Global Nitrogen Oxide Control Systems Market - Key Trends & Drivers Summarized

Why Are Nitrogen Oxide Emission Controls Gaining Unprecedented Regulatory Urgency?

Nitrogen oxides (NOx), a group of reactive gases composed primarily of nitric oxide (NO) and nitrogen dioxide (NO2), are among the most significant pollutants generated from combustion processes. These emissions contribute to smog formation, acid rain, and ground-level ozone, as well as exacerbate respiratory and cardiovascular conditions in humans. As global environmental regulations tighten in response to climate change and air quality concerns, the demand for nitrogen oxide control systems has surged across sectors such as power generation, marine transport, cement manufacturing, chemical processing, and automotive.Governments in North America, Europe, and Asia-Pacific have implemented stringent standards for NOx emissions, with agencies such as the U.S. EPA, EU’s Industrial Emissions Directive, and China's Ministry of Ecology and Environment mandating continuous monitoring and emission reduction targets. Industrial operators are responding by integrating post-combustion control systems such as Selective Catalytic Reduction (SCR), Selective Non-Catalytic Reduction (SNCR), Exhaust Gas Recirculation (EGR), and Low-NOx burners. These technologies are being adopted not only to meet compliance but also to avoid carbon penalties, secure permits, and gain ESG-related investment advantages.

How Are Emerging Technologies Enhancing Efficiency in NOx Mitigation?

The evolution of NOx control systems is being shaped by the convergence of advanced materials, control automation, and AI-powered process optimization. SCR systems, which convert NOx into nitrogen and water using ammonia or urea in the presence of catalysts, have become more efficient through the use of novel catalyst materials such as vanadium-tungsten-titanium (VWT) composites and zeolite-based alternatives that extend service life and reduce operating temperature thresholds. These innovations have improved the viability of SCR in low-load and cyclic industrial operations.SNCR technologies, commonly deployed in cement kilns and biomass plants, are also becoming more adaptable through real-time ammonia injection controls and temperature-based optimization algorithms. EGR systems, predominantly used in internal combustion engines, are now being integrated with electronic control units (ECUs) and exhaust sensors to ensure precise flow rates and thermal management. Additionally, Low-NOx burners and staged combustion technologies are being employed in gas turbines and utility boilers to limit NOx formation at the source by altering flame temperature and air-fuel ratios.

Digital control platforms have revolutionized the way NOx reduction systems are operated. Predictive analytics and cloud-based emission monitoring systems enable facility managers to track performance, detect anomalies, and automate reagent dosing in real time. This not only improves compliance but also reduces operating costs and downtime. In hybrid systems, where multiple technologies are combined (e.g., SCR + EGR), integrated software platforms coordinate their operation for optimal performance, especially in dynamic load environments.

Which End-Use Sectors and Regions Are Spearheading Deployment Trends?

The power generation sector, particularly coal-fired and gas-fired thermal plants, remains the largest consumer of NOx control systems. However, as renewable energy penetrates the grid, older fossil fuel plants are being retrofitted with advanced NOx mitigation systems to remain compliant and extend operational life. The cement and steel industries also represent high-growth markets, especially in Asia-Pacific, where industrial output continues to expand alongside regulatory tightening.The marine industry is rapidly adopting SCR and EGR systems for vessels, driven by the IMO Tier III regulations that cap NOx emissions in Emission Control Areas (ECAs). This is prompting shipbuilders and engine OEMs to design compliant propulsion systems and retrofit existing fleets with modular NOx reduction units. Similarly, on-road and off-road vehicle manufacturers are integrating compact SCR and EGR modules to meet Euro VI and EPA 2027 standards, with commercial vehicles leading in SCR adoption due to their higher duty cycles and emissions footprint.

Regionally, China dominates in volume deployment, supported by aggressive industrial policy and pollution control funding. Europe is advancing via its Green Deal framework and sustainable transport policies, while the U.S. market is driven by a mix of federal and state-level regulations (e.g., California Air Resources Board standards). In emerging economies such as India, Brazil, and South Africa, donor-backed clean air initiatives and industrial modernization efforts are catalyzing investment in NOx control infrastructure.

What Is Fueling Growth in the Global Nitrogen Oxide Control Systems Market?

The growth in the global nitrogen oxide control systems market is driven by several factors, including expanding regulatory mandates, rising awareness of environmental health impacts, and the increasing need for cleaner industrial and transport operations. Governments worldwide are setting aggressive NOx reduction targets to meet national and global climate goals, thereby creating a high-growth compliance market. For operators, investment in NOx control systems is not just about regulatory avoidance-it also supports corporate sustainability goals and access to green financing.Technological advancements are making NOx control systems more affordable, efficient, and scalable. Modular systems are enabling small and medium-sized plants to adopt mitigation technologies without extensive retrofits. Additionally, the move toward integrated environmental control platforms-combining SOx, NOx, and particulate controls-offers economies of scope and simplified operation. As new industrial facilities are planned with zero-emissions benchmarks, NOx control systems are becoming embedded into base designs rather than as retrofit options.

Furthermore, government subsidies, emission trading schemes, and carbon offset mechanisms are providing financial incentives for early adoption. As ESG reporting becomes standard in global capital markets, industries that proactively reduce emissions are improving investor confidence and stakeholder value. All these factors are converging to position nitrogen oxide control systems as a cornerstone of industrial decarbonization and environmental stewardship strategies.

Scope of the Report

The report analyzes the Nitrogen Oxide Control Systems market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Technology (Selective Catalytic Reduction, Selective Non-Catalytic Reduction, Low NOx Burner, Fuel Reburning); Application (Power Generation & Energy Application, Chemical Application, Transportation Application, Industrial Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Selective Catalytic Reduction segment, which is expected to reach US$2.6 Billion by 2030 with a CAGR of a 3.0%. The Selective Non-Catalytic Reduction segment is also set to grow at 3.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.3 Billion in 2024, and China, forecasted to grow at an impressive 6.4% CAGR to reach $1.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Nitrogen Oxide Control Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Nitrogen Oxide Control Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Nitrogen Oxide Control Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ADA-ES, Inc., Air Liquide, Alstom, Amec Foster Wheeler, Babcock & Wilcox Enterprises, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Nitrogen Oxide Control Systems market report include:

- ADA-ES, Inc.

- Air Liquide

- Alstom

- Amec Foster Wheeler

- Babcock & Wilcox Enterprises, Inc.

- BASF SE

- BHEL (Bharat Heavy Electricals Limited)

- CECO Environmental

- CORMETECH Inc.

- Ducon Technologies Inc.

- Elessent Clean Technologies

- FLSmidth & Co. A/S

- Fuel Tech, Inc.

- GE Vernova

- Hitachi Zosen Inova

- Johnson Matthey

- Mitsubishi Heavy Industries, Ltd.

- Siemens Energy

- Tenneco Inc.

- Yara International ASA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADA-ES, Inc.

- Air Liquide

- Alstom

- Amec Foster Wheeler

- Babcock & Wilcox Enterprises, Inc.

- BASF SE

- BHEL (Bharat Heavy Electricals Limited)

- CECO Environmental

- CORMETECH Inc.

- Ducon Technologies Inc.

- Elessent Clean Technologies

- FLSmidth & Co. A/S

- Fuel Tech, Inc.

- GE Vernova

- Hitachi Zosen Inova

- Johnson Matthey

- Mitsubishi Heavy Industries, Ltd.

- Siemens Energy

- Tenneco Inc.

- Yara International ASA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 275 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

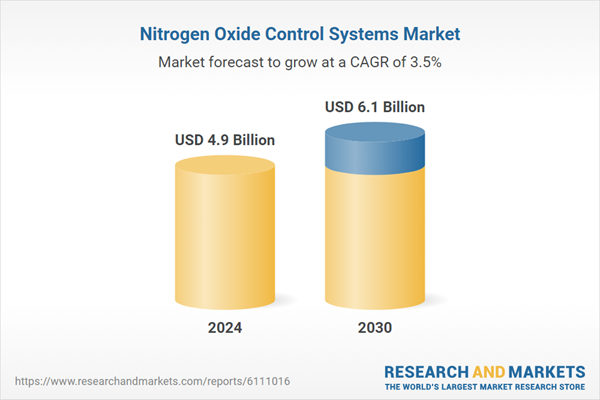

| Estimated Market Value ( USD | $ 4.9 Billion |

| Forecasted Market Value ( USD | $ 6.1 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |