Global Commercial and Industrial Solar PV Modules Market - Key Trends & Drivers Summarized

Why Are Commercial and Industrial Sectors Leading the Charge in Solar PV Adoption?

The commercial and industrial segments are emerging as the primary drivers of solar photovoltaic (PV) module adoption, as businesses increasingly seek to reduce operational costs, meet sustainability goals, and gain energy independence. High and unpredictable utility rates, coupled with mounting pressure to reduce carbon emissions, are compelling enterprises across industries to adopt solar energy as a stable and long-term solution. Warehouses, factories, retail complexes, office buildings, and logistic hubs are utilizing large rooftops, parking structures, and adjacent land to install solar arrays and meet significant portions of their electricity demand. These installations not only reduce electricity bills but also act as a hedge against future energy price volatility. Companies with aggressive environmental, social, and governance (ESG) mandates are also turning to solar PV systems to meet internal emissions targets and qualify for sustainability certifications. In parallel, governments across North America, Europe, Asia-Pacific, and Latin America are offering incentives, tax credits, and streamlined permitting processes to accelerate solar adoption in the commercial and industrial domains. Solar PV modules are being seen as a strategic asset rather than a utility expense, contributing directly to a company’s brand reputation and long-term resilience. Additionally, the improved aesthetics, declining installation costs, and extended warranties of modern PV systems have made them more attractive to risk-averse corporate buyers. Solar energy procurement is also being facilitated through power purchase agreements (PPAs) and leasing models, which allow businesses to benefit from solar power without upfront capital expenditures. This shift toward decentralized energy solutions positions commercial and industrial users at the forefront of the solar revolution.How Are Technological Advancements Enhancing the Efficiency and Appeal of Solar PV Modules?

Technological innovation is playing a pivotal role in driving the performance, reliability, and widespread adoption of solar PV modules in commercial and industrial applications. The evolution of module design, including the rise of bifacial panels, half-cell technology, and PERC (passivated emitter and rear cell) architecture, has significantly improved energy yields and system efficiency. Bifacial modules, for example, can capture sunlight from both the front and rear sides, generating more power per square meter and making them ideal for commercial rooftops and ground-mounted systems. Advances in anti-reflective coatings, transparent backsheets, and module encapsulation materials have further enhanced durability and weather resistance, ensuring sustained performance over decades. As a result, modules now offer higher wattage outputs while occupying the same or even less space, an important factor in urban environments with limited rooftop area. Digitalization is another major contributor, with intelligent monitoring systems, IoT sensors, and AI-powered analytics enabling real-time performance tracking, predictive maintenance, and fault detection. These tools are particularly valuable for industrial users managing multi-site operations, as they help optimize system performance and minimize downtime. Inverters have also seen significant improvements, with string inverters and microinverters offering greater flexibility in system design and better shading tolerance. Modular system architectures now allow for scalability, enabling businesses to start small and expand their solar installations as needs evolve. Additionally, advancements in battery storage technologies are improving the viability of hybrid solar-plus-storage solutions, allowing companies to store excess energy for use during peak demand or outages. These technological breakthroughs are collectively making solar PV systems not only more efficient and cost-effective but also more adaptable to the unique needs of commercial and industrial users.What Economic and Regulatory Trends Are Shaping Market Expansion Across Regions?

Economic and regulatory factors are having a profound influence on the growth trajectory of the commercial and industrial solar PV modules market, creating fertile conditions for adoption across both developed and emerging economies. Policy frameworks such as feed-in tariffs, net metering, investment tax credits, and renewable portfolio standards are key enablers of market expansion. In the United States, for instance, the Investment Tax Credit (ITC) continues to incentivize corporate solar investment, while similar programs in India, China, Germany, and Australia are accelerating installation rates across industrial estates and commercial zones. The falling cost of solar modules, driven by economies of scale and improved manufacturing techniques, is making solar competitive with or even cheaper than grid electricity in many regions. Global supply chains have matured, allowing for faster deployment and reduced logistics costs. Multinational corporations are also driving cross-border adoption by committing to renewable energy targets and requiring solar integration across their global facilities. Financial institutions are increasingly offering green bonds and preferential loan terms for solar projects, making funding more accessible for small and medium-sized enterprises. Local governments are contributing by simplifying zoning laws, offering rebates, and mandating solar-ready infrastructure in new commercial developments. The intersection of sustainability regulations and corporate responsibility reporting is further reinforcing the business case for solar adoption. Additionally, power outages, grid instability, and rising diesel costs in many developing regions are pushing businesses to invest in solar PV systems for energy security. As energy markets liberalize and carbon pricing mechanisms evolve, companies that proactively adopt solar are positioning themselves to capitalize on both regulatory incentives and competitive differentiation. These multifaceted dynamics are expanding the reach of solar PV modules far beyond early adopters to become a mainstream business strategy globally.What Key Factors Are Driving the Continued Surge in Demand for Solar PV Modules in Commercial and Industrial Sectors?

The growth in the commercial and industrial solar PV modules market is driven by several interconnected factors related to economics, technology, policy, and operational strategy. Rising electricity tariffs are prompting businesses to explore self-generation as a cost-containment measure, especially in energy-intensive sectors such as manufacturing, logistics, and food processing. The decreasing cost of solar technology, combined with better financing options, is making adoption feasible even for mid-sized businesses. Market-ready financing models like third-party ownership, solar leasing, and power purchase agreements are reducing upfront investment barriers and spreading costs over manageable timeframes. Increasing awareness of climate change and environmental impact is encouraging companies to pursue carbon neutrality, with solar installations serving as visible, measurable progress toward that goal. The availability of rooftop space and open land in industrial estates makes solar installations both practical and scalable. Supply chain pressures and energy-related disruptions have heightened the need for energy independence, prompting companies to localize power generation through on-site solar. Technological improvements in panel efficiency, inverter reliability, and monitoring systems are boosting confidence in long-term performance and return on investment. Many businesses are now incorporating energy strategies into broader ESG frameworks, with solar PV being one of the most direct and effective tools to lower emissions. Additionally, growing consumer preference for environmentally responsible brands is incentivizing companies to adopt visible green technologies. The rise of electric vehicle fleets in commercial logistics is also creating synergies, where solar installations can offset both operational and mobility-related energy consumption. Collectively, these drivers are reinforcing the upward momentum of solar PV module demand, establishing the technology as a cornerstone of sustainable and resilient business operations around the worldScope of the Report

The report analyzes the Commercial and Industrial Solar PV Modules market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Monocrystalline, Polycrystalline, Thin-Film); Technology (Passivated Emitter & Rear Cell Technology, Passivated Emitter & Rear Totally Diffused Cell Technology, Heterojunction with Intrinsic Thin Layer Cell Technology, Interdigitated Back Contact Cell Technology); Application (Rooftop Systems Application, Ground-Mounted Systems Application, Floating Solar Systems Application); End-User (Utilities End-User, Commercial & Industrial End-User, Residential End-User).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Monocrystalline segment, which is expected to reach US$67.2 Billion by 2030 with a CAGR of a 19.3%. The Polycrystalline segment is also set to grow at 14.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $11.1 Billion in 2024, and China, forecasted to grow at an impressive 23.2% CAGR to reach $24.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Commercial and Industrial Solar PV Modules Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Commercial and Industrial Solar PV Modules Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Commercial and Industrial Solar PV Modules Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AE Solar, Canadian Solar, Celestica, Chint Power Systems, First Solar and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Commercial and Industrial Solar PV Modules market report include:

- AE Solar

- Canadian Solar

- Celestica

- Chint Power Systems

- First Solar

- GCL System Integration

- Hanwha Q CELLS

- JA Solar Technology

- JinkoSolar

- LONGi Green Energy

- Meyer Burger

- REC Solar Holdings

- ReneSola Ltd.

- Risen Energy

- Seraphim Solar

- Sharp Corporation

- SolarEdge Technologies

- SunPower Corporation

- Trina Solar

- Vikram Solar

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AE Solar

- Canadian Solar

- Celestica

- Chint Power Systems

- First Solar

- GCL System Integration

- Hanwha Q CELLS

- JA Solar Technology

- JinkoSolar

- LONGi Green Energy

- Meyer Burger

- REC Solar Holdings

- ReneSola Ltd.

- Risen Energy

- Seraphim Solar

- Sharp Corporation

- SolarEdge Technologies

- SunPower Corporation

- Trina Solar

- Vikram Solar

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 479 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

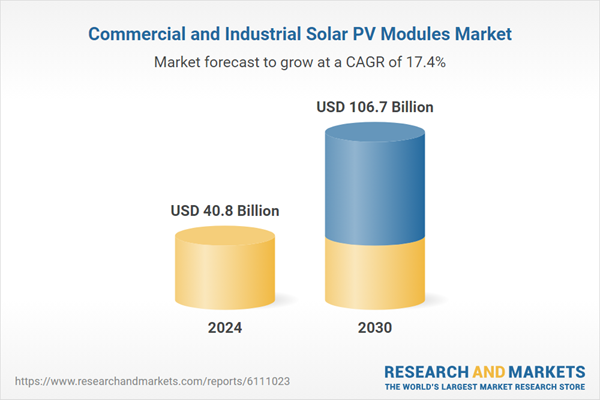

| Estimated Market Value ( USD | $ 40.8 Billion |

| Forecasted Market Value ( USD | $ 106.7 Billion |

| Compound Annual Growth Rate | 17.4% |

| Regions Covered | Global |