Market Size & Trends

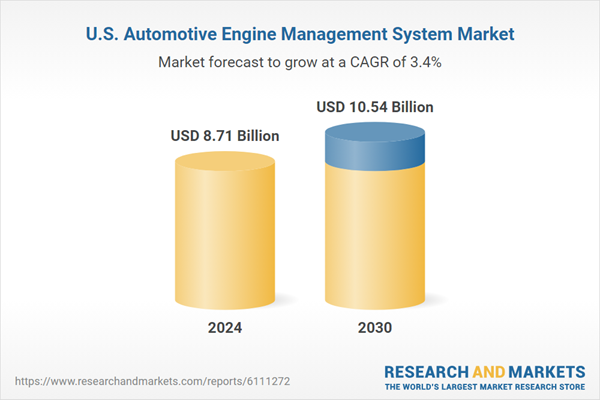

The U.S. automotive engine management system market size was estimated at USD 8.71 billion in 2024 and is projected to grow at a CAGR of 3.4% from 2025 to 2030.The market growth is being significantly boosted by the stringent implementation of Tier 3 emission standards, which aim to reduce gasoline sulfur content to 10 ppm and enforce fleet-average emission targets through 2025. The Environmental Protection Agency’s (EPA) 2024 Multi-Pollutant Emissions Standards, set to phase in through 2032, are driving automakers to overhaul their engine systems. The required 57% per-mile NOx emission reduction compared to 2021 levels has accelerated the adoption of next-gen automotive engine management systems, integrated with real-time emission tracking, adaptive catalytic converters, and gasoline particulate filters. These evolving regulatory pressures are forcing OEMs to invest in more advanced automotive engine management system technologies, positioning them as central to compliance strategies and sustainability roadmaps.Automotive engine management system solutions are increasingly being integrated with autonomous vehicle systems and V2X (vehicle-to-everything) networks, which U.S. transportation agencies support. Automotive engine management system now plays a critical role in synchronizing engine output with real-time data from radar, LiDAR, GPS, and onboard computers that power self-driving features. By enabling smoother acceleration, predictive braking, and optimal fuel burn in autonomous environments, this integration is propelling automotive engine management system demand in high-tech vehicle platforms. As autonomous driving tech gains ground, especially in urban delivery fleets and high-end passenger vehicles, automotive engine management system evolution becomes non-negotiable, leading to significant investments by OEMs.

Between 2022 and 2025, the use of artificial intelligence (AI) and machine learning (ML) in automotive engine management systems has surged. AI-powered automotive engine management system platforms can analyze driving behavior, weather conditions, and traffic patterns to dynamically adjust engine parameters for peak efficiency. These self-learning systems not only boost fuel economy and reduce GHG emissions but also ensure long-term engine performance. Supported by U.S. initiatives around clean transportation and digital mobility, OEMs are actively embedding AI into automotive engine management system units. This trend is creating a competitive advantage and pushing rapid automotive engine management system software upgrades, reshaping the technological landscape of engine management.

The push for cleaner and smarter engines has fueled the adoption of advanced sensors like knock sensors, MAF (mass airflow), NOx sensors, and oxygen sensors. These sensors are now smaller, faster, and more accurate, enabling the automotive engine management system to fine-tune combustion in milliseconds. High-resolution data from these sensors is essential for real-time diagnostics, emission control, and efficient fuel injection. As Tier 3 and future emission regulations tighten, automotive engine management system platforms equipped with sensor fusion capabilities are becoming a market standard, driving exponential growth in both passenger and commercial vehicle segments.

U.S. Automotive Engine Management System Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, the analyst has segmented the U.S. automotive engine management system market report based on component, engine type, andvehicle type:Component Outlook (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit (ECU)

- Sensors

- Fuel Pump

- Actuators

- Others

Engine Type Outlook (Revenue, USD Million, 2018 - 2030)

- Gasoline Engines

- Diesel Engines

- Hybrid Engines

- Electric Engines

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Two-Wheelers

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- BorgWarner Inc.

- Hitachi Astemo, Ltd.

- Valeo

- Infineon Technologies AG

- Sensata Technologies, Inc.

- Mitsubishi Heavy Industries Ltd.

- Cummins Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 100 |

| Published | June 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 8.71 Billion |

| Forecasted Market Value ( USD | $ 10.54 Billion |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |