgXeed B.V.

- Autonomous Solutions Inc. (ASI)

- Bear Flag Robotics (John Deere)

- Blue River Technology (John Deere)

- Clearpath Robotics (OTTO Motors)

- CNH Industrial N.V.

- Ecorobotix SA

- Einride AB

- Exyn Technologies

- FJDynamics

- Husqvarna Group

- Kiwibot

- Komatsu Ltd.

- Monarch Tractor

- Naïo Technologies

- Nuro Inc.

- Raven Industries (CNH Industrial)

- Robomow (part of MTD Products)

- Starship Technologies

- Yamaha Motor Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AgXeed B.V.

- Autonomous Solutions Inc. (ASI)

- Bear Flag Robotics (John Deere)

- Blue River Technology (John Deere)

- Clearpath Robotics (OTTO Motors)

- CNH Industrial N.V.

- Ecorobotix SA

- Einride AB

- Exyn Technologies

- FJDynamics

- Husqvarna Group

- Kiwibot

- Komatsu Ltd.

- Monarch Tractor

- Naïo Technologies

- Nuro Inc.

- Raven Industries (CNH Industrial)

- Robomow (part of MTD Products)

- Starship Technologies

- Yamaha Motor Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 176 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.4 Billion |

| Forecasted Market Value ( USD | $ 29.6 Billion |

| Compound Annual Growth Rate | 37.5% |

| Regions Covered | Global |