Market Size & Trends

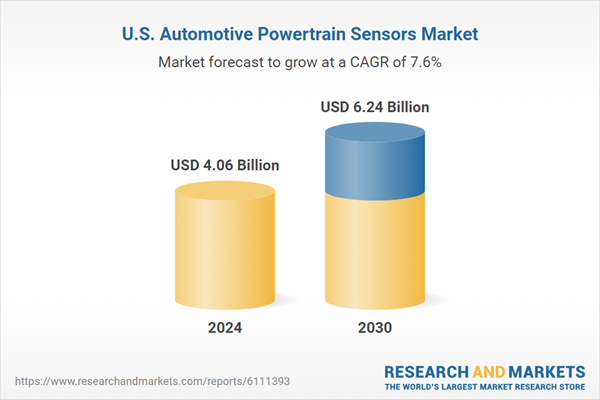

The U.S. automotive powertrain sensors market size was estimated at USD 4.06 billion in 2024 and is projected to grow at a CAGR of 7.6% from 2025 to 2030. The rapid shift toward electric vehicles (EVs) in the U.S. has significantly boosted the market growth of advanced powertrain sensors.According to the Department of Energy’s (DOE) 2022 Electrification Annual Progress Report, substantial investments are being made to enhance sensor technologies that improve lithium-ion battery efficiency and thermal management. Real-time voltage and current sensors now provide accurate data to battery management systems (BMS), extending battery life and optimizing charge cycles. Temperature sensors embedded within battery packs help prevent overheating, particularly in extreme climates a critical factor in enhancing EV reliability. Torque sensors in electric motors are enabling seamless and energy-efficient power delivery. These innovations are part of DOE-funded programs targeting a 15% reduction in powertrain energy consumption by 2025, which has propelled the market toward high-performance EV components.

Federal regulations aimed at reducing vehicle emissions have driven the demand for highly accurate aftertreatment sensors in internal combustion engine (ICE) vehicles. The EPA’s 2023 Clean Trucks Plan, which mandates a 90% reduction in NOx emissions from heavy-duty vehicles by 2027, has boosted the market growth of technologies like wide-band lambda sensors and particulate matter (PM) sensors. These sensors play a vital role in maintaining air-fuel ratios and monitoring diesel exhaust filters, ensuring compliance with strict emission thresholds. In addition, the DOE’s High-Efficiency Engine Technologies program is fostering the development of sulfur-resistant NOx sensors for hybrid engines, particularly useful in low-temperature exhaust scenarios. These regulatory pressures have propelled the market toward sensor solutions that improve environmental performance and vehicle longevity.

The increasing integration of Advanced Driver Assistance Systems (ADAS) with powertrain controls is creating new opportunities for sensor deployment, thereby boosting the market growth in this segment. Radar and lidar inputs from ADAS are now leveraged for predictive powertrain actions, such as anticipatory gear shifting and regenerative braking control in ICE and hybrid vehicles. The Federal Highway Administration’s 2023 V2X Deployment Guidelines emphasize the importance of Vehicle-to-Infrastructure (V2I) communications, which adjust throttle and transmission behavior based on real-time traffic data using sensors like crankshaft and throttle position monitors. Field trials conducted by NREL have shown that such integrations can lead to 6-8% fuel efficiency gains in heavy-duty trucks, propelling the market for sensor-based energy optimization systems.

Growing concerns about the embedded energy consumption of automotive electronics have boosted the market demand for low-power sensor solutions. The DOE’s 2024 Sustainable Transportation Strategy and a 2023 Oak Ridge National Laboratory (ORNL) study revealed that sensor manufacturing contributes significantly to an EV’s overall energy footprint, up to 12%. As a result, sensor developers are focusing on innovations like silicon carbide (SiC)-based sensors, which reduce power consumption by 40% compared to conventional silicon components. Similarly, Hall-effect sensors in traction motors now operate on lower voltages, and CAN FD protocols minimize sensor wake-up cycles, improving energy efficiency. These trends are directly aligned with the EPA’s 2025 CAFE standards, which call for a 32% boost in fleet-wide fuel efficiency compared to 2022, propelling the market toward energy-conscious sensor technology.

U.S. Automotive Powertrain Sensors Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, the analyst has segmented the U.S. automotive powertrain sensors market report based on sensor type, vehicle type, and propulsion type.Sensor Type Outlook (Revenue, USD Million, 2018 - 2030)

- Pressure Sensors

- Temperature Sensors

- Position Sensors

- Speed Sensors

- Others (Oxygen Sensors, Knock Sensors, Air Flow Sensors (MAF), NOx Sensors, Fuel Level Sensors, and Torque Sensors)

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Two-Wheelers

Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Fuel Cell Vehicles (FCVs)

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Continental AG

- DENSO CORPORATION

- Infineon Technologies AG

- Innovative Sensor Technology (IST)

- Mitsubishi Electric Automotive America, Inc.

- NXP Semiconductors

- Robert Bosch GmbH

- Semiconductor Components Industries, LLC

- Smith Systems Incorporated

- Texas Instruments Incorporated

- Trensor, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 100 |

| Published | June 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.06 Billion |

| Forecasted Market Value ( USD | $ 6.24 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | United States |

| No. of Companies Mentioned | 11 |