Global Automotive Platooning Systems Market: Key Trends & Drivers Summarized

How Are Emerging Technologies Reshaping the Future of Automotive Platooning?

Automotive platooning systems are rapidly advancing through the integration of cutting-edge technologies that are fundamentally redefining vehicle connectivity and coordination. Central to this evolution is the deployment of vehicle-to-everything (V2X) communication, which enables real-time exchange of data between vehicles and their environment. These systems rely on a fusion of radar, LiDAR, computer vision, and AI algorithms to allow multiple vehicles to travel in tightly knit formations while maintaining safe inter-vehicle distances and synchronized movement. Adaptive cruise control, lane-keeping assistance, and emergency braking have been transformed by advancements in real-time data processing, especially with the adoption of edge computing infrastructure onboard vehicles. Original Equipment Manufacturers (OEMs) are actively collaborating with tech startups and Tier 1 suppliers to enhance the decision-making capabilities of platoon leaders through machine learning and predictive analytics. Meanwhile, high-speed 5G connectivity ensures ultra-low latency communication, which is vital for maintaining the integrity of platoon formations, particularly on high-speed motorways. Blockchain technology is also emerging as a promising tool for managing secure and immutable data exchanges between platooning vehicles, regulators, and fleet managers. Innovations in digital twins and simulation platforms now enable extensive virtual testing of platooning scenarios, reducing time-to-market for new systems. Technology providers are also working on interoperability protocols to allow cross-brand platooning, which would open up broader commercial applications. These cumulative advancements are pushing automotive platooning closer to large-scale commercialization, enhancing fuel efficiency, safety, and operational reliability across the transportation sector.Is Regulation Catching Up With the Pace of Innovation in Platooning?

While the technological landscape of automotive platooning systems is evolving rapidly, regulatory frameworks are progressing at a more measured pace, with varying levels of readiness across different regions. In the European Union, government-backed initiatives such as the ENSEMBLE project have laid the groundwork for a harmonized platooning protocol, encouraging OEM collaboration and cross-border logistics compatibility. Countries such as the Netherlands, Germany, and Sweden have enacted laws permitting truck platooning trials, and are gradually expanding these allowances to include mixed-traffic environments. In Asia, Japan and Singapore are actively revising their road safety codes to accommodate platooning use cases in both public transport and commercial freight sectors. The United States has seen individual states like Texas, Florida, and Michigan pass legislation supporting platooning, although a lack of federal coherence continues to pose implementation challenges. Regulatory uncertainties persist around the topics of liability attribution, data ownership, and platoon disengagement protocols in emergency scenarios. Additionally, cybersecurity has become a pressing area of concern, prompting regulatory bodies to incorporate secure communication standards and resilience assessments into compliance requirements. Insurance models are also undergoing transformation, as underwriters seek to develop actuarial data based on platoon-specific driving patterns and reduced accident probabilities. The evolution of regulatory oversight is increasingly focused on achieving a balance between fostering innovation and ensuring road safety. While gaps remain, especially in emerging markets, the policy environment is steadily aligning with the needs of large-scale platooning deployment, suggesting a supportive trajectory for market growth.What Sectors and Use Cases Are Leading the Way in Real-World Implementation?

Real-world implementation of automotive platooning systems is currently being led by the freight and logistics sectors, where the operational and economic benefits are most tangible. Long-haul trucking operators, facing chronic driver shortages and fluctuating fuel costs, are adopting platooning to enhance fuel efficiency, reduce emissions, and lower labor dependency. Pilot programs in the United States and Europe have demonstrated fuel savings of up to 10 percent in follower trucks, a compelling incentive for logistics providers to invest in the technology. Logistics giants such as DHL, FedEx, and DB Schenker have initiated trials involving semi-autonomous convoys on interstate corridors and dedicated freight lanes. In Asia, China and South Korea are deploying platooning-enabled electric buses in urban public transit networks to improve route scheduling and energy efficiency. Municipalities in smart city initiatives are incorporating platooning into their mobility blueprints to optimize fleet-based transport. The military sector is also experimenting with platooning for unmanned resupply missions, leveraging convoy technology to navigate hazardous or contested terrain autonomously. Additionally, technology-driven courier services are evaluating platooning to support last-mile delivery efficiency by deploying synchronized vehicle clusters during peak demand hours. Fleet operators managing corporate or government vehicles are exploring platooning for improved fuel management and reduced wear-and-tear through controlled acceleration and braking. Moreover, the private automotive sector is testing high-end electric and hybrid cars equipped with semi-autonomous convoy features to appeal to affluent customers seeking premium travel experiences. Each of these use cases presents unique performance demands, influencing the direction of platooning software development, safety validation, and market readiness strategies.What Forces Are Driving Growth in the Automotive Platooning Systems Market?

The growth in the automotive platooning systems market is driven by several factors directly linked to technological progress, logistics transformation, and changing industry and consumer behaviors. One of the most significant drivers is the increasing availability of V2V and V2I communication infrastructure, allowing vehicles to coordinate movements with minimal latency and high reliability. The advancement of onboard autonomous systems, including sensor suites and AI decision modules, has reduced the complexity and cost of platooning solutions, making them viable for large-scale fleet deployment. Rising demand for freight transportation across global markets is pressuring logistics operators to seek cost-saving innovations, with platooning emerging as a solution to improve fuel efficiency and delivery predictability. At the same time, the growing digitization of fleet operations has made it easier to integrate platooning systems into centralized management platforms, enabling remote monitoring and automated compliance tracking. Electrification trends are also converging with platooning, especially in commercial electric trucks and buses, where synchronized driving behavior helps optimize battery usage and charging cycles. Road congestion in urban corridors and long-haul highways is incentivizing planners to adopt platooning as a method to improve vehicle throughput and lane efficiency. Furthermore, OEMs are increasingly embedding platooning capabilities into their advanced driver assistance system (ADAS) offerings as a value-added feature, targeting both commercial buyers and tech-savvy consumers. Cross-industry collaboration between automotive manufacturers, software firms, and infrastructure providers is accelerating ecosystem maturity, while growing acceptance of autonomous features is easing market entry barriers. These factors collectively underscore a strong and multi-dimensional growth outlook for automotive platooning systems across global markets.Scope of the Report

The report analyzes the Automotive Platooning Systems market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Component (Hardware Component, Software Component); Communications Type (Vehicle-to-Vehicle, Vehicle-to-Infrastructure, Vehicle-to-Everything); Functionality (Adaptive Cruise Control Functionality, Co-operative Adaptive Cruise Control Functionality); End-Use (Passenger Cars End-Use, Light-Duty Commercial Vehicles End-Use, Heavy-Duty Commercial Vehicles End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hardware Component segment, which is expected to reach US$21.4 Billion by 2030 with a CAGR of a 39.2%. The Software Component segment is also set to grow at 28.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.3 Billion in 2024, and China, forecasted to grow at an impressive 46.5% CAGR to reach $8.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Platooning Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Platooning Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Platooning Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AB Volvo, Aptiv PLC, Continental AG, Daimler Truck AG (Mercedes-Benz Trucks), Einride AB and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Automotive Platooning Systems market report include:

- AB Volvo

- Aptiv PLC

- Continental AG

- Daimler Truck AG (Mercedes-Benz Trucks)

- Einride AB

- Embark Trucks Inc.

- FAW Jiefang Automotive Co., Ltd.

- Hino Motors, Ltd.

- Hitachi Astemo, Ltd.

- Hyundai Motor Company

- Kodiak Robotics, Inc.

- NVIDIA Corporation

- PACCAR Inc. (Kenworth, Peterbilt, DAF)

- Peloton Technology

- Robert Bosch GmbH

- Scania AB

- Tesla, Inc.

- Toyota Motor Corporation

- TuSimple Holdings Inc.

- ZF Friedrichshafen AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AB Volvo

- Aptiv PLC

- Continental AG

- Daimler Truck AG (Mercedes-Benz Trucks)

- Einride AB

- Embark Trucks Inc.

- FAW Jiefang Automotive Co., Ltd.

- Hino Motors, Ltd.

- Hitachi Astemo, Ltd.

- Hyundai Motor Company

- Kodiak Robotics, Inc.

- NVIDIA Corporation

- PACCAR Inc. (Kenworth, Peterbilt, DAF)

- Peloton Technology

- Robert Bosch GmbH

- Scania AB

- Tesla, Inc.

- Toyota Motor Corporation

- TuSimple Holdings Inc.

- ZF Friedrichshafen AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 471 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

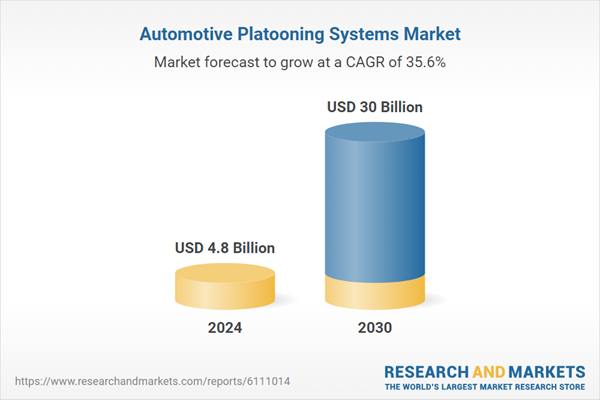

| Estimated Market Value ( USD | $ 4.8 Billion |

| Forecasted Market Value ( USD | $ 30 Billion |

| Compound Annual Growth Rate | 35.6% |

| Regions Covered | Global |