Market Size & Trends

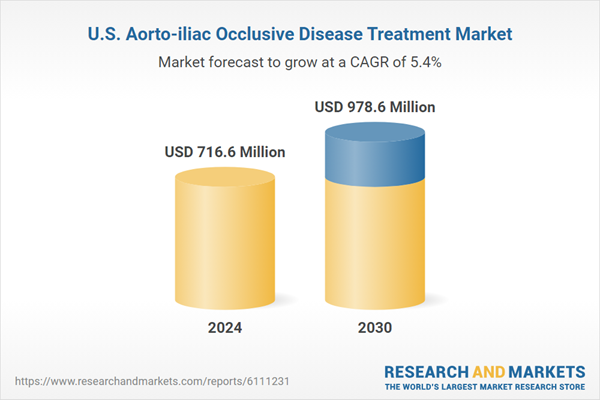

The U.S. aorto-iliac occlusive disease (iliac disease) treatment market size was estimated at USD 716.6 million in 2024 and is projected to grow at a CAGR of 5.4% from 2025 to 2030. Increasing PAD incidence, rising government initiatives, and technological advancements drive market growth. For instance, in November 2024, Philips recently launched the THOR IDE clinical trial in the U.S. to evaluate a novel hybrid catheter system that combines laser atherectomy and intravascular lithotripsy.The device is designed to treat severely calcified lesions commonly found in PAD and aorto-iliac disease. The first successful patient procedure, conducted at the Cardiovascular Institute of the South in Louisiana, demonstrates the potential for this device to streamline complex interventions and improve procedural outcomes. Increasing government initiatives drive market growth. According to the Congress.Gov article published in June 2023, the U.S. government took a significant step toward enhancing early detection and management of Peripheral Artery Disease (PAD), a primary contributor to Aorto-Iliac Occlusive Disease, through the introduction of the Arterial and Venous Comprehensive (ARC) Act. This legislation proposes amendments to the Social Security Act, aiming to ensure that Medicare and Medicaid beneficiaries identified as high-risk can access PAD screening without incurring out-of-pocket costs.

Covered diagnostic procedures include ankle-brachial index (ABI) tests and arterial duplex scans, which are critical for identifying PAD and assessing disease severity in the aorto-iliac region. Authorizing USD 6 million in annual funding from 2024 to 2028, the ARC Act seeks to improve early diagnosis and timely intervention, potentially reducing the burden of advanced occlusive conditions and boosting the demand for targeted treatment options such as iliac stenting and revascularization therapies. This initiative promotes preventive care and supports broader access to essential vascular health services.

The proliferation of ambulatory surgical centers (ASCs) and office-based labs (OBLs) across the U.S. significantly contributes to the growth in procedural volumes for vascular interventions, including those for aorto-iliac occlusive disease. These facilities offer a cost-effective and convenient alternative to traditional hospital settings, enabling quicker patient turnaround, reduced overhead costs, and enhanced scheduling flexibility for both patients and physicians. As a result, iliac artery interventions-such as balloon angioplasty, stenting, and atherectomy are increasingly being performed in ASCs and OBLs, especially for patients presenting with early to moderate stages of the disease. These minimally invasive procedures can often be completed on an outpatient basis, making them well-suited to these settings where shorter recovery times and lower procedural risk are prioritized. The shift toward these centers is also supported by favorable reimbursement policies, making them a preferred site of care for providers and payers.

U.S. Aorto-iliac Occlusive Disease Treatment Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, the analyst has segmented the U.S. aorto-iliac occlusive disease (iliac disease) treatment market report based on device type, procedure, and end-use:Device Type Outlook (Revenue, USD Million, 2018 - 2030)

- Endovascular Devices

- Balloon Angioplasty Devices

- Atherectomy Systems

- Stents

- Self-Expanding Stents

- Balloon-Expandable Stents

- Covered Stent Grafts

- Bifurcated Aortic Stent Grafts

- Surgical Devices

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

- Endovascular Procedures

- Balloon Angioplasty

- Primary Stenting

- Kissing Stents

- Covered Stent Grafts

- Endovascular Aortic Repair (EVAR)

- Hybrid Procedures

- Open Surgical Procedures

End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospitals

- Outpatient Facilities

- Others

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BD

- Abbott

- Boston Scientific Corporation

- W. L. Gore & Associates, Inc.

- Medtronic

- Cook

- Terumo Corporation

- Getinge AB

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 100 |

| Published | June 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 716.6 Million |

| Forecasted Market Value ( USD | $ 978.6 Million |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | United States |

| No. of Companies Mentioned | 8 |