Global Optoelectronics Market - Key Trends & Drivers Summarized

Why Is Optoelectronics Gaining Ground Across High-Impact Industries?

Optoelectronics-the convergence of optics and electronics-is at the forefront of innovation in communications, sensing, medical devices, and consumer electronics. It encompasses devices that source, detect, and control light, including photodiodes, light-emitting diodes (LEDs), laser diodes, image sensors, optocouplers, and optical fibers. The integration of photonic components into electronic systems has enabled faster data transmission, miniaturized sensing, and high-efficiency lighting-powering advances from autonomous vehicles to 5G infrastructure.The growing demand for high-speed internet, advanced imaging, and precision sensing across sectors such as automotive, aerospace, healthcare, consumer electronics, and industrial automation is fueling the rapid growth of optoelectronic technologies. Smartphones use CMOS image sensors and proximity sensors; electric vehicles rely on LiDAR modules; smartwatches incorporate pulse oximeters; and fiber optics form the backbone of global data centers-all driven by optoelectronic innovations.

How Are Device Innovations and Material Advancements Expanding Applications?

Breakthroughs in optoelectronic materials and device architectures are enhancing performance while reducing power consumption and manufacturing complexity. Compound semiconductors like gallium arsenide (GaAs), indium phosphide (InP), and gallium nitride (GaN) offer superior electron mobility and light-emitting capabilities compared to silicon, enabling high-efficiency laser diodes, high-frequency photodetectors, and UV/IR emitters. Quantum dot-based photodetectors and organic photodiodes are enabling lightweight, flexible, and wearable optoelectronic applications.In image sensing, backside-illuminated CMOS sensors, time-of-flight (ToF) sensors, and spectral imaging arrays are providing superior sensitivity, resolution, and depth sensing for use in AR/VR devices, smartphones, and machine vision systems. In communication, vertical-cavity surface-emitting lasers (VCSELs) are becoming critical for 3D facial recognition, optical interconnects, and data center transceivers. Meanwhile, advances in microLED and OLED-on-silicon technologies are paving the way for ultra-high-resolution displays in near-eye and projection systems.

Integration of photonic integrated circuits (PICs) is reducing the size and cost of optoelectronic modules, while enabling scalable manufacturing of complex optical functions on a single chip. Hybrid integration of silicon photonics with CMOS platforms is allowing mainstream electronics manufacturers to incorporate optical capabilities into mass-market devices, expanding commercialization potential across consumer, automotive, and healthcare domains.

Which End-Use Sectors and Regional Markets Are Accelerating Demand?

The optoelectronics market is rapidly expanding across several verticals. In telecommunications, fiber-optic networks and 5G infrastructure rely heavily on optoelectronic transceivers, amplifiers, and modulators to manage ever-increasing data traffic. In automotive applications, advanced driver-assistance systems (ADAS) and autonomous vehicles depend on LiDAR, infrared sensors, and night vision cameras for real-time perception.In healthcare, optoelectronic components are used in diagnostic imaging (e.g., OCT), phototherapy, wearable pulse oximeters, and laser-based surgical tools. Consumer electronics continue to drive volume demand for optoelectronic sensors and emitters in devices like smartphones, tablets, AR/VR headsets, and TVs. In defense and aerospace, optoelectronics is central to navigation systems, surveillance, laser ranging, and secure communication.

Geographically, Asia-Pacific dominates the global optoelectronics market, led by countries like China, Japan, South Korea, and Taiwan-each boasting strong electronics manufacturing ecosystems. North America and Europe contribute significantly through technological innovation, IP development, and defense-related demand. The U.S. leads in photonics R&D, while Germany and the U.K. focus on high-precision industrial and medical applications. Emerging markets in Southeast Asia and the Middle East are investing in optical fiber rollouts and smart infrastructure, expanding the global demand base.

What Factors Are Propelling Market Growth and Shaping Future Opportunities?

The growth in the global optoelectronics market is driven by several high-impact factors: digital transformation, photonic miniaturization, renewable energy adoption, and increasing demand for data-driven, vision-based technologies. As industry 4.0 and smart cities evolve, the need for intelligent sensors, high-resolution imaging, and seamless optical communication is becoming fundamental.Government and corporate investment in next-generation communication networks (5G/6G), semiconductor innovation, and photonics research is boosting R&D and commercialization. For instance, national photonics initiatives in the U.S., EU, and Japan are fostering collaboration between academia, startups, and industry players. Photovoltaic optoelectronic applications-such as solar panels and light-sensing in energy-efficient buildings-are also seeing increased adoption amid climate commitments.

Strategic partnerships and M&A activity are intensifying as players seek to capture share in key optoelectronic subsegments. Companies like Hamamatsu Photonics, Broadcom, Sony, Osram, Finisar, II-VI Inc., and Lumentum are actively investing in compound semiconductor fabs, photonic integration, and vertical integration of supply chains.

As optoelectronics converges with AI, quantum sensing, and edge computing, its applications will continue to diversify. Its foundational role in enabling light-based data transmission, precise imaging, and real-time environmental interaction positions optoelectronics as a critical enabler of tomorrow’s intelligent systems across every major industry vertical.

Scope of the Report

The report analyzes the Optoelectronics market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Device Type (LED Device, Laser Diode Device, Image Sensors Device, Optocouplers Device, Photovoltaic Cells Device, Other Devices); End-User (Automotive End-User, Aerospace & Defense End-User, Consumer Electronics End-User, Information Technology End-User, Healthcare End-User, Residential & Commercial End-User, Industrial End-User, Other End-Users).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the LED Device segment, which is expected to reach US$15.1 Billion by 2030 with a CAGR of a 5.9%. The Laser Diode Device segment is also set to grow at 2.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $11.5 Billion in 2024, and China, forecasted to grow at an impressive 8.2% CAGR to reach $11.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Optoelectronics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Optoelectronics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Optoelectronics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ams-OSRAM, Analog Devices, Broadcom Inc., Canon Inc., Hamamatsu Photonics and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Optoelectronics market report include:

- ams-OSRAM

- Analog Devices

- Broadcom Inc.

- Canon Inc.

- Hamamatsu Photonics

- Himax Technologies

- II-VI Incorporated (Now Coherent Corp.)

- Infineon Technologies

- Innolux Corporation

- Intel Corporation

- Jenoptik AG

- Kyocera Corporation

- LITE-ON Technology Corporation

- Micropac Industries

- ON Semiconductor (onsemi)

- Panasonic Holdings Corporation

- Samsung Electronics

- Sharp Corporation

- Sony Group Corporation

- Texas Instruments

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ams-OSRAM

- Analog Devices

- Broadcom Inc.

- Canon Inc.

- Hamamatsu Photonics

- Himax Technologies

- II-VI Incorporated (Now Coherent Corp.)

- Infineon Technologies

- Innolux Corporation

- Intel Corporation

- Jenoptik AG

- Kyocera Corporation

- LITE-ON Technology Corporation

- Micropac Industries

- ON Semiconductor (onsemi)

- Panasonic Holdings Corporation

- Samsung Electronics

- Sharp Corporation

- Sony Group Corporation

- Texas Instruments

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 303 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

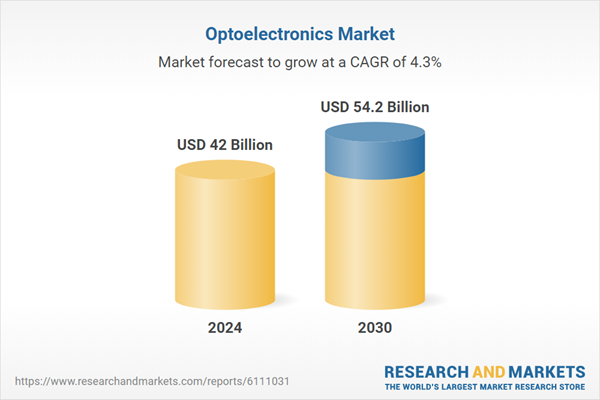

| Estimated Market Value ( USD | $ 42 Billion |

| Forecasted Market Value ( USD | $ 54.2 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |