Market Size & Trends

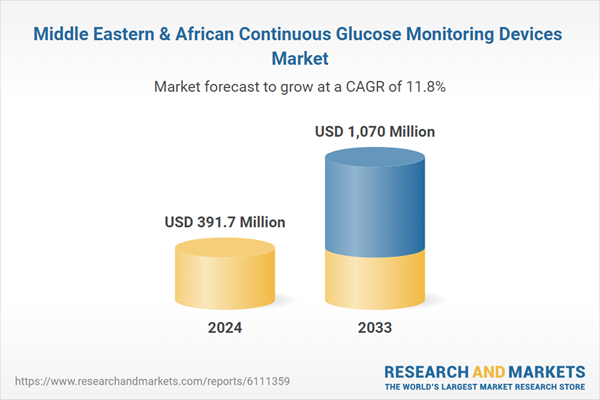

The Middle East & Africa continuous glucose monitoring devices market size was estimated at USD 391.7 million in 2024 and is expected to grow at a CAGR of 11.8% from 2025 to 2033 to reach a value of USD 1.07 billion in 2033. This growth is fueled by the alarming rise in diabetes cases across the region. In the Middle East and North Africa (MENA), the number of adults aged 20-79 with diabetes increased from 17 million in 2000 to 84.7 million in 2024 and is expected to reach 162.6 million by 2050. MENA has the world’s highest regional prevalence at 17.6% and a projected 92% surge in cases.In support of increasing access to continuous glucose monitoring (CGM) technologies, the Foundation for Innovative New Diagnostics (FIND) launched the “Access to CGMs for Equity in Diabetes Management” (ACCEDE) initiative, seeking proposals from CGM manufacturers not yet commercialized in Kenya and South Africa. As of early 2023, only about 10% of the 55,000 people living with type 1 diabetes in these countries were using CGMs. Furthermore, rising insulin use among type 2 diabetes patients-estimated at 18% in Kenya and up to 45% in South Africa’s private sector-presents a significant opportunity for CGM expansion.

FIND’s strategy aims to double CGM usage in Kenya and South Africa by 2025 and extend reach to an estimated regional market of 213,000 type 1 and 21.5 million type 2 diabetes patients across Eastern and Southern Africa. The project emphasizes affordability, training, and evidence generation to ensure scalable and sustainable CGM adoption. CGM devices provide continuous, real-time glucose data, supporting better glycemic control and reducing the need for invasive fingersticks. However, their effectiveness depends heavily on proper patient training and healthcare provider support.

Safety concerns linked to CGM misuse, particularly from insufficient training, have been highlighted in recent evaluations. A cross-sectional study in Saudi Arabia showed that 40% of users operated CGMs without adequate guidance. Additionally, over half of CGM-related adverse event reports between 2019 and 2021 were attributed to user error rather than device failure, reinforcing the need for structured training programs.

The UAE’s annual diabetes conferences further highlight the region’s commitment to advancing diabetes care. The 2024 event, co-hosted by the Imperial College London Diabetes Centre and HealthPlus, drew over 400 professionals and emphasized CGM innovations and practical applications. It fostered dialogue on new management strategies, from low-calorie diets to artificial pancreases, reinforcing the role of CGMs in modern diabetes treatment.

In H2 2024, the World Diabetes Foundation (WDF) approved seven ambitious projects focused on expanding non-communicable disease (NCD) prevention and primary care across Africa, the Middle East, North Africa, and South-East Asia. These initiatives are significantly contributing to the growth of the continuous glucose monitoring (CGM) devices market by enhancing healthcare infrastructure and expanding access to diabetes care.

Middle East & Africa Continuous Glucose Monitoring Devices Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and analyzes the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, the analyst has segmented the Middle East & Africa continuous glucose monitoring devices market report based on type, connectivity, indication, end use, and region:Type Outlook (Revenue, USD Million, 2021 - 2033)

- Standalone CGM Devices

- Integrated CGM-Insulin Pump Systems

Connectivity Outlook (Revenue, USD Million, 2021 - 2033)

- Bluetooth

- 4G/Cellular

- NFC (Near Field Communication)

Indication Outlook (Revenue, USD Million, 2021 - 2033)

- Type 1 Diabetes

- Type 2 Diabetes

End Use Outlook (Revenue, USD Million, 2021 - 2033)

- Hospitals & Clinics

- Homecare / Personal Use

- Other

Regional Outlook (Revenue, USD Million, 2021 - 2033)

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Rest of Middle East & Africa

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Dexcom, Inc.

- Abbott Laboratories

- Medtronic plc

- Senseonics Holdings, Inc.

- F. Hoffmann-La Roche (Roche Diabetes Care)

- Ypsomed AG

- GlySens Incorporated

- Novo Nordisk A/S

- Ascensia Diabetes Care

- Diabetes Cloud (Aidex) and Meiqi (emerging startups)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 391.7 Million |

| Forecasted Market Value ( USD | $ 1070 Million |

| Compound Annual Growth Rate | 11.8% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 10 |